Is CD Laddering No Longer Effective with Downturned Rates

Post on: 16 Март, 2015 No Comment

It is during challenging times when our discipline and diligence are tested. Now that CD account rates are so low, does it still make sense to lock into long-term accounts? What can depositors do instead of traditional CD laddering ?

What Is the CD Ladder Strategy?

Before discounting CD laddering, its good to remind ourselves of what the purpose of the CD ladder strategy is. Its main purpose is to reduce large rates swings affecting the entire CD portfolio. Secondly, it provides potential access to maturing funds if financial needs arise.

If you have funds coming due every six months to a year, you wont have to wait an exceedingly long time to access your funds. This will save you money versus paying withdrawal penalties.

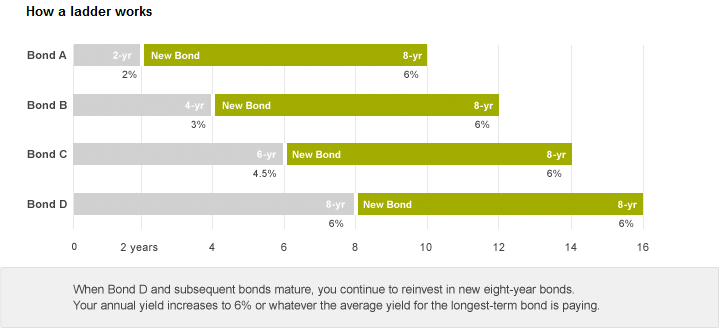

The basic CD ladder strategy would have your funds spread across various maturities such as 6-month, 1-year, 18-month, 2-year term. If you have $25,000 to invest into a CD, you could put $5,000 on a 1-year, 2-year, 3-year, 4-year, and 5-year CD. Each year would have $5,000 coming due.

If you dont need the funds just re-invest them for the longest term your ladder has (5-years in this case). Since in general, a long-term CD pays more than short-term accounts, once the ladder is established youll earn more. Our research shows longer-term CDs on average pay 1.5 percent higher than their shorter-term cousins.

When rates are flat or inverted it is very difficult to stomach sticking with a CD ladder. When a 5-year CD is paying 1.50% APY and a 1-year is paying 1.00% APY, there isnt much incentive to go long. But remember the purpose remain disciplined in maintaining the CD laddering approach.

Alternate CD Laddering Strategies

Another strategy is to invest in short-term CDs when rates are low and long-term CDs when rates are high. The biggest problem with this is that its very difficult to guess when CD rates will change. You could end up with all of your CDs at the lower rates and depending on the duration of the downturn, it could be for a significant time.

Human nature tends to believe that when there isnt much difference between short-term and long-term interest rates, CD rates will soon go up and they might as well wait. But ask people how well that worked in 2000 and 2006 2008 (and any other rate peak).

Even though it seems like CD rates cant get any lower, believe me they still can drop lower. People also seem to think that while rates are rising they wont stop, however, rates always go up and down. At the moment we happen to be stuck in a protracted downturn.

If all of your finds are in long-term certificates of deposit and you dont have any other funds set aside, an emergency need could arise and you would pay a penalty to access your funds. Historically, the average penalty has been 6-months, but as this downturn has lasted quite a long-time, many banks have increased their penalty to 1-year or longer.

The downside to CD laddering is during an extended downturn, your portfolio will probably end up with low yields. You may also end up investing in long-term CDs that are lower than their short-term counterparts.

This outcome can cause people to think youre crazy for continuing with the CD ladder strategy. Just smile on the inside knowing that the history of rate trends and laddering CDs is on your side.