How to Start Investing for Beginners

Post on: 28 Апрель, 2015 No Comment

Skip to:

Whatever your reason for investing — be it retirement, a college fund for your child, or a major future purchase — it is a good idea to start as soon as possible.

There are some basic ideas you should consider as you get started. Before committing money to any investment, you should ask yourself the following questions:

- What are my financial objectives?

- What is my current financial position?

- How much risk am I willing to take?

- Do I understand this investment?

No matter how much money you are planning to invest, it’s important to have clear answers to all of these questions before you begin. Your financial professional can help you set reasonable goals and identify investments that are appropriate for your financial situation and risk tolerance.

What Are My Financial Objectives?

The first thing to do when considering an investment program is to determine your financial objectives. Do you want to increase your current income? Are you trying to save for a home? Perhaps you’d like a tax break, or are interested in increasng your net worth.

With these objectives in mind, consider how your initial investment would have to perform in order to meet your goals. High-yield, long-term growth would suggest one type of investment, while reliable, steady income might suggest another.

What Is My Current Financial Position?

An easy way to determine your current financial position is to calculate your net worth. Add up all of your assets, and then subtract your liabilities. Examples of assets might include:

- Personal property

- Bank accounts

- Salary

- Interest or dividends on other investments

- Pension plans

- Real estate holdings

Liabilities might be:

- Mortgages

- Credit card debt

- Auto loans

- Everyday bills (utilities, food, clothing)

The remaining balance is your net worth — a snapshot of your current financial situation. Your net worth can be the starting point for your financial goal setting.

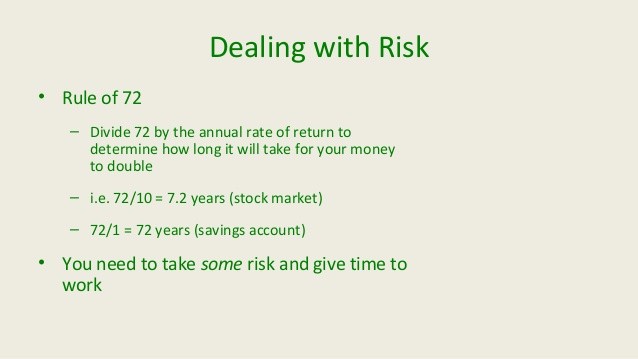

How Much Risk Am I Willing to Take?

Now that you have a better idea of your financial objectives, you need to determine the amount of risk you are willing to take to reach your goals. Some factors you might want to consider are:

- Your age

- Family situation

- Income

- Financial goals

If you cannot afford to lose your principal, you might consider a safer investment with lower risks (and lower returns). If you are willing to put your money at higher risk, however, there are other investments that potentially offer higher returns. It is often best to consult with your financial professional for help in determining your risk tolerance. He or she can also suggest suitable investment vehicles.

Do I Understand This Investment?

Take the time to understand how an investment works before committing any money. For example, if you are thinking about investing in a stock, you should be familiar with the ways that stocks behave. You should examine research reports on that stock’s performance. You should also ask the advice of your financial professional.

Get to know the company you’re about to buy a share of. Reading the firm’s annual report is a good way to find out about the company and the industry it operates in; research reports by professional analysts is another. Investing in a corporate bond? Find out as much as you can about the corporation that offers it.

Conclusion

With a fundamental grasp of the basics of investing in place, you should now be ready to explore more detailed information on building a successful portfolio. You can explore our other Learning Guides — Equities, Fixed Income Securities, Estate Planning, and more — until you feel confident that your knowledge in these fields has improved. However, before putting your money in any investment, it is crucial that you speak with a financial professional.

Financial professionals offer guidance in choosing the investments that should work best for you. These are professionals who often have the research, analysis, opinions, and recommendations of an entire firm at their disposal. They monitor investments and market conditions and can recommend to you when your investments may no longer be suitable.

Your financial professional can help you through each step of the investing process — setting objectives, developing investment plans, and so on — both initially and in the long term. Remember that part of your financial professional’s job is to help you understand the investments being recommended. Don’t be afraid to ask questions or to inquire about research reports and other materials available to you. Since most financial professionals do not provide tax and/or legal advice, you should consult with your tax and/or legal professional concerning your particular situation.

As time goes on, market conditions and your financial requirements will change. Therefore, it’s a good idea to stay in touch with your financial professional regularly. He or she will review your portfolio and help to reevaluate your strategy, based on your objectives and the current market conditions.