Invest in Real Estate with a SelfDirected IRA LLC

Post on: 10 Апрель, 2015 No Comment

Terminology

Real Estate IRA is not a “technical” term, rather it is a “descriptive” term. In much the same way that Checkbook IRA implies that it is an IRA with checkbook control, Real Estate IRA simply means that an IRA is being used to purchase real estate.

For clarity, Safeguard’s IRA plans have “checkbook control”, are formed using a Limited Limited Company (LLC) and may be used for investing in real estate, or any other asset allowed by law.

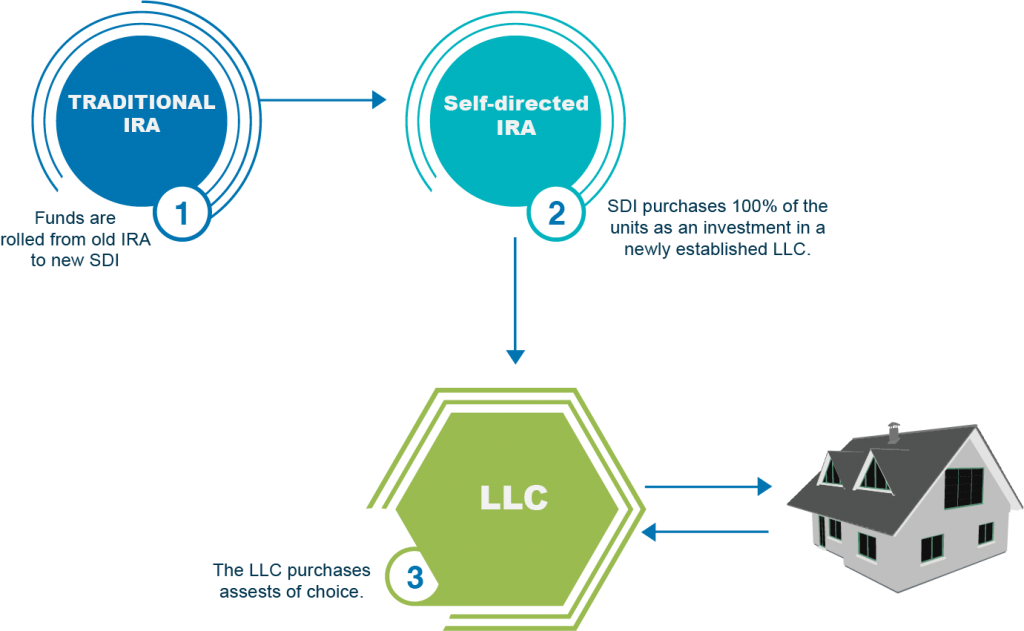

The process to set up a Real Estate IRA is identical to the Self Directed IRA LLC .

Fully Approved By Government Regulators

Although few people have known about the ability to invest in real estate with an IRA, it is fully permissible according to the Employee Retirement Income Security Act (ERISA).

This legislation, passed in 1974, shifted the responsibility of retirement savings from the employer to the employee. The following year, IRAs were created to provide individuals a chance to direct where their retirement funds were invested.

Rather than distinguishing which investments are allowed, the IRS code instead identifies which investments are not permitted under these laws. Only two types of investments are excluded under ERISA and IRS Codes:

- Life Insurance Contracts

- Collectibles such as works of art, rugs, jewelry, etc.

Go to this link for more information on this topic: FAQ

Main Advantage of a Real Estate IRA

The main advantage is that YOU control your own retirement funds.

Once your existing retirement funds are transferred to an LLC bank account, you have immediate access to the funds and as Manager of the LLC you can execute any allowable transaction.

This is in direct contrast to Custodians and Administrators that will set up a Real Estate IRA, but require you to fill out paperwork and wait for processing each time you make an investment. They control the checkbook, write the checks and pay the bills, and you’re charged a fee for each transaction.

Safeguard’s Real Estate IRA cuts through the red tape by giving you “checkbook control” of your retirement funds through a local bank account. No hassles. No transaction fees. No lost deals because of Custodial delays related to paperwork.

In the case of real estate investments, you can make an offer, negotiate the deal and handle the closing with the Title Company or with an Attorney, depending upon the state laws in force. Once the property is acquired, you have the option of handling administrative duties, or appointing a property manager.

Property types which can be held in a Real Estate IRA

- Residential

- Commercial

- Industrial Buildings

- Raw Land & Lots

- Foreign Real Estate

- Farm Land

- Trust Deeds & Mortgages

- Tax Liens & Options

The Real Estate IRA Opportunity

Due to the distressed property market and foreclosures since 2008, potential home buyers have been forced to become renters and rental rates have steadily increased nationwide! Even as many real estate markets recover, foreclosure rates are still high and retirement investors are still finding solid deals.

Quick Turnaround for Set Up

Typically, from the point of initiating the transfer of retirement funds to actually making the Real Estate IRA investment, it takes 30 days or less to complete the process.

Your Next Step

For immediate analysis of your situation and the best strategy for your investment interests, call us today at 877-229-9763

Special Report

Download our “Special Report” and learn how to take advantage of one of the best real estate investment opportunities you will see in your lifetime.