Is Europe s Banking System Broken Beyond Repair

Post on: 19 Июль, 2015 No Comment

DISCLAIMER

Is Europe’s Banking System Broken Beyond Repair?

Tuesday, January 29, 2008

Are recent events in the European banking industry unmistakable signs that the relative calm on the surface will soon give way to the biggest financial disaster — and the resulting panic — the old continent has ever seen?

The scandal at French banking giant Societe Generale firstly shows that monetary dimensions of the past and present may not work much longer. I am stunned by the growing amounts of losses publicized on an almost daily basis. When the crisis began last August, losses publicized were mostly below the billion mark. Then came British mortgage lender North Rock and pushed for another digit, announcing its de facto bankruptcy and held alive only by government guarantees.

German banks tuned into the choir. From leader Deutsche Bank to lesser known regional lenders, fall was spattered with bad surprises after banks had first tried to defuse mounting speculations in vain and then shyly admitted that the US alphabet soup made from ABS, CDO’s, CDS, MBS, SIV indeed played the dominating role in their downfall.

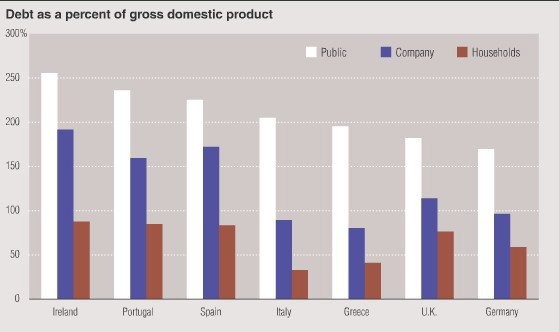

The German crisis, WestLB took a billion hit last week, may still be only the tip of the iceberg. Due to slower reporting mechanisms crucial annual results for 2007 will trickle into markets until April. Do not expect any better performance in Italy, France, Spain, Portugal, Greece, Cyprus and all other countries where property had bubbled until then. Only today Belgian bank Fortis announced one billion Euros in mortgage write downs and expects another billion less in profits. East European financial institutions may be even worse off relative to their size.

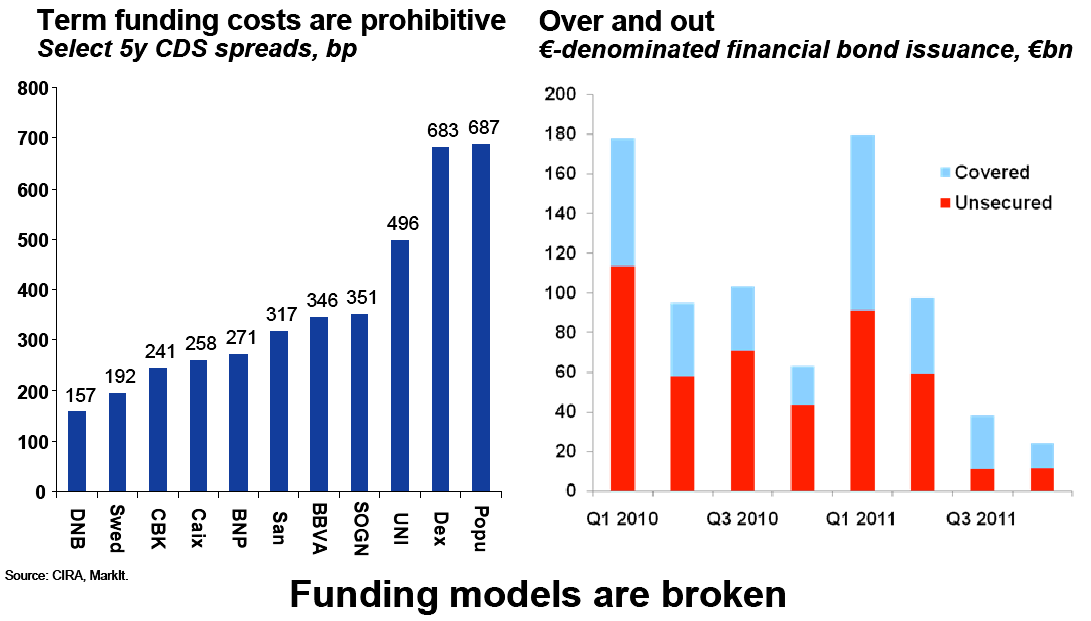

GRAPH: The DJ Stoxx 600 banking sub index is a warning telltale if the old rule that stocks discount the future still applies. It doesnt take a forensic accounting degree to see that the general problem is unprecedented over-leverage across the industry. Banks moved gigantic sums — no one can even roughly guess it — into under capitalized legal entities they created for this reason. This offspring used the good rating of its parent companies to borrow at historically low rates and buy still more of the same, driving capital-risk-ratios to ridiculously low levels of less than 3%. Now these entities sit on mountains of unmarketable securities, bought around par. Until December 31, banks could push the problem into the future as interim reports are only pro forma.

The annual report is an entirely different affair. Banks cannot dress the numbers anymore and have to value at market. If prices were not found due to a lack of trading in these securities they will be found in bankruptcy proceedings where every asset is given a price. I guess neither method will be a pleasant experience for the holders of the American alphabet soup. Guesstimates price a good part if not the majority of the volume of these problem papers at anywhere between 15 and 45 cents to the dollar.

What is so difficult to understand is that it appears that the global crowd of money managers all had the same unrealistic expectation: Low rates and rising property prices forever, blanking out inflation although warning signs and deteriorating indicators have been written on the wall since at least 4 years.

Lacking EU internal growth apart from real estate finance banks fanned out to fund whatever came along, as long as it had a modest yield pickup compared to government debt and carried an investment grade rating from rating agencies that had failed in all other financial crises before. Remember Enron, Worldcom and Metallgesellschaft? To name only a few.

Funded with cheap money provided by the European Central Bank — money supply M3 growth is at a record level of more than 12% — and peer pressure from bonus-hungry executives are the two ingredients that led to all manias and subsequent panics:

- Monetary expansion

Before SocGen’s revelations all misdoings fell into the category of investments gone bad. But now we witness the first mega-giga flop where possibly some fraud is involved. The bank released a letter today that blames the 4.9 billion Euro loss on the misdeeds of a single trader who had risen through the back office, knowing how to hide his trades.

This story will not end here as it raises multiple questions about risk control on a company and supervisory level. The French central bank had said earlier that they had been informed by SocGen before the bank started unwinding trades worth 50 billion Euros. This represents about the annual GDP of Libya or Qatar.

A lot of safety measures seem not to have worked. How can such enormous volumes be traded without anybody raising eyebrows? Such figures have to be put into everyday terms to demonstrate that data-based sanity has left the financial world a while ago. 50 billion Euros divided by 300 million Eurozone inhabitants makes 166 Euros per capita. Squaring these positions led to the strong declines in Frankfurt and London on MLK day.

The game of shifting the blame has begun. According to a Reuters report ,

the Paris prosecutor said that derivatives exchange Eurex alerted the bank to (rogue trader Jerome) Kerviel’s activities in November. A French lawyer now sues SocGen as they have not informed markets ahead of their panic selling that wiped out hundreds of billions of Euros market capitalization in one day.

Political Repercussions to Follow

And in a new political twist to the scandal, Bank of France chief Christian Noyer revealed that he delayed telling the government about it for several days because he feared a leak.

I considered that the huge size of the position meant that any risk of an involuntary leak — involuntary of course — should be removed because that was the major risk that could happen in the first hours, he told BFM radio in an interview according to the Reuters report.

Kerviel told police he concealed his trades because he wanted to enhance his reputation as a trader, not out of any desire to hurt the bank, prosecutor Marin told a news conference. And his lawyer voices suspicions that the bank tries to make a scapegoat out of Kerviel, offloading hidden skeletons on his shoulders. Kerviel had a salary of 100,000 Euros, including 1,500 Euros performance bonus.

SocGen’s problems may be a leading example that there was a bit too much freewheeling in market capitalism, as authorities may once more turn out to be inadequate in a rapidly evolving market that has tried one more time where alchemy never had success: Creating unlimited gold. The alchemists in medieval times did not succeed. Today’s equivalent, mathematicians and rocket scientists in derivatives departments, will share their unlucky fate.

UPDATE. Authorities released Kerviel Thursday evening after questioning him. According to a new Reuters report — with all the details here — Kerviel had told the prosecutor others also played fast and loose with bank rules.