Investing In the Stock Market The Best Kept Secret in the World

Post on: 12 Апрель, 2015 No Comment

By By: Godfrey Gosein Securities Dealers Association of Trinidad and Tobago

Story Created: Aug 1, 2012 at 12:06 AM ECT

Story Updated: Aug 1, 2012 at 12:06 AM ECT

Almost every wealthy person in Trinidad and Tobago owns shares on the stock market. It is a place where wealth is created and where wealth is accumulated. It is also a well known fact that stocks outperform all other investments over the long term. If you do not already own shares, these are just some of the reasons why you should be investing in the stock market. Many people are intimidated by the stock market mostly because they do not understand how it works. However, it is very easy to get started and it is definitely not rocket science!

All you need to do is fill out a few account-opening forms and then you can begin to invest. In addition, unlike some other investment vehicles, there is no minimum investment. You can buy one (1) share or you can buy one million shares depending on your pocket.

The World Economy

The year 2011 was indeed tumultuous for the major economies of the world. The political gridlock in the United States resulted in a credit rating downgrade and the sovereign debt crisis in Europe intensified. The economic outlook for Europe is weak and will worsen before it gets better through austerity measures that are and will become necessary if investor confidence is to be restored. Although some significant progress was made regarding Greece’s debt restructuring, there are still those who feel that Greece will eventually have to leave the Eurozone. In other words, Europe’s woes are far from over and in fact, it is all but certain that Europe will slide into a recession this year.

Moreover, China, one of the BRIC countries seems to be heading towards a hard landing after many years of double-digit economic growth. What is clear though is that China’s economic growth is slowing and double-digit growth is no longer on the cards. However, the corrections in the real estate market and in the banking system are fundamentally different from what caused the economic crisis in the United States and Europe.

The Trinidad and Tobago Story

Here in Trinidad and Tobago, the economy recorded a decline in growth of about 1.5% in 2011. This will mean three consecutive years of decline. However, this performance is neither as bad as some of our Caribbean neighbours nor many countries around the world whose economies have suffered tremendously since the global meltdown in 2008.

The stock market, on the other hand, did remarkably well. The Trinidad and Tobago Composite Index was up 21% and was ranked the fifth best performing market in the world, behind Venezuela (up 80%), Mongolia (up 32%), Panama and Tehran (both up 29%). The top performers for 2011 in the local stock market were as follows:-

There is excess liquidity in the system and as a result, interest rates are extremely low. As a matter of fact, some commercial banks are refusing deposits into Money Market accounts. Do you remember a few years ago when the Unit Trust Corporation (UTC) was offering 10% interest on their TT Money Market Fund? Well, those days are over and I dare say they may never return. The UTC rate is currently below 1.5%. The fact of the matter is that financial institutions have little options in terms of placing these funds to earn a sufficient spread and that is why Fixed Deposit rates are at an all time low.

Although there is now a platform where bonds could be traded, the secondary bond market is virtually non-existent. This is because with limited investment opportunities, as soon as a Government Bond or a good Corporate Bond, for that matter, is issued, large institutional investors buy up huge blocks of these bonds and hold them until maturity.

Another relatively new development with the issuance of bonds is that primary issues are now being done by Auction. This is an entirely new concept that needs a fair amount of explanation and the ordinary man on the street does not readily comprehend what is required in order to invest. Oftentimes, the retail investor will just not bother.

Another traditional investment vehicle is Real Estate. Do you recall a few years ago, you could have bought a property, fix it up and sell it for a substantial profit? In the US this practice is referred to as flipping and there are many who make their living from flipping properties. Alternatively, if the property was located in a sought after area, could you have gotten it rented by an ex-pat relatively easy? Well, there are persons who have bought units in One Woodbrook Place as an investment and have, to date, not gotten it rented.

So, we are operating in an investment landscape where Fixed Deposit rates are below 1%, UTC rates are below 1.5%, there is virtually no secondary bond market, primary issues are not only few and far between but the pricing is complicated and real estate may be a risky proposition. Against this backdrop, let me introduce you to the best kept secret in the world – investing in the Stock Market.

Opportunities in the Stock Market

As mentioned earlier, it is very easy to buy shares on the stock market. The trick is to put aside what you can afford each month and start an Equity Investment Portfolio.

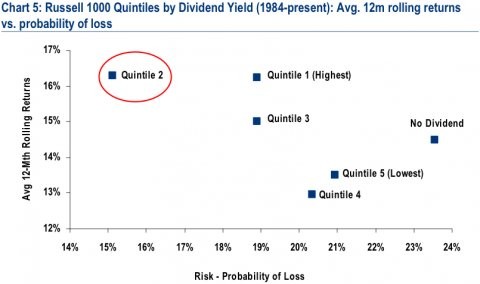

Recently done research on the local stock market have revealed some amazing results. Do you know that the dividend yield on shares in Scotia Investment Jamaica Limited (SIJL) is 5.42%? SIJL pays dividends four times a year and having already paid two interim dividends in April and July this year totaling TT$0.066. It is expected to pay a third interim in October and a final dividend in January 2013. Cumulatively, it is expected to pay an annual dividend of TT$0.13. In other words, if you buy this stock, sit back and hold it, you will receive four cheques in the mail, which cumulatively will provide a return on your investment of 5.42% per annum. In addition, because of its strong dividend yield, this particular stock is expected to attract a fair amount of demand and in any market where demand is greater than supply, the price tends to increase. So, if you buy at TT$2.30 and the price reaches TT$2.50, you would have gained 5.42% in dividends and another 8.70% in what is referred to as capital appreciation.

A table showing the top five stocks in terms of dividend yields is given here to show you the other investment opportunities in the stock market and to let you in on the best kept secret in the world.

Godfrey Gosein is a member of the Board of Directors of the Securities Dealers Association of Trinidad and Tobago.