Intro to Calculate the Net Profitability of your Rental Income Property Credit Finance

Post on: 24 Май, 2015 No Comment

Buy to rent; evaluating your real estate investment

Buying a real estate property with the goal of renting it is an investment that insures a constant cash flow income. However, even if it is a popular investment, when looking at the numbers, it is an opportunity comparable to any other investment like the stock market, government titles or other business projects.

This simulator will help you calculate the potential financial outcome, net of taxes, of your investment property, which could then be compared to other investment opportunities. However, this calculator cannot measure more qualitative aspects like the relevant expertise required to run the business, which can favor this form if investment over others.

Income and expenses of a rental property

Managing financially a rental property is comparable to all other businesses; you have a start-up cost which will later on generate income and expenses, and then create a profit (or a loss). You will also add a capital gain or loss when you resell the real estate property, hoping that, like any other stock market purchase or businesses; you bought it at a good price in order to resell it at a higher price.

Such a real estate project requires initial investments: the cash negotiated to buy the business (based on the evaluation of the future cash flow), the cash down on the mortgage balance, the acquisition costs and, if it’s the case, the disbursements needed for renovations. For the investor, this initial cost is considered the purchase price of the project that will generate income from rent and other services, but also current and capital expenses.

Managing financially a rental property is comparable to all other businesses; you have a start-up cost which will later on generate income and expenses, and then create a profit (or a loss).

Current expenses are the costs related to normal operations such as cost of utilities, insurances, property taxes, repairs and maintenance. All these expenses are tax deductable. It is important to differentiate the two types of work on a real asset. The costs of repairs are current expenses made to maintain the building in good condition in the short term (painting the walls for example). The capital expenses, on the other hand, are disbursements made for additions or improvements to the property (installing new windows for example).

The capital expenses aim to increase the value of the property. They are considered an investment with the objective of creating higher revenue in longer term, while the current expenses are made to maintain the revenue. The capital expenses are not tax deductable, but instead amortised, which will reduce the tax load when included in the depreciation expenses .

If the rental property is resold, there will be a capital gain or loss, depending on the level of appreciation or depreciation of the real estate asset. Some expenses are directly related to the sale, such as the realtor fees and the closing mortgage cost; these are all tax deductable on capital gain. Finally, two different taxes are applied when resold; one on the depreciation recapture and the other one on the capital gain.

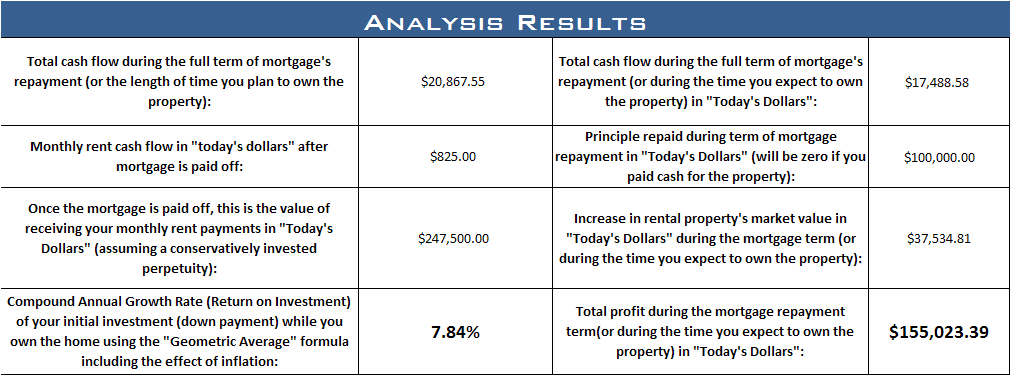

All these revenue and expenses enumerated are quantifiable and can be included in an analysis. It is important to measure the performance of a rental property investment and convert it in a universal language, such as the rate of return on investment or net present value, so it can be compared with the performance of other potential investment.

Taxes and depreciation

There are strong similarities between countries when it comes to tax application, only the tax rate and type of depreciation on rental real estate differs. This calculator takes into account your country’s regulation, by giving you the choice to insert a tax rate bracket and the type of depreciation (see reference on type of depreciation for countries). Our financial simulator executes the calculation automatically, but to better understand the taxes’ law and depreciation mechanism, here is an explanation:

In a financial report, we include an annual depreciation expense, tax deductable, related to the purchase, addition and improvement of the real estate property. It is not a real cash disbursement, but it is added as an expense to reduce the tax load. In other words, it offers a tax break to encourage capital investments. The annual depreciation amount is calculated by spreading the purchase cost of the property and other capital expenses over many years.

There are two main types of depreciation used for buildings: straight line and declining balance, but only one per country is adopted. The calculator provides the option to select one of the two, but note that only the building and its related costs are taken into account for the depreciation calculation. The land and its related costs are never considered as a depreciable asset.

In the case of declining balance, the annual depreciation expense is calculated by applying a rate on the purchase cost. The following year, the same rate is applied on the new depreciated balance. Let’s take Canada’s rate of 4% as an example:

Purchase cost: $100,000.00