Investing in real estate via REITs real estate mutual funds

Post on: 7 Июнь, 2015 No Comment

By John Waggoner, USA TODAY

You’ve probably read about the troubled real estate industry, in stories with headlines like Real estate continues slump, Real estate woes deepen, and Real estate surrenders after three-county car chase.

By Paul J. Richards, AFP/Getty Images 2006 file

Homes for sale in Centreville, Va.

But real estate funds have been on a tear. The past two years, the average real estate fund has soared 128%, including reinvested dividends, vs. 72% for the average stock mutual fund.

The question now: Are real estate funds overvalued? The answer: No, but they sure aren’t cheap.

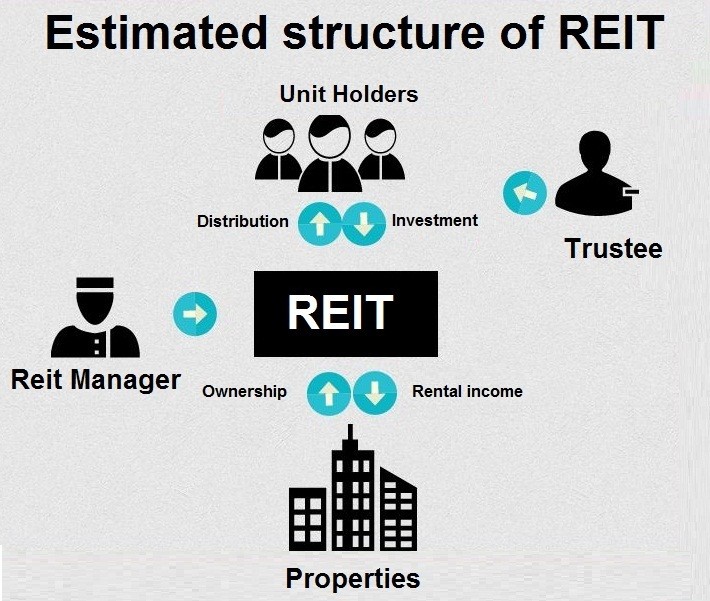

Real estate funds invest primarily in real estate investment trusts, or REITs which, in turn, invest in commercial real estate. You can buy REITs that specialize in office buildings, shopping malls, hotels and even self-storage facilities.

By law, REITs have to return 90% of their taxable income to shareholders, so most REITs have attractive yields. The average REIT had a 4.12% annual yield at the end of February, says the National Association of Real Estate Investment Trusts. The Standard & Poor’s 500 stock index, in contrast, yields 2.1%.

(Most REIT dividends, incidentally, are taxed at your ordinary income tax rate, rather than the 15% maximum tax on qualified stock dividends.)

In REIT parlance, a low yield means a high price, and vice versa. Yield is the annual dividend payout divided by price. As prices rise, dividend yields fall.

And by historical standards, REIT dividends are low. The average REIT has yielded 5.8% the past decade, according to NAREIT. The all-time low yield: 3.78%, set during the halcyon days of January, 2007. REIT yields eventually shot to 11.3% in February 2009. In between those times, the average REIT plunged 58% and that’s including dividends.

The main problem with REITs now: They’re not cheap, says Ken Heebner, manager of CGM Realty fund. But when other yields are zero, something is better than nothing. And, he says, much of the rise in REITs stems from investors’ hunger for yield. If there’s any evidence of a real estate bubble, it’s pretty well hidden.

The argument for REITs: As the economy grows, many types of REITs should raise their dividends. Heebner thinks the economy will grow for several more years, and that there’s no particular need for the Federal Reserve to hike interest rates.

Not all REITs are equal. Scott Crowe, portfolio manager for Cohen & Steers Global Real Estate Securities, likes apartment REITs. As the housing market has deteriorated, demand for apartments has risen in many areas, allowing landlords to raise rents. Another plus: Apartment construction has been negligible and many apartments were converted to condos during the boom years, he says.

Jim Beers, portfolio manager of Stratton Real Estate fund, has liked lodging REITs. Hotels can raise their prices overnight, and many have. But the sector seems overvalued, he says. Instead, he’s looking at stocks of companies like Marriott and Starwood, both leaders in the lodging sector.

Office REITs look cheap to Heebner. True, vacancy rates are high, particularly in suburban areas, he says. But as business gets better, vacancy rates will decrease and rents should rise. And, says Crowe, very few new office buildings have been built.

For most people, the most convenient way to invest in REITs is via a mutual fund (see chart). If you’re a fan of low-cost index funds, you have a handful to choose from: The Vanguard REIT Index ETF (ticker: VNQ) and its garden-variety twin, the Vanguard REIT Index fund (VGSIX) are two well-known REIT index funds. Another to consider: iShares Cohen & Steers Realty Majors (ICF).

If you want to invest in individual REITs, you can find a useful list of REITs at www.nareit.org. Look for companies with growing funds from operations (FFO) a REIT-specific measure that is net income minus gains from real estate sold, as well as any depreciation and amortization. You should also look at the FFO payout ratio, which compares the dividend per share to FFO per share. A REIT with a payout ratio of more than 100% is probably not going to sustain its dividend. A REIT with a low payout ratio has room to increase its dividend, or to make additional property purchases.

Buying a real estate fund now is a bet on future prosperty: You’re not bargain-hunting here. You’re looking for REITs to improve along with the economy. If you think the economy and commercial real estate is speeding down the highway to Palookaville, stay away. But if you want reasonable income, and the chance for decent growth, REITs might be a good choice.

For more information about reprints & permissions. visit our FAQ’s. To report corrections and clarifications, contact Standards Editor Brent Jones. For publication consideration in the newspaper, send comments to letters@usatoday.com. Include name, phone number, city and state for verification. To view our corrections, go to corrections.usatoday.com .