Investing in the endowment

Post on: 27 Май, 2015 No Comment

IRS offers opportunity for MIT charitable trusts

A private letter ruling by the IRS allows MIT to invest certain charitable trusts with the larger university endowment. Now, when you establish a charitable trust with MIT, you can request that it be invested with the endowment and get approximately the same results as the endowment does.

Over the 10-year period ending June 30, 2008, the Institute’s endowment has had an annualized return of 13.2 percent.

How charitable trusts work

A charitable remainder trust is a fund in your name, managed by MIT, that pays you, or the beneficiary you name, five percent of its fair market value annually for life. If the market value increases, so does the annual payout. At the end of the contract, the remaining trust assets pass to MIT, to be used according to your instructions.

Establishing a charitable remainder unitrust provides you with—

- an income tax deduction,

- estate tax savings, and

- the opportunity to defer capital gains taxes.

When you contribute highly appreciated assets (such as stocks or real estate) to your trust, MIT can sell them without paying capital gains and put all of the proceeds to work for you in a more diversified portfolio.

Opportunity for diversification and growth

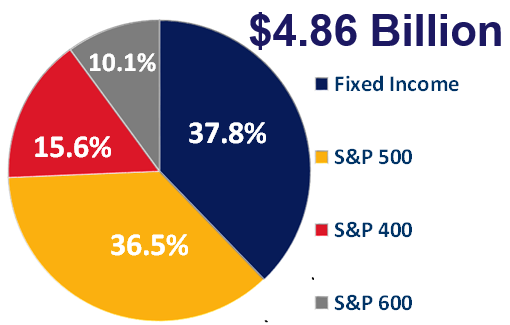

The IRS ruling provides charitable remainder trusts with significant diversification and growth potential. Qualified charitable trusts can now be invested in non-marketable securities, or “alternative assets,” which form a significant portion of MIT’s endowment.

These assets, which are rarely available to smaller investors, include—

- private equity,

- real estate,

- absolute return investments, and

- natural resources investments.

The IRS ruling applies to most charitable trusts set up at MIT. Donors who turn suitable outside trusts over to MIT as trustee and designate the entire charitable remainder for the university may also benefit.

Before you reach any decisions about creating a charitable trust as a gift to MIT, please consult your attorney, accountant, or other financial advisor.

For more information, please contact:

The Office of Gift Planning

Massachusetts Institue of Technology

600 Memorial Drive, W98-500

Cambridge, MA 02139-4822

(JavaScript must be enabled to view this email address)