Index Funds vs Mutual Funds Active v Management

Post on: 9 Апрель, 2015 No Comment

A commonly repeated bit of so-called conventional wisdom in investing is that you cant beat the market, so you may as well duplicate the market and put your money in an index fund. This passive management philosophy is so often recited, including by mutual fund and ETF managers who profit from attracting money to market-mimicking funds, that it is widely accepted.

But determining the best approach for your investments depends on a variety of factors – so consider the common advice with caution. Here are some facts on actively and passively managed mutual funds.

Whats active and whats passive funds?

Understanding the differences begins with defining the two approaches:

- Actively managed funds build and maintain a portfolio by making deliberate decisions on securities to buy, sell or hold. Managers select securities from the universe of possibilities based on research and judgments on company fundamentals, economic trends and cycles for industries or asset classes. They generally seek to outperform a particular market index or strategy.

The lines blur in some cases, such as active funds known as closet indexers that doggedly follow the benchmark indexes by which managers are evaluated.

Passive management is rather easily defined as the process of tracking/mimicking an index. But active management is much more nuanced on a number of different levels: it comes in many forms (fundamental vs. macro vs. quantitative); it can be acquired in more varied packages (mutual funds, CEFS, SAs, and CITs); and there are managers of materially varying skill.

Conventional wisdom: not always right

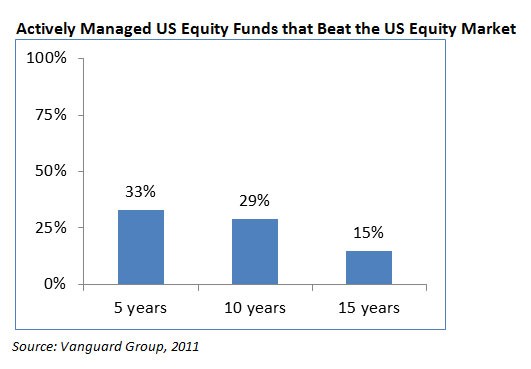

The common advice (of trying to duplicate the market) contains a kernel of truth. Many have compared returns of actively managed funds against indexes and found that historically the majority of active managers – about 80 percent on average – fail to do as well as their indexes. While this may be true, it is also true that the majority of index funds also underperform their benchmarks.

Here are some other points to consider in the active-passive debate:

- If roughly 80 percent of active funds underperform, then roughly 20 percent consistently outperform their benchmark indexes. The key is to identify them.

Active vs. passive studies are nuanced. Results depend on time spans, and there are periods when active managers do better, and vice versa. The studies also show active management works better in assets where research is an advantage, such as small cap stocks, international, emerging markets and Real Estate Investment Trusts.

Investing Considerations: Whats better for you?

Investment Time Horizon

Investor assets may be designated for long-term growth for the purpose of a distant retirement, while others may be invested in securities for a more near-term need. In either case, the length of the anticipated holding period for those assets may be a consideration in determining which investment approach is most appropriate.

- Studies have shown that active managers have a higher probability of success if held for longer periods. For example, the frequency that a manager adds value increases from 59 percent to 73 percent by extending the holding period from one year to five years.

Market Conditions

- The performance of active and passive strategies runs in cycles. Evidence suggests that certain market conditions favor either active or passive management. Actively managed investments have historically performed better than passively managed investments when the markets are decidedly negative, or in flat-to-moderate markets. Conversely, passive investments have generally outperformed in swiftly rising markets. While there are exceptions to these dynamics, understanding when market conditions are favorable or unfavorable for an investment style is important in managing expectations.

Tax Sensitivity

- Generally speaking, passive investments offer investors greater tax efficiency because they create fewer capital gains situations due to in-kind distribution. Also, because of the low turnover of the securities that comprise most of the indexes such funds are modeled after, a lot of trading is not necessary. For active managers, however, buying and selling securities is one way they attempt to add value by capturing excess returns. This can come at the cost of increased capital gains exposure .

Our View on the Active vs. Passive Management Debate

We have been, and continue to be, strong advocates for active investment management. It is our contention that over the long-term (seven to 10+ years), investors are usually best served using a diversified portfolio of genuinely active managers with a demonstrated ability to provide consistent above-average risk-adjusted returns.

Our active bias notwithstanding, we are not dogmatic in our viewpoint and believe investors can benefit from both active and passive investments in a portfolio. As weve discussed, there are often times, places and conditions in which the benefits of passive management may be useful or favorable. The active versus passive debate does not produce a clear and decisive position that either approach is always and everywhere superior.

What to do next

- Consult an objective, fee-based advisor with your interests at heart.

- Seek insights on funds long-term performance, management and costs.

- Develop an asset allocation plan to diversify holdings for your situation.

- Schedule regular monitoring and reviews with your advisor.