Inflation in 2008

Post on: 28 Май, 2015 No Comment

Like many here, I have done the AOR thing per FWF both personal and business. I have mastered how to be smart with money and understand credit in many ways. FWF has changed my life for the better due to dialoging with many of a similar mindset. I, and I believe many others, desire to take our FWF experience to another level.

Discussion of the real estate bubble issue is, in my opinion, dated. The number one issue in our immediate lives is Inflation. The monetary policies of Greenspan and Bernake will soon continue to play out and change (eliminate) large portions of the American middle class forever.

I desire to start a thread on the most important issue in my financial life. Inflation and HOW TO PROFIT FROM IT.

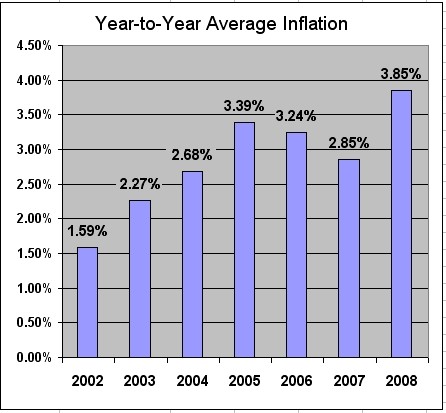

I’ll start out with two data points.

1) I subscribe to an eclectic array of investments. A recent newsletter I received stated direly as follows:

Inflation is a society-changer. Inflation and taxes comprise a diabolical capital confiscation scheme. Inflation is an efficient mechanism by which wealth is transferred from the saving and working class to the speculating and borrowing class. It is something that governments lie about, and we sincerely hope that someone can encourage the U.S. government to stop doing so. There is, for example, no such thing as core on non-core inflation. Food, fuel, and oil products are just as important to the generalized increase in prices as other good and services. It is true that commodities can fall in price, of course, but the easy money policy that has been so powerful in increasing nominal demand will likely keep putting upward pressure on commodity and other asset prices.

It is easy for consumers and investors to be very confused in periods of inflation. It is important to own assets. or at least having investments or trading approaches which can make returns which can keep up with inflation.

However, some people extrapolate from the basic truth about inflation (long-term depreciation of purchasing power) that they should leverage to the hilt. Such people think that if owning real assets is good, then owning as much of them as your can stuff into your portfolio is better. and, in truth, at certain point in the cycle that strategy looks brilliant and the most aggressive players make the most money. The trouble with the “damn the torpedoes, full speed ahead!“ strategy is that inflation periods are rarely smooth one-way asset-appreciation rides. There are typically interspersed with bouts of tight money deep asset price corrections, and other confusing complexities. Thus, leverage to the hilt almost ensures being frightened or forced out of the game at some point.

2) Robert Kiyosaki of Rich Dad, Poor Dad fame is touting the dire effects of coming inflation and has a new mantra “Cash is Trash.”

Kiyosaki recommends investing heavily in silver as it is a hard asset and is diminishing in supply as it has industrial uses.