Investing in timberland Good move if it’s priced right

Post on: 27 Апрель, 2015 No Comment

Several individuals have contacted me in the last few weeks because they are interested in buying timberland. That’s new. Are these signals of a turnaround? After all, they are quantitative evidence…of something.

The problem with investing in timberland right now is that precious little of it is priced as timberland, that is, land whose basic use is to produce and sell timber.

Timberland is priced higher than its timberland value because sellers have reclassified it for an economically “higher and better use (HBU),” namely as second homes. Where $500/acre might be the market price for timberland that’s used for producing timber, $2,000 an acre might be right for the same woods marketed to an urban second-home buyer.

Part of the price difference has to do with pitching to different buyers, but the rest involves rebranding it and using the unchanged asset differently.

The price inflation that arises from a two-level market is more evident in smaller tracts of, say, 1,000 acres or less than larger one involving, say 10,000 acres or more. The timberland as timberland prices have edged up too, but not like the HBU conversions.

The large tracts are still for the most part being bought and sold by people who value this real estate mostly for its timber production and understand its pricing in those terms. HBU is, however, in the backs of their minds…and moving forward.

I’ve seen recently timbered tracts (with the next timber cutting 25 to 35 years in the future) priced at double or triple their bare land value. New England cutover is going for $800 an acre and up; one Michigan parcel of 80 acres of managed timberland was priced at $6,000 an acre; small tracts of southern pine land are priced at $2,500 an acre and up, with the emphasis on the up; West Virginia woods with limited timber value are $2,000 to $5,000 an acre depending how close they are to Baltimore, Washington or Pittsburgh.

Timberland that contains a lot of merchantable timber that can be sold immediately is worth more than timberland where the next harvest is 20 years out. But dirt-cheap cutover on a selective harvest may prove to be a better long-term investment than a parcel with 75 percent of its purchase price covered by the sale of merchantable timber. It depends on the price paid for each.

So my first bit of advice to timberland investors is don’t pay an HBU price for timberland if you want to keep it and use it primarily as timberland. The numbers will not work. The comps you will be shown are for HBU tracts, not timberland for timber production.

This market might eventually reset itself by dividing into its components as buyers refuse to pay an HBU price for timberland.

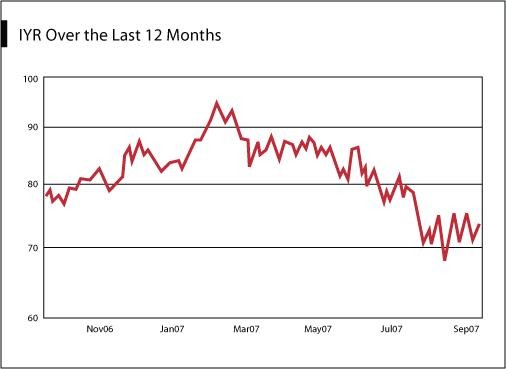

Timberland that’s bought at timberland prices has been an excellent investment, outperforming stocks since the 1960s. But that will end if buyers buy at HBU prices.

Small investors can still make money with properly bought timberland.

Timberland appreciation is driven by the following combination of factors:

- Background appreciation in land prices from population growth and continuing demand for wood products;

- Annual gain in tree height and diameter, which increases timber volume in all diameter classes (sizes); gain in volume is compounding;

- In-growth, which is the immediate increase in value as trees grow and move from a lower-value product category into a higher-value category. In a simplified example, hardwood trees have no timber value from, say, one to six inches in diameter; pulpwood value from six to, say, 12 inches; sawtimber value above 12; and possible veneer value above 18 or 20. At each change point, the value per unit (board feet, cords or tonnage) goes up several times over.

- Multiple-use timberland is likely to appreciate more than single-use timberland;

- Timberland usually has some environmental value that can be protected through the donation or sale of a conservation easement. A typical easement will preserve timberland as open space and for continued timber production, but prohibit or substantially limit division potential and improvements, such as residences. Sellers usually do not price CE value into their asking price, but buyers should calculate its possible monetary value, as well as its pros and cons, if the encumbrance of a CE is something that interests them;

- Certain types of timber and timberland will lend themselves to producing wood as an energy feedstock, such as the current market for pellets or a possible future market for cellulosic ethanol; product diversity can increase value of the timber resource;

- Timberland can be managed in a way to receive payment for CO2 retention;

- Some states extend land-use tax status to “managed timberland” that’s enrolled in a state program. This substantially reduces annual property tax, but may involve “strings” on the land’s sale and use.

- Rental/lease income from hunting and other recreational uses (cross-country skiing, horseback riding, mountain biking, ATVs, camping, etc.);

- Sale income from products, e.g. firewood, maple taps, ginseng, nuts, etc.;

- As federal policy backs out timber sales from public land, private timberland should increase in value owing to a shrinking national timber base;

- And…finally…HBU value at the time the landowner sells.

Timberland, of course, is subject to risk of loss from disease, pests, natural calamities (ice, wind, fire and drought), timber theft and troubles with natural regeneration post-timbering.

But the biggest problem from an investor’s perspective in my opinion, is the tendency to pay too much.