Investing in REITs_1

Post on: 9 Июнь, 2015 No Comment

Real Estate Investment Trusts, or REITs, are investment products specializing in owning, operating, leasing or financing real estate. Depending on the market, REIT investors can realize a profit without the problems associated with directly acquiring real estate investments.

REITs were created by Congress in 1960 to allow average investors the opportunity to combine resources in order to engage in significant real estate investments and realize major real estate assets. REITs legislation allowed those investing in REITs to avoid corporate income tax, providing the company met certain criteria.

Why REITs Might Be a Good Idea

A REIT is a real estate investment corporation, so investing in a REIT means you are not investing directly in real estate but rather in a company that manages real estate. Such an investment provides a number of benefits. First, REITs must distribute roughly 90 percent of their taxable income as dividends. Also, REITs are bought and sold on the major stock exchanges, and REIT mutual funds are dedicated to owning such publicly traded REITs. Such investment power gives a large group of REIT shareholders indirect ownership of real estate investments.

Like a mutual fund, the returns based on investing in REITs depend on the skills of those who manage it. REITs give you the chance to have your property managed by real estate professionals who understand real estate investments and the real estate industry. Investing in REITs also limits your personal risk by avoiding the massive debt associated with acquiring typical real estate investments. For example, you’re not the one whose wallet is on the hook for vacancies or repairs.

Borrowing for a typical real estate investment also requires borrowing from associates or a lender and usually requires a personal guarantee, leaving you exposed to crippling liability should your real estate investment not pan out. If you are unable to borrow enough capital, you might be left with liquidating other resources like stocks and bonds, mutual funds or insurance policies. Buying into a REIT, however, allows you to buy real estate investments with the price of a share, often a few hundred dollars. You will realize the same reward, based on your purchase, as an investor who invests thousands more than you do. Finally, REITs are a liquid asset that can be liquidated fairly easily.

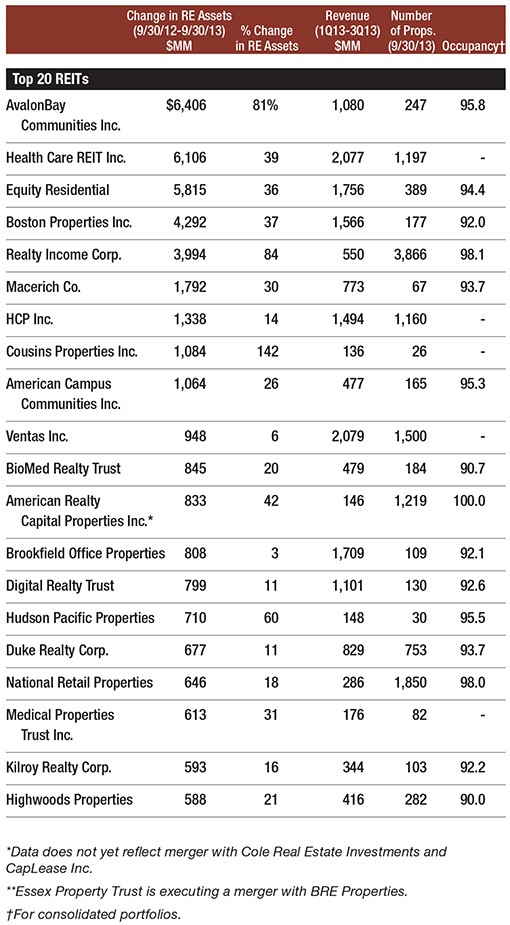

You can invest in a variety of REITs. Such real estate investments include residential, retail, office, industrial, health care, hotel and resort REITs, each with its own area of emphasis and its own unique form of return.

An Alternative to Buying

Buying a home or any sort of real estate is inherently risky and requires a substantial amount of upfront money. If you don’t have readily available cash and you don’t think a loan may be forthcoming from your lender, a REIT may be an excellent option to build equity. While purchasing real property results in a higher yield, REITs allow you to make money in real estate without the risk of buying a real estate investment and carries far fewer headaches than typical real estate investments.

A REIT lets you build the capital to purchase real estate and to buy your home without relying on the kindness of a lending institution and lets you gain an understanding of the real estate market before leaping into it. Investing in REITs also gives you a great deal of flexibility due to their liquidity. REITs are easier to get out of than putting a real estate investment on the market, and you won’t end up paying a real estate agent’s fee.

Investing in REITs can also help you take advantage of the ebb and flow of the real estate market. While real property may appreciate rapidly, it can also depreciate just as quickly, as seen in the recent housing downturn. By investing in REITs, however, you can realize nice dividends and diversify your portfolio.

Investing in REITs, however, is an investment strategy and should be treated as such. While you might not be fixing roofs or patching walls in your own real estate investment, you need to manage your investment in a REIT carefully, and past success does not guarantee future reward. Your investment is a business concern that you need to analyze and evaluate constantly, not a passive form of income that you can ignore.