Invest In Tax Lien Certificates

Post on: 8 Июнь, 2015 No Comment

What are Tax Lien Certificates?

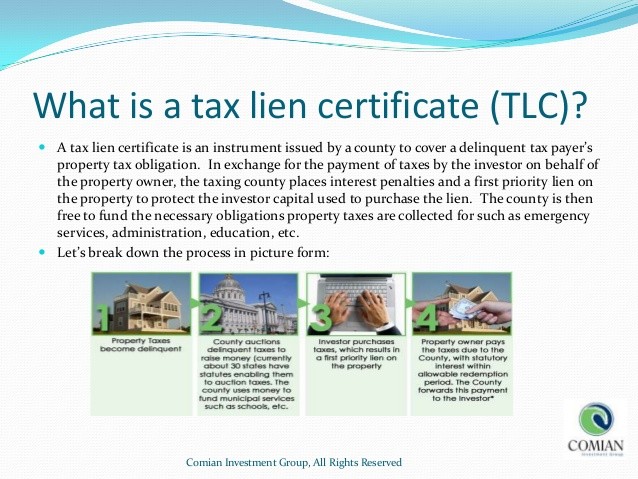

When a homeowner owes outstanding property taxes on his or her property, the city or county will impose a tax lien. or judgment, against the house. Some states allow for a tax lien to be placed in first position on the house and then issue tax lien certificates-investment documents which are transferable to third parties. The tax lien certificates are then sold at auction.

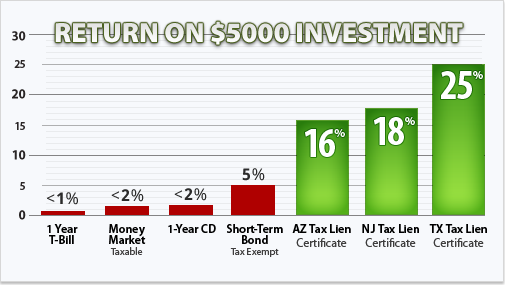

A Solid Opportunity

If an investor purchases a tax lien certificate through a successful bid, he or she is buying the rights to that particular tax-related debt, as well as any interest that has been attached to the lien. (Tax lien certificates are assigned a fixed-rate interest rate by the city or county.) Investors then hold the rights to these tax lien certificates-and collect on interest-until the debt is paid in full.

In some cases, the investment opportunity can become even more lucrative. If the homeowner doesnt pay the tax lien certificate (after a government-mandated length of time), the investor is entitled to receive the title to the property. Receiving the title to a real estate property at a substantial discount makes for a potentially high-profit investment opportunity, and is an ideal scenario for some investors to add real estate property into their investment portfolio.

The benefits of tax lien certificates are potentially rewarding in a way that is rarely seen in real estate: fixed-interest rate returns and a potential chance to purchase property at a fraction of the normal cost.

But if it sounds too good to be true it just might be.

Buyer Beware

Investors have placed their money in tax lien certificates only to discover later that the property they thought they had purchased at a value was really worth nothing. For one, if a homeowner declares bankruptcy while the tax lien is outstanding, the bankruptcy court could outweigh the rights of investors, leaving the tax lien certificate worthless in the wake of the IRS. Other scenarios could include a property that has significant damage, making the structure uninhabitable or the property unbuildable-and thereby making the sale worthless. Its important to perform physical inspections and surveys on property before making a decision to invest in tax lien certificates. Otherwise, the loss to your investment portfolio could be much more significant than any potential gain.

Also keep in mind that its a good idea to meet with a realtor who is familiar with the industry so that he or she can perform the proper due diligence on the property and its title. A real estate agent will be able to confirm that the property has no other liens against the title, as well as tell you whether or not the person whose name is on the lien actually has legal rights to the property.

Lastly, before you decide whether or not to ****invest in tax lien certificates, its best to consult with a tax or real estate attorney. Your advisor will be able to tell you whether or not tax lien certificates are a good fit for your risk management profile. And, keep in mind that tax lien certificates must be purchased in cash-either payable immediately or within 48 hours of the auction.

For more information, try a search for tax lien certificates on the internet. Some government agencies are starting to offer online auctions, so try a search through your local county web site as well.

Answered about 9 years ago