Index Investing Conferences Are Extinct

Post on: 16 Март, 2015 No Comment

Follow Comments Following Comments Unfollow Comments

I am sad to report that industry conferences that used to spotlight good ole’ John Bogle-type indexing no longer exist. All the index and exchange-traded fund conferences (ETF) I’ve attended in the past few years have shifted their focus away from market-tracking products to highly sophisticated, actively managed strategies. I’m just grateful the conference hosts still let me get on my soapbox for a few minutes and remind people that simple low-cost strategies work best.

I attended the Morningstar ETF Invest Conference in Chicago last week. This sold-out event was held at the classy Radisson Aqua Blue downtown. The 750 participants included investment advisers, fund sponsors, index providers, market makers, journalists and others from the financial industry.

My take on this event, as with other indexing and ETFs conference of late, is that we’re not in Kansas anymore. Index and ETF strategies have morphed into something from the The Wizard of Oz, an unrecognizable place to us old-timers in the industry.

The main session began with an excellent economic overview by Joe Davis of Vanguard followed by investment strategist Heidi Richardson of BlackRock. Ms. Richardson’s principal message was very clear, “Active management is required to be a successful investor.”

Next was a panel discussion on The New World Order in Indexing. The description on the agenda was as follows, “The index industry is evolving at light speed. Index providers have moved from methodological convergence in the plain-vanilla beta space to exploring the next great frontiers in ‘smart beta’.”

The rest of the day was devoted to panel discussions on tactical, strategic, and managed portfolios. Don’t be misled by what strategic meant – it is not a fixed asset allocation to various asset classes based on an investor’s long-term needs. Strategic discussions at this conference included “how bond investors should be positioning themselves in the face of increased bond-market volatility” and “insights into how investors are putting ETFs to work in implementing their quantitative strategies.”

The next day, Rob Arnott of Research Affiliates presented his firm’s latest quantitative research. His talk was interesting, although it was all about converting active management strategies into indexes. Rob must have said the phrase “smart beta” over one hundred times.

Those who know me can understand why Rob’s use of “smart beta” to describe active management is bothersome to me. In my opinion, this phrase has no meaning aside from being a slick way to sell actively managed products. See this article where I quote several leading academics, including Noble Laureate William Sharpe, Smart Beta is Silly Talk .

I get the odd feeling that I’m the old guy at conferences these days. I’m a black-and-white TV sitting on the shelf among hundreds of brand new LED LCD flat screens. My voice is heard, but just for a little while. Then the next “negatively correlated alternative asset class” takes the stage.

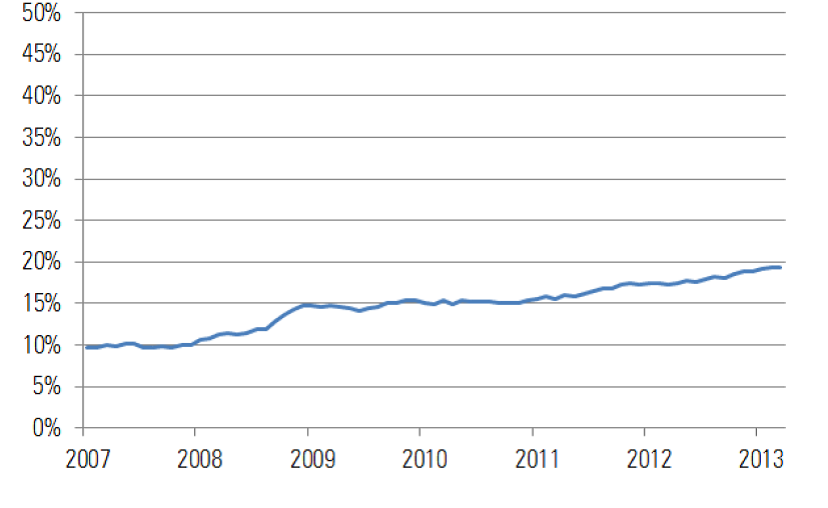

I’m just glad other black-and-white TV advisers go to these conferences and provide support for sensible indexing. They still put their client’s money in dirt-cheap ETFs and index fund products that track markets. Follow this link to find the latest trends from ICI, Morningstar and Vanguard .

I applaud Morningstar and other conference hosts for attempting to remain balanced by continuing to invite people like me to speak, if for no other reason than to remind the attendees that good ole’ John Bogle indexing isn’t going away. In the end, most advisers continue to do what’s in their clients’ best interest; they create a long-term asset allocation, buy low-cost index fund, and then stay the course!