Investing in Cashflow with Doug Fath

Post on: 20 Апрель, 2015 No Comment

I Will Never Be Financially Free

I wrote this blog post almost exactly two years ago and this topic came up again when an old high school classmate asked me if I could suggest a financial advisor for her.

Here is what I wrote on April 29th, 2011.

what I discovered shocked me.

Rather than bore you with the details of the meetings

with the different financial planners lets cut right to the chase

and talk about one of the meetings in particular.

This financial planner asked me when I want to retire

and how much money I want coming in.

I told him I never plan to retire ( I love what I do) but

for the purpose of his exercise I said I want to retire in

the next 10 years and make $250,000 each year after taxes.

He ran his computation (not including existing assets) and told me that I would need to create a nest egg of over $1.6 Million dollars in the next ten years to achieve my goal.

With that nest egg I could then invest in the stock market, mutual funds, annuities and other financial products to achieve my annual retirement income goal.

Lets take a look at this plan in 4 parts.

1. Coming up with an extra $1.6 Million

2. Risk of Income

3. Risk of Investments

4. The Alternative

1. Coming up with an extra $1.6 Million

Most people if they had to save an extra $1.6 million dollars over the next 10 years would do what they know how to do…work harder.

That means I would need to save an extra $160,000 / year for the next ten years. This amount wouldnt even include the money I need to live, to feed my family, to have some fun etc. But for the purposes of this example and to be ultra conservative, lets say that I managed to live extremely frugally and lived off of $40,000 so my needed income would be an even $200,000 after taxes.

That means I would need to make $240,000 / year to net approximately $200,000 after taxes.

This is not realistic for most Americans given the median household income in the US is $46,326

But, even if you can make $240,000 / year busting your a$$ at a job, why would you?

As weve discussed, earned income is the highest taxed type of income AND you are putting in lots of time to achieve your goal. That time you lose, not spending with your family, not doing the things you love to do, you cannot get back.

2. Risk of Income

How are you generating this income? Even if you have gotten resigned to paying high taxes, how secure is your job? Is your job going to be safe with the economic changes we are undergoing and will your job be necessary in the new global economy? If it is, then you should do ok. But I would argue that very few jobs will really be safe with the changes that are coming. If you know your job is not going to be safe, now is the time to start looking at new ways to produce income.

Make sure to get a free copy of The Freedom Report if you havent yet to ensure your freedom in the new economy. If your job is safe then keep on producing income, because that is only the first step of the plan. The next step is then investing that money.

3. Risk of Investments

I find it mind boggling that the majority of Americans

work so hard for money and then they turn their money

over to the so called experts without doing much

diligence.

Most financial advisors want you to put your money into the stock market, mutual funds etc and hope to get a 10 or 15% return on your money.

This sounds crazy to me for a few reasons. First off, I think 10-15% return is extremely low. There are ways to get higher returns with less risk. Second, you have absolutely no influence over how your investment performs.

It doesnt make any sense to me to work hard your entire life and then trust your retirement to strangers. Does that really sound like a safe and secure plan to you?

I know many people who lost at least 50% or more of the value of their retirement accounts after the mess of 2008.

How much influence did you have to actually affect the value and profitability of your retirement account when the financial storm hit? If the answer is not much, it may be time for you to change your investment strategy, especially because the worst is still yet to come.

And yet this is what is scariest to me. Lets say I had taken the financial advisors advice 10 years ago and had found a way to save $1.6 million dollars in my retirement account and then after the subprime mess of 2008 that account dropped to $800,000. What would I do then? I busted my a$$ for 10 years, did everything I was supposed to and because I had limited influence over my investments, when the financial storm hit I ended up only halfway towards retirement instead of being able to retire.

The unfortunate thing is that today lots of potential retirees find themselves in this exact position. Yet today when I sit with most financial advisors they give me the same advice that they have given in the past.

Do you think that potential retiree who cant retire now would endorse the plan that the financial advisors gave me?

The problem now though is that potential retiree has been practicing how to make earned income for the past 40 years and that is the only thing he/she knows how to do. And since he is now $800,000 short to retire he has three choices.

1. Cut his lifestyle for the last years of his life

2. Continue to do what he has been doing the past 40 years, work for earned income

3. Learn an entire new skill set and take control of his investments and learn how to create passive income.

Unfortunately at this age, most people arent willing to even consider number three as an option so they resort to 1 or 2, neither of which is very appealing.

4. The Alternative

After meeting with financial planners and listening to their options Ive come to the conclusion that the plan I first created after reading Rich Dad Poor Dad, when I was in my young 20s is still the best plan for me and my new, soon to be family.

I realize this plan isnt for everybody, but for me, its the only one I have confidence in because I am able to influence the results and am 100% responsible for how it goes.

Its a simple plan, but it takes hard work. The exciting news is that the harder you work upfront, the less work you have to do on the back end and the more money you make.

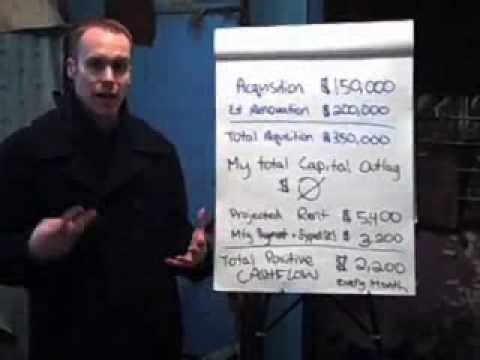

Like Robert Kiyosaki says, acquire income producing assets.

Specifically I acquire assets that:

1. I control/influence

2. Are tax friendly Allow me to make money and pay zero taxes or very little taxes (less than 10%)

3. Provide steady cashflow and capital gains appreciation

4. Allow me to use leverage ( I dont use my own money)

5. Protect principal (allow me to recoup my initial investment in 12 months, if I use my own money)

The truth is at the end of the day, risk is always a part of any financial plan…nothing is guaranteed.

The question is which financial plan makes the most sense for you and will help you achieve your desired goals?

I believe I am able to reduce my risk by increasing the influence I have over my investments. In addition the more I educate myself, the more investing experience I get, I further reduce my risk. Not only do I further reduce my risk, but I also increase my financial returns.

This makes sense for me.

This also requires courage, especially at the beginning.

When I read Rich Dad Poor Dad at the age of 20, I learned a new way to create wealth and make money but it is one thing to know how to do something and to actually do it.

When I purchased my first piece of real estate 7 years ago at the age of 22, I got in the game. For the past 7 years I have continued to educate myself in the virtual classroom by attending seminars, reading books, etc as well as getting real world experience by actually doing what Id read.

Each year I develop skill sets that enable me to increase my income producing assets, make more money, pay less in taxes and have the time to do the things I enjoy most with the people I love.

Stay tuned because in my next post I will be sharing in detail how my real estate assets are able to achieve the results I mentioned above.

Join the conversation and let us know what your plan is by leaving a comment below.

Permanent link to this post (1660 words, 2 images, estimated 6:38 mins reading time)