Investors Should Buy Stocks Real Estate Yale’s Shiller Says

Post on: 1 Апрель, 2015 No Comment

Traders work on the floor of the New York Stock Exchange

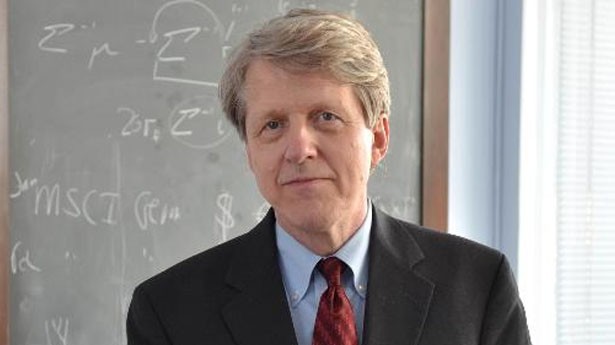

May 5 (Bloomberg) — Investors should brave the risk of “economic chaos” and buy stocks and real estate, said Yale University professor Robert Shiller. whose 2000 book “Irrational Exuberance” predicted the market’s collapse.

“I’m less pessimistic than I was a few months ago,” Shiller said of U.S. equities in an interview in New York. “The price-earnings ratio is about average. and by that you might say it sounds like one should be in the market and have a balanced portfolio that has a good share of stocks.”

The Standard & Poor’s 500 Index trades for 13.9 times its companies’ annual profits, up from a 24-year low of 10.1 in March, after the gauge rallied 33 percent since March 9. Its average price-earnings ratio for this decade is 19.4, according to data compiled by Bloomberg.

Shiller, who helped create the S&P/Case-Shiller home price index, warned in an August 2006 interview that there was a “significant probability” that housing market declines would accelerate and push the U.S. economy into a recession. He said today that an increase in pending home sales in March and February’s drop in properties on the market are “positive” signals for U.S. housing prices.

“Having a good fraction of your portfolio in stocks, not zero, is probably sensible now,” he said. “People should be in real estate as well because that has a chance of rebounding. It has to be about diversification, about spreading risks.”

The S&P 500’s advance from a 12-year low during the last two months may falter because unemployment is rising, he said. Joblessness in the U.S. is projected to have risen to 8.9 percent in April, according to economists surveyed by Bloomberg.

“The big thing is that we don’t know,” Shiller said in an interview at The New Yorker Summit: The Next 100 Days. “We could have a huge rally like the 1933 to 1937 rally. That happened in the middle of a depression so it could happen now.”

Stock Swings

The S&P 500 added 41 percent in 1935 and 28 percent the next year before slumping 39 percent in 1937. The benchmark erased its 2009 loss yesterday after home sales beat estimates, boosting confidence the global recession is easing. The benchmark plunged 38 percent last year, the most since 1937.

“The unemployment rate is probably going to go up substantially more, we’re going to have more economic chaos, confidence will come back to a lower level again,” Shiller said. “It’s still a seriously cloudy picture and there’s substantial risk of further substantial home price and further stock price declines.”

The S&P/Case-Shiller index, a gauge of home prices in 20 major U.S. cities, slowed its decline in February for the first time since 2007, according to data released April 28. The index has retreated 31 percent from its 2006 record.

The number of Americans signing contracts to buy previously owned homes jumped 3.2 percent in March for the first back-to-back gain in almost a year, the National Association of Realtors said yesterday. The number of houses on the market dropped 1.6 percent to 3.74 million, the group said April 23.

To contact the reporter on this story: Jeff Kearns in New York at jkearns3@bloomberg.net.

To contact the editor responsible for this story: Nick Baker at nbaker7@bloomberg.net.