Investment Strategies of High Net Worth Millennials

Post on: 16 Март, 2015 No Comment

The investment strategies of high net worth Millennials and members of Generation X reflect a generally upbeat attitude. Learn more about the young and the wealthy.

Wed, 05/16/2012 | BY Adriana Reyneri

The generally aggressive investment strategies of young, high net worth investors reflect an upbeat attitude, tempered by concerns about personal debt and retirement, according to a Millionaire Corner study completed over the first quarter of 2012.

High net worth members of Gen X and Gen Y – those ages 44 and younger with investable assets of $5 million to $25 million – are more optimistic about the future than their older peers. Nearly 70 percent expect their personal financial situation to be stronger in a year, and 59 percent describe their financial situation as better than it was a year ago. (Just over 55 percent of high net worth investors as a whole expect to be better off next year, and 41 percent say they are better off compared to last year.)

A more positive outlook appears to have inspired more aggressive investment strategies for younger high net worth investors. While the majority of their older peers feel that it’s more important to protect principal than grow investments in the current economic environment, a minority of young high net worth investors agree with such conservative investment strategies.

Nearly 60 percent say they are willing to take “significant risk” on a portion of investments in order to earn a higher return. Desire for a higher return and more aggressive investment strategies may stem from relatively high levels of concern about personal debt levels and retirement security expressed by the young high net worth. More than half (56 percent) say they are worried about having enough money set aside for retirement, compared to 32 percent of high net worth investors as a whole, and 49 percent express concern about being able to retire when they want to. More than one-third (35 percent) they will be delaying their retirement as a result of the economy, and one-third is concerned about current levels of household debt.

Despite these concerns, high net worth Millennials and members of Generation X prefer to devise their own investment strategies. Fewer than 30 percent report working with a financial advisor on a regular basis. Nearly two-thirds (65 percent) like to be actively involved in the day-to-day management of their investments, and well over half (57 percent) enjoy investing and do not want to give it up. Blogs are more likely to influence the investment strategies of young high net worth investors: 57 percent regularly read blogs pertaining to financial topics, compared to 30 percent of high net worth investors as a whole.

Young high net worth investors are also more likely to adopt tax-advantaged investment strategies. Fifty-seven percent said that potential increases in tax laws is prompting them to change some of their investment strategies, compared to 40 percent of high net worth investors as a whole.

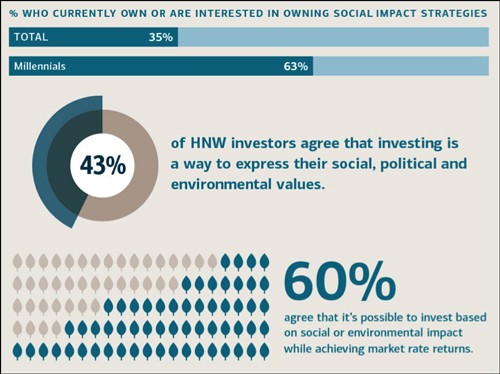

The investment strategies of the young high net worth are also likely to include charitable or philanthropic goals. More than half say they are concerned with using their wealth to help others, compared to 38 percent of all high net worth investors. Fifty-seven percent consider the social implications of their investment strategies, compared to 27 percent of investors as a whole.