Investment Property Calculator

Post on: 24 Май, 2015 No Comment

A Few Thoughts on Rental Investing and ROI

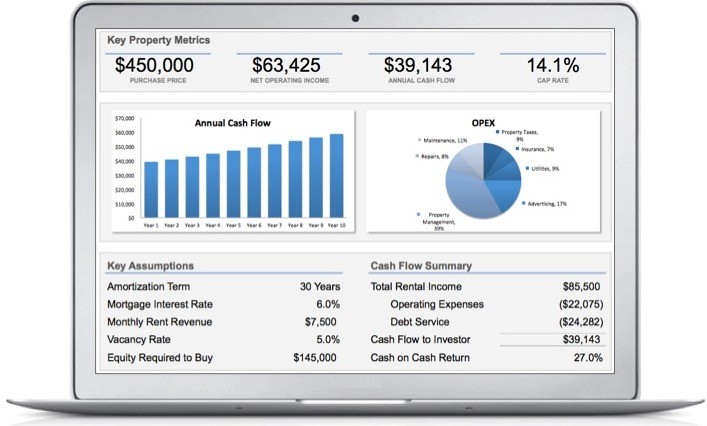

The math for evaluating prospective rental investment properties is extremely important (although it’s not without its limitations – more on that below). Understanding the full costs of owning real estate, from taxes to vacancies to unexpected repairs to mortgage interest and beyond, is critical to making informed decisions. Here are a few bullet points to consider, before buying any rental property:

- Budget for Unexpected Repairs – Many novice (and some experienced) landlords panic or rage when they get a call from their tenant saying the roof is leaking. Or the furnace just went out. Or the plumbing needs updating. But all roofs eventually leak, and all furnaces eventually break, and so on. Budget for repairs each year; some years the property may only need $200 in quick patches, but the next year it might need $3,500 in new appliances, roofing, etc. Budget for Property Management (even if you’re managing the rental unit yourself) – It costs time to manage rental properties, and even landlords who manage their own properties should pay themselves for property management costs. Calculating this expense helps real estate investors budget the true cost of managing the property. and ensures the deal makes sense regardless of who’s managing the rental unit. Budget for Vacancies – Vacancies are the single most expensive incident that most landlords are afflicted with, and of course they happen somewhat regularly. Budget at least 10% of the rent each year for potential vacancies, to avoid budget-busting calamities.

- Don’t Forget PMI – Private mortgage insurance can be several hundred dollars each month, yet many rental investors forget about it. Don’t be one of them.

With all of that said, property-specific math doesn’t tell the whole story. Is crime increasing or decreasing in the area? Are rents increasing or decreasing? Population? Wages? Do you have a sense of the local turnover rate? Understanding the broader context of the neighborhood and its trends is as important as the details of the property itself. Be sure to understand what direction a neighborhood is headed before sinking tens (or hundreds) of thousands of dollars into a single investment. A final word to the wise: regardless of how confident you are that a neighborhood is improving or appreciating, never base your property math on assumptions of future growth in rent or equity. Always, always base your ROI calculations on today’s rents and real estate values, so that your success is not gambled on future market movements, but based in today’s facts.