Invest IBacked Securities

Post on: 10 Июнь, 2015 No Comment

It may not be Halloween yet, but let’s talk about something scary: mortgage-backed securities. Concepts like toxic assets are making many people shy away from mortgage-related investments–with good reason, too, as they almost destroyed our economy.

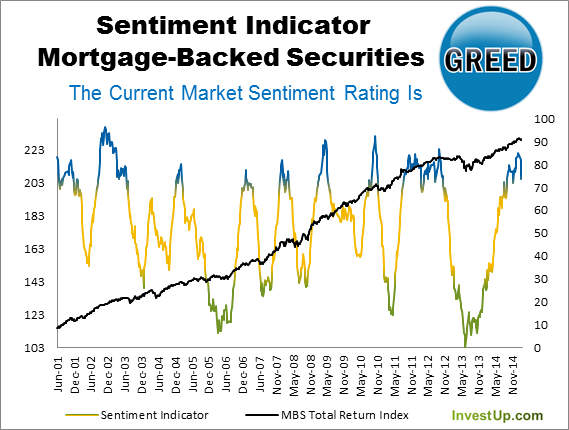

Still, as investors try to avoid these troubled assets, they might be missing out on other healthy investments. Some of our investment advisers think these assets are worth a gander, but only with professional help.

Mortgage-backed securities certainly require more babysitting than other types of assets. But with tighter spreads and many investors running (screaming) away from these assets, investors who can do their due diligence and are working with trustworthy investment advisers gain a way to diversify their portfolios.

Those looking to invest in these securities should note the increased risk that comes with private mortgage-backed securities instead of the government-backed ones, says Curt Lyman, managing director at investment house HighTower. “With mortgage-backed securities backed the government, the government will soak up what otherwise would have been your losses,” he says.

These are also trickier investments because they can be affected by increased interest rates and pre-payments. Pre-payment happens when, for example, a homeowner sells his house and has to pay off the rest of his mortgage. If the pre-payment slows down on these securities, investors who thought they were holding onto a 10-year security might actually have a 15-year investment.

Years ago, mortgage-backed securities were seen as much safer investments because homeowners worked hard to avoid foreclosure. As of august, there were 2.7 million mortgages at least 60 days past due, according to the U.S. Department of Treasury. (See “Weak Progress On Loan Modification.” )

Mortgage-backed securities are a way to diversify the fixed-income portion of your portfolio with something that performs differently than your standard bond. Lyman recommends investing in exchange-traded funds, such as iShares MBS Bond Fund and Vanguard REIT. Mortgage-backed securities should only be tackled by advanced investors, he says.

Matt Lloyd, chief investment strategist at Advisors Asset Management, suggests looking at mortgage-backed securities that originated before 2005, as some of the assets from 2006, 2007 and 2008 had underwriting issues. He advises conservative retail investors who don’t need money right away and who like the monthly cash flow to allocate between 5% and 10% of their fixed-income portfolios to mortgage-backed securities.

P. Brett Hammond, chief investment strategist at TIAA-CREF, notes that investors are aware that there are some pitfalls related to mortgage-backed securities and these investments should be made with the help of an adviser.

And there’s no real reason to fear these “toxic assets,” as they are really just mispriced, says Barry Ritholtz, chief executive of Fusion IQ. The assets are mispriced because banks that received Troubled Asset Relief Program (TARP) funds, such as Citigroup. Bank of America and Wells Fargo. don’t want to take a loss by lowering the price of these assets and would prefer to hold on to them, he says.

“The government has to stop giving these drunks more drinks,” Ritholtz says, so that banks can put these products out to market at a fair price. He cautions investors to look for an adviser with a good record before investing in these securities, although most investment professionals also haven’t accurately evaluated these assets in the past. So if you want real estate exposure in your portfolio, Ritholtz suggests buying some property that is aggressively priced.

These mortgage-backed securities used to, for example, have $50 million of mortgages bundled together, anywhere from 5% to 10% of which could go into default without endangering the MBS holder’s payment and principle. Hilary Kramer, chief investment officer at A&G Capital Research, is concerned that banks looking to get these assets off their balance sheets will offer them at a discount to hedge funds, and that these investments will trickle into some pension funds.

Mortgage-backed assets need to be monitored because, as mortgages are repackaged and sold–which is what happens when these assets are securitized–the person who originated the risk no longer has it, says Marc Lowlicht, head of the wealth management division at Further Lane Asset Management. The risk of someone defaulting on their mortgage has been pushed off of someone’s plate and has made its way onto yours. And that is a very real risk.

The seasonally adjusted mortgage delinquency rate (the number of loans where a person has missed at least one mortgage payment) on one- to four-unit residential properties is 9.24% of all outstanding loans in the second quarter, according to the Mortgage Bankers Association. This is the highest default rate since the group started tracking this data in 1972.

So if you’re looking to diversify into these assets, be sure to enlist some help, and to do your research.

Taking Risks with Someone Else’s Money

Forbes: In recent months, investment banks have been repackaging old mortgage securities and offering to sell them as new products, a plan that’s nearly identical to the complicated investment packages that really presaged the market’s collapse. How dangerous is this, and what does this make you think about picking stocks–including those to avoid?

Marc Lowlicht: I would say that the repacking of mortgages and the selling created the original problem with the credit crisis, and–I’ve said this in the past–the problem in the markets is that people take risk[s] with other people’s money. And when you repackage a mortgage and resell it, the person who created the risk is no longer being reached back by that risk.

Hilary Kramer: Right. Right. Right.

Lowlicht: That risk has been sold.

Kramer: They just get a commission off of it.

Lowlicht: They got paid and resold the risk. Exactly right.

Kramer: And their risk ends up in pension funds. It ends up exactly where it shouldn’t end up. But it also tells us that the fact that repackaging and selling mortgages–and that this business is continuing–first of all, we don’t know what kind of controls are there. We don’t know of S&P and Moody’s and how they’re rating these packages, because, remember, they’re at fault. I mean, the fact that they’re still around and got away with still existing after all this has been incredible.

Forbes: Right. Arthur Anderson went out of business for Enron. Nobody went out of business for this.

Kramer: But S&P and Moody’s were being paid and had to give a certain rating or they wouldn’t get the assignment.

Forbes: Right.

Kramer: I mean, this was a scam. We had a scam on Wall Street. All Americans are paying for that. But the real problem is that, because the banks were bailed out–and they were bailed out with no restrictions, no punishments and didn’t have to change their compensation structure and that they still received bonuses, including AIG–tells me that we didn’t discipline them, you know?

But because we didn’t discipline the culprit, they’re just back to their old tricks again. Wall Street still hasn’t learned. I just had a friend of mine, he must make something between $8 million and $12 million a year, because he’s in the mortgage-backed securitization arena, he just told me how upset he is that he can’t spend more than $125 on dinner for a client.

And he’s making $8 million to $12 million a year. I said, “Did you ever think about just putting in for $125 and you’ll pay the difference?” He looked at me like I was crazy. Why would he ever, ever do that? That’s not his responsibility. So, the Wall Streeter mentality is insane and out of touch with reality, and out of touch with what business owners on every level have to deal with.

Forbes: Sounds almost like some kind of weird entitled psychosis.

Kramer: Well, but shouldn’t they have that? Shouldn’t they have it? I mean, there were bankers that thought they were going to be taking $2 billion to $5 billion of losses, of hits, in the third quarter of 2008, and then suddenly AIG got an $80 billion wire in from the Fed or from the Treasury. And then, suddenly, all these banks got paid in full. And they were hedged. Plus, they had hedges on.

Forbes: Should we be scared that, you know, these old mortgages are being repackaged a la what caused all these problems? Should we be worried about this?

Kramer: Yes.

P. Brett Hammond: I think we’re informed on it. So, I think part of it is, you know, you should certainly be worried, but also the investor is informed enough to know how these things can go wrong and should seek the advice of people who really understand and can dig deeper into whatever they’re putting their investments in.

Kramer: There is a good chance that it’s specialized hedge funds that are buying up these repackaged mortgages. And what they’re really doing is they’re buying repackaged mortgages at a significant discount to the way they used to be structured.

The way the mortgage-backed market used to work is that, let’s say, $50 million of mortgages were bulked together, but there was a cushion so that 10% of those mortgages could go under and you’d still receive your payment and your principle at the end when that bond came to maturity, so that mortgage-backed security came to maturity, and you would get your cash flow.

And what could be going on now is that some banks are trying to get these off their books and they’re offering a discount. And that’s where, you know, you have hedge funds stepping in. But the hedge funds are using it again, this goes back to the point of taking risks with other people’s money.

The hedge funds–it’s not their money. You know, this is not the Bill Gates family office that’s buying these. These are hedge funds that have pension fund money that they were able to obtain because the pension fund investment team on the other side thought that they were going to have better returns by handing the money over to these hedge funds without realizing what they were really doing with the money.

Forbes: What do you think about that, Brett? You’re obviously at a very large fund or a firm that works with pensions. What do you think? What do you think about the repackaging of these old mortgages? And what kind of danger do you think it poses to our financial system and to pension funds?

Hammond: Well, where I keep going is, I mean, we’ve been having these discussions about public policy, but it seems to me that the agenda, the big agenda for public policy in the financial and economic area has been, first, recovery–or you know, stabilization then recovery–so those two things. And then, it seems to me that what was on the agenda was thinking about financial system reform. And we haven’t gotten there yet.

Kramer: Right.

Hammond: Now, we’ve had a lot of conversation. There’ve been some proposals even starting back as long ago as Paulson. Somehow, the big macro thing is off the agenda, and is probably pushed off by health care policy in Washington. I think that the way to see this is, in my mind anyway, is the business and economic system evolves.

Now, it’s constrained. And government, you know, sets some ground rules and guardrails and all that sort of thing. But it does evolve. And you can see it with the growth of the herd of global mega-elephants around the world that we all know about. And that’s emerged over the last 20 years.

What’s also emerged, of course, is the new instruments such as the mortgage-backed securities and other kinds of, you know, CDOs and everything else. But what hasn’t happened is that we haven’t had a discussion about what’s the appropriall of itate way to oversee those things.

We’ve got the same set of regulatory institutions that, you know, each of which has a piece of the elephant, but nobody, like the blind man, nobody kind of sees the whole thing. And I’m not talking about, you know, the lever that we all debate about, whether we should have deregulation or regulation, you push the lever, you pull the lever.

No, I’m more talking about every couple of decades, there’s a rethinking, in light of the fact that economic and financial system evolves and can change dramatically, the oversight system sort of stays stuck. And then that ends up producing a debate, maybe even a crisis-driven debate about, “OK, what do we do now?” What’s the right way to oversee this system and set the ground rules? And I think that’s what’s being cried out for right now. But it’s not clear that it’s really actively on the agenda at the moment.