Insight 2012 Year in Review

Post on: 31 Июль, 2015 No Comment

You are here

U.S. Solar Market Insight® is a quarterly publication of GTM Research and the Solar Energy Industries Association (SEIA)®. Each quarter, we survey nearly 200 utilities, state agencies, installers, and manufacturers to collect granular data on the U.S. solar market. This data provides the backbone of this Solar Market Insight® report, in which we identify and analyze trends in U.S. solar demand, manufacturing, and pricing by state and market segment. We also use this analysis to look forward and forecast demand over the next five years.

Introduction

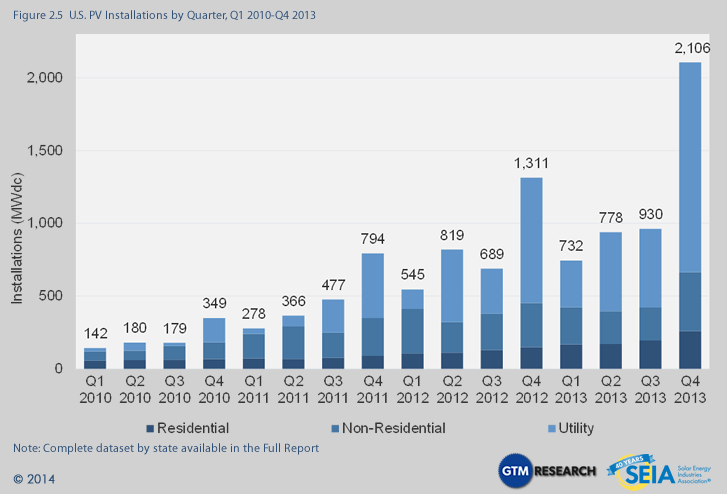

2012 was a historic and busy year for the U.S. solar market. Photovoltaic (PV) installations grew 76% over 2011, to total 3,313 megawatts (MW) in 2012, with an estimated market value of $11.5 billion. Each market segment (residential, non-residential, and utility) showed growth over 2011, while the overall marketsin most U.S. states expanded as well. Installed prices for PV systems fell 27% during 2012 and at least 13% in each market segment. Nearly 83,000 homes installed solar PV, and cumulative PV installations in the U.S. surpassed 300,000.

Apart from installation growth, four trends and events strongly shaped the market in 2012:

- Trade Dispute Resolution: The U.S. government concluded its investigation of Chinese PV cell imports to the U.S. which resulted in the creation of tariffs on these cells. Although the ultimate impact of this decision is difficult to gauge, Chinese module shipments to the U.S. decreased significantly. PV prices, however, continued to fall. Meanwhile, global trade tensions continue and ongoing investigations in Europe and China could result in new tariffs.

- Ongoing Manufacturing Consolidation: PV manufacturers saw little relief from global oversupply in 2012 as manufacturer margins remained depressed and less-competitive facilities were shuttered around the world.

- The Third-Party-Owned (TPO) Residential Solar Revolution: Residential solar leases and power purchase agreements (PPAs) continued to gain popularity throughout 2012. Third-party-owned systems accounted for over 50% of all new residential installations in most major residential markets, with Arizona topping 90%. New vendors entered the space to provide unique twists on the business model or offer ancillary services such as customer lead generation. GTM Research forecasts that the third-party-owned residential solar market will maintain its momentum and become a $5.7 billion market by 2016.

- Mega-Scale Solar Coming to Fruition: After years of announcements and preliminary milestones, the first wave of truly utility-scale solar came on-line in 2012. Eight of the ten largest PV projects operating today were completed in 2012, some of which were recipients of the DOE Loan Guarantee program. This trend should continue in 2013, with more than 4,000 MW of utility solar projects currently under construction and more than 8,000 MW of projects with PPAs in place and yet to begin construction.

One trend already apparent in 2013 is diversification in project financing. Market participants have laid the groundwork for a variety of new ways to finance solar projects. Some of these have been introduced already and now need to scale, while others will become a reality for the first time this year. Examples of such structures include solar real estate investment trusts (REITs), crowdfunded solar projects, securitized solar assets, and solar inclusion in master limited partnerships (MLPs).