Insight Real Estate Blog The Bottom of the Market Are we there yet

Post on: 20 Июнь, 2015 No Comment

The Bottom of the Market: Are we there yet?

Guest Contributor Charles Richardson. Senior Vice President, Southeast Florida, Coldwell Banker

For anyone who has taken long trips with children in the back seat of the car, one question invariably comes up and is repeated often by the kids, Are we there yet? The annoying repetition only begets frustration to those who are facing the reality that we have miles to travel till we reach our destination. Similarly, we face the same issue and questions by buyers who are seeking value in todays real estate market.

The question today concerns the bottom of pricing that will be discovered in the current real estate market. When and where will it be found as prices are reported to be falling in every report published in the local and national media on almost a daily basis. This question remains at the forefront of decision making for buyers who are out inspecting current values and realizing that they are significant as compared to anything seen in recent years. The questions center on whether values will have improved if we wait a few weeks or months to make that purchase under consideration.

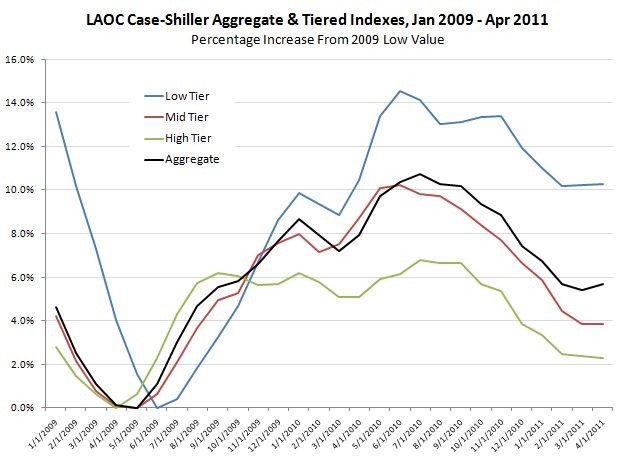

First and foremost, we will not know exactly where the bottom was until it has been passed. The bottom of the real estate market is not going to be a spot of a graph which will look like a point with a directional vector spiking directly back up. A better description will be that of a rolling wave where prices are basically stabilized for a given period of time which might show prices rolling up and down prior to a slow but steady increase.

In reviewing the market, you have to recognize that prices are not depreciating at equal levels when you compare them with average sale prices in geographic areas. The mix of a market will determine which parts are stable and which parts of that market are declining. In other words, if you have a lot of lower price-range homes which could include REO or foreclosure properties selling and a fewer number of higher priced homes selling in more stable neighborhoods, the average sale price will be showing substantial declines but that may not be the case in the neighborhoods which are not impacted by those foreclosed homes.

If you are considering making a purchase in the near future, you have to factor in the cost of money into the equation when you determine the best possible time to buy. If you are looking at 30-year fixed rate mortgages, the rates have been dancing around five to 5.25 percent over the past month. If you could get a five percent today and you decided to wait six months to purchase in hopes of finding values decline only to have the cost of a mortgage increase to 6.25 percent would you have improved your market position? This 25 percent increase in the cost of the mortgage would likely have offset any potential gain in value you would have gained by waiting for that price to adjust even if it had declined over the six months. Interest rates are as unpredictable for economists to predict as the cost of housing for the foreseeable future.

Buying at the absolute bottom is a difficult thing to predict and achieve. The buyers who take the step out in confidence to lead others will ultimately win out in the end. As buyers see the activities begin to take place around them, they will flood back into the market which will increase the demand on homes available and on the mortgages available through the lenders active in the market. What will result as this happens is prices of homes and mortgages will begin to escalate together changing the value proposition of those homes for sale rather quickly. What you want to measure as you decide on whether this is the right time to buy are the values of the price of the home and the cost of ownership through the mortgages available at this time.

Warren Buffet once said, When all around you are greedy be fearful. When all around you are fearful, be greedy. The winners are often those who take a step out in faith when others are afraid to do so. Buying at the absolute bottom isnt critical for the end result to be a great gain of equity for you. To expect to flip a property for a quick profit in any market is a risky position to take. If you are in it for a long term hold and purchasing a home for your family for the future, now is a great time to buy in most markets of Florida. Good real estate counsel can guide you through the opportunities available in the market today and allow you to secure exceptional values in todays market.