Is Gold the Best Inflation Hedge US News

Post on: 22 Июль, 2015 No Comment

Don’t forget about TIPS and REITs.

Kelly Campbell

No, not really. So why is everyone so interested in this precious metal? And what are your alternatives?

First, there are reasons that the price of gold is, and has been, increasing. But, with gold being a commodity, prices are mostly based on supply and demand.

Let’s start with the supply side. Gold must be mined and that process is expensive. If mining output decreases below the long-term trend, there will be upward pressures on the price of gold. As the price increases, miners will likely ramp up gold extraction, which puts more money into their pockets. Remember, gold is also limited in quantity: If you put all of the gold ever mined into a single cube, it would measure about 65 feet on each side.

On the demand side, with the status of the U.S. dollar as the global currency threatened, demand has increased. Going back to the early 1970s, in times of a weakening dollar, the price of gold goes up.

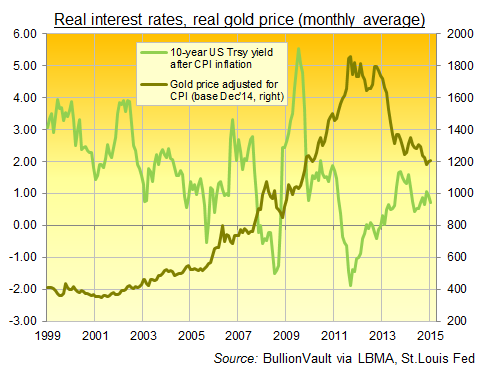

In addition, as the U.S. heads into inflationary times, gold’s price tends to increase. Historically, gold has been a good inflation hedge, and people tend to buy more as they fear the value of their money is decreasing, which again pushes up the price.

Finally, consumer expectations can be a demand driver. As consumer confidence wanes, investors look to gold as a safe haven, further driving up its price.

Aside from supply and demand, pure speculation is also driving the price to all-time highs. Some investors are now looking to gold as a significant return generator for their portfolio, and are giving it a more dominant role in their long-term planning.

Given these facts, most people would say keep buying, but there is a problem. Gold, as of last week, was trading at about $1,500 per ounce, fairly close to the all-time high reached in the early 1980s. But remember what happened back then. Within 10 years, the price was cut in half and in the next 10 years, cut in half again. Gold’s volatility is far too great.

So what can you do to outpace inflation? Don’t abandon gold, but also don’t rely on it solely. Here’s a look at some inflation-hedging alternatives:

While this strategy seems easy on paper, it is a little more difficult to develop in real life. Look for some mutual funds and exchange-traded funds (ETFs) that offer bits and pieces of each of the above positions. However, do your due diligence, and don’t just buy based on return. Look for those with a track record.

The more work you do now, the better off you will be when inflation rears its ugly head.

Good luck and happy investing.

Kelly Campbell , CFP and Accredited Investment Fiduciary, is founder of Campbell Wealth Management. a Registered Investment Advisor in Alexandria, Va. Campbell is also the author of Fire Your Broker , a controversial look at the broker industry written as an empathetic response to the trials and tribulations many investors have faced as the stock market cratered and their advisers abandoned their responsibilities to help them weather the storm.