IRS Tax Form 1099DIV How Are Dividends Taxed

Post on: 17 Июль, 2015 No Comment

Many investors choose to invest in dividend-bearing stocks. or mutual funds focusing on dividend payers, as part of their portfolio. And those dividends can pay off in a major way. Investing in dividend-bearing stocks can be a great choice for investors who are thinking long-term. You may receive dividends in stock or cash, and you can frequently reinvest cash dividends to buy more stock. Depending upon how you receive dividends, you may need to plan ahead for tax day. Specifically, it is important to understand the different types of dividends, what you can expect as far as paying taxes on them, and how to read the 1099-DIV tax form so youre adequately prepared.

Types of Dividends

There are three main categories of money you might receive: ordinary dividends, qualified dividends, and capital gain distributions. Each type has its own tax implications.

- Ordinary Dividends . Dividends paid out from a companys earnings and profits are referred to as ordinary dividends. They are taxed at normal income tax rates. Many real estate investment trusts (REITs). for example, primarily pay out ordinary dividends, which can raise your overall tax burden. These are sometimes referred to as non-qualified dividends and are reported in box 1a of the 1099-DIV.

- Qualified Dividends. Dividends may be considered qualified if theyre paid by a U.S. corporation or qualified foreign corporation and if youve met the holding period requirement for the underlying stock. Qualified dividends are subject to long-term capital gains tax rates and are reported in box 1b on your 1099-DIV.

- Capital Gains Distributions . You may also receive payments from your dividend-paying stock in the form of capital gains distributions. These are generally received from mutual funds or real estate investment trusts. They are reported in box 2a on your 1099-DIV and are subject to long-term capital gains rates (regardless of how long you owned the shares).

Reporting Requirements

Keep in mind that you must report all dividends received on your taxes, but the company that paid dividends doesnt have to send you a 1099-DIV unless you received more than $10 that year. In other words, maintain a record of how much you earned in case you dont receive a 1099-DIV.

What Is a Dividend Reinvestment Plan?

A DRIP, or dividend reinvestment plan. is a method that allows you to use your dividends to purchase more of the same stock instead of receiving the dividends in cash. Simply put, instead of receiving $3.24 in dividends, the company automatically purchases for you however many shares (or portions of a share) that $3.24 will buy on the day its sending other investors their checks. This nets you a little more stock each time, so that, ultimately, you end up with more shares than you started with. However, even when dividends are reinvested, you will receive a 1099-DIV with the dividends reported on it. In the eyes of the IRS, this circumstance is the same as if you received a check for $3.24 and then immediately purchased $3.24 worth of the stock. A DRIP is simply more convenient and has additional advantages to purchasing stock, such as dollar cost averaging.

Taxes on DRIP Purchases

Each quarter, when your dividend payments are automatically reinvested to acquire more stock, you will inevitably buy shares at different prices, which determines your cost basis in those shares. When you eventually sell your stock for a capital gain or loss. you need to know your cost basis for each share sold. Therefore, hold onto the quarterly statements you receive, which reflect how many shares were bought, at what price, and on which day the investment was made. You can then determine your actual profit. Some software programs and brokerage accounts can also keep track of this for you.

1099-DIV Tax Form

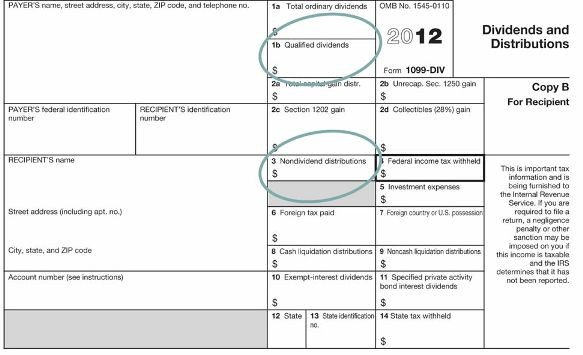

The 1099-DIV is the tax form that you receive from each company that sends you dividends (or with whom youve started a DRIP plan) if it paid you $10 or more in dividends or withheld any taxes from your dividends (or if the company was liquidated and you received at least $600). This document splits out the types of dividends you received as follows:

- Box 1a Total Ordinary Dividends: All ordinary dividends are reported here. These dividends are taxed at the same rate as your ordinary income.

- Box 1b Qualified Dividends: Your qualified dividends are taxed at long-term capital gains rates instead of ordinary income tax rates.

- Box 2a Total Capital Gains Distributions: Amounts here are also taxed at long-term capital gains rates.

- Box 2b Un-recaptured Section 1250 Gain: You may realize this type of gain from certain real estate or REIT transactions.

- Box 2c Section 1202 Gain: This is applicable when selling shares of some small businesses.

- Box 2d Collectibles Gain at 28%: If you sold artwork or other collectibles held for investment purposes, the profit is taxed at ordinary income rates if you held it for one year or less. If you held the investment for longer than a year, you may be taxed up to a maximum of 28%, depending on your income.

- Box 3 Non-dividend Distributions: If you received non-dividend money from a company, it may be reported here.

- Box 4 Federal Income Tax Withheld: If youre subject to backup withholding and a company withheld taxes from money reported on the 1099-DIV, it is reported here.

- Box 5 Investment Expenses: If you received discounted broker services or other stock-related services by purchasing stock directly through a company, the value of the discount is taxable income to you. Any other expenses paid on your behalf are also listed here.

- Box 6 Foreign Taxes Paid: If foreign taxes were withheld and paid on the money received, it will be reported here.

- Box 7 Foreign Country: In this box, the country to which foreign taxes were paid (the amount in box 6) is reported.

- Box 8 Cash Liquidation Distribution: If a company was liquidated, this is the amount that it paid to you out of the liquidation in cash.

- Box 9 Non-Cash Liquidation Distribution: If you received your portion of a liquidated companys assets in non-cash items, the fair market value must be listed here.

- Box 10 Exempt-Interest Dividends: In many cases, you do not have to pay taxes on exempt interest dividends.

- Box 11 Specified Private Activity Bond Interest Dividends: If you are subject to the AMT (alternative minimum tax), you may have to pay tax on a portion of the amount in box 10. This amount is entered here.

- Box 12 State: If you had state income tax withheld from these earnings, this box reports which state.

- Box 13 State Identification Number: The state identification number of the firm that withheld state income tax is entered here.

- Box 14 State Tax Withheld: The amount of state income tax withheld is reported here.

Final Word

In general, taxes on dividends are pretty simple. Most tax preparation software programs ask you to input the information from your 1099-DIV, and then proceed to make the necessary calculations for you and record them on the appropriate tax forms. However, its important to know what you earn over the course of the year in dividends in order to anticipate how much your tax bill will increase as a result. Do you take your dividends in cash or do you reinvest them? Have you ever sold stock purchased with a DRIP program?