International real estate get exposure with this timber ETF

Post on: 26 Август, 2015 No Comment

June 19, 2012 at 8:00 am by Jonathan Yates

Baron von Rothschild, the legendary French financier, once stated that the ideal portfolio should consist of one-third securities, one-third art, and one-third real estate. The current international real estate market would appear to belie his advice however. Emerging market investors and other legendary financiers with real estate holdings have suffered pain. there is no doubt. The housing markets in Spain, Ireland and many other countries are years, if not decades away from recovery. The is true for international real estate around the globe.

This is the primary reason for the collapse of the banking systems in these countries. But international real estate should have a place in every portfolio. As with so much other investing advice, Baron von Rothschild is right here too. For emerging market investors, the exchange traded fund for timber and related products, Guggenheim Timber (CUT. quote ), sprinkles a flavoring of international real estate with other protection.

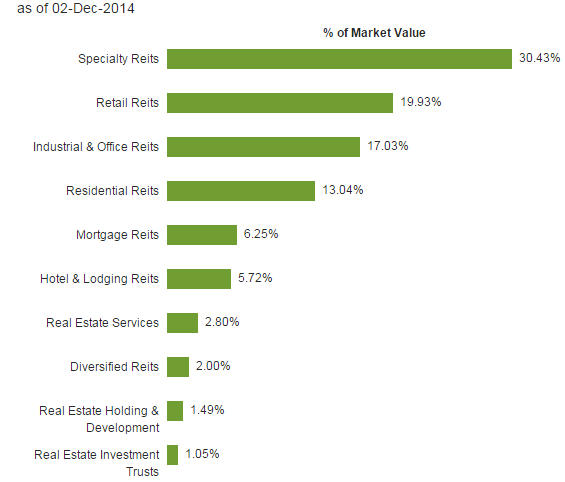

Historically, timber land has outpaced inflation. Guggenheim Timber has large positions in timber real estate investment trusts. It also has holdings in companies that produce and distribute assocated items such as paper and packaging, amongst others. This also results in exposure to the international real estate market in emerging market nations, and around the globe.

When real estate rises, timber land is strong for a variety of factors. Overall, the whole international real estate sector will rise, including uncut timber land. Specifically, when more homes are being built, there is a greater demand for lumber for houses. From the floors to the roof, wood is needed in the building of houses and commercial buildings for both decorative and construction purposes. International real estate will recover and when it does, timber land will rise again.

This no doubt lured uber investor John Paulson into his ill-fated investment in Sino Forest. His example illustrates one of the main benefits of an exchange traded fund for individual investors: there is a broad diversity of investments and superior research resources, in addition to lower costs. This is particularly valuable for investing in international real estate.

At the nadir of the Great Recession in early 2009, Guggenheim Lumber was trading under $7.50 a share. It is now around $16. It has been the same story of recovery for the home builder ETF, SPDR S&P Homebuilders (XHB. quote ). The rebound has slowed in recent trading however, for both CUT and XHB.

Year to date, the Guggehiem Lumber ETF is down 2.90%. It has increased in the short term and is up 1.45% for the last week of market action.

2ccut&E1=0&LPR=2&C1=1&C3=256&C4=0&D5=0&D2=0&D4=1&DD=1&width=600&height=336&CB=1&CE=0&CF=0&palette=2&AF=2 /%