Investing In REITs To Diversify Your Investments

Post on: 29 Март, 2015 No Comment

by Tim P. on 2011-01-02 6

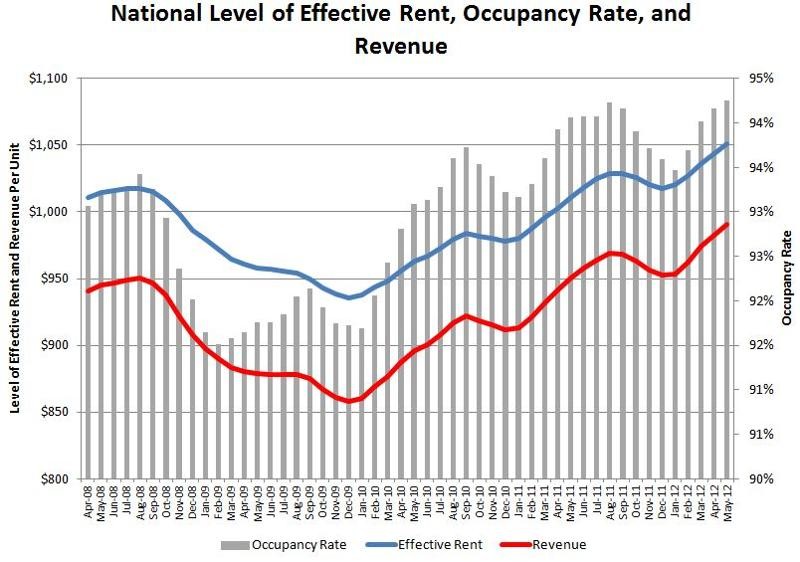

The real estate market has been the black sheep of the financial world since the summer of 2008 when the real estate bubble burst to cause the American economy to plunge into what many feared would be the next Great Depression. But as you can expect with the economy and the markets, what goes down will eventually come back up. And as the real estate market stabilizes, recovers and begins appreciating in value, REITs will once more, find themselves increasingly popular. In fact, as youll see from our tour of REITs below, the markets have already shown changes over the past few years.

Investing In REITs To Diversify Your Investments

But were here to talk about REITs. A REIT, or Real Estate Investment Trust is a real estate company that offers shares to the public. In other words, it operates much like stock in that it represents ownership in a business. There are two unique characteristics that set a REIT apart from other types of stock: first, its primary business must be to manage groups of income producing properties and second, almost all of its profits must be distributed to the stock holders in the form of dividends.

Image from SeekingAlpha

What benefits do REIT managers have? In exchange for paying out 90% of its profits to its shareholders, the company avoids corporate income tax. Whereas a mutual fund is a large scale fund that pools money to invest in stocks and bonds, REITs do the same thing but they invest in real estate.

Check your broker or these best brokerage firms to get started with REITs.

Types of REITs

There are a few different types of REITs. One of those types is called a mortgage REIT. They make loans that are secured by real estate but normally don’t own or operate any physical properties. Around 10% of all REITs are mortgage REITs.

Now equity REITs are the subject of this article. An equity REIT specializes in owning certain types of properties which might be apartments, strip malls, or lodging facilities. Some only own one kind of property while others prefer to diversify their properties.

5 Safe REITs To Consider (from Kiplinger)

Kiplinger identifies 5 safe REITS that the investor may want to look into. As you can see from the accompanying 5 year charts below, these REITs have already bounced back quite a bit from their 2009 lows. Youd have done well if you took the contrarian approach and managed to incorporate them in your portfolio as the financial crisis was unfolding.

#1 Simon Property Group (SPG)

This REIT specializes in high quality shopping malls. Although they have had to cut their dividend, theyve got a strong claim: “high quality shopping malls will never go away.” It’s important to remember that all REITs could be depressed in value for a while as the market recovers. Diversify with malls and retail establishments.

SPG REIT chart from Yahoo! Finance