How to Invest in REIT in Malaysia

Post on: 3 Апрель, 2015 No Comment

“Next to the right of liberty, the right of property is the most important individual right guaranteed by the Constitution and the one which, united with that of personal liberty, has contributed more to the growth of civilization than any other institution established by the human race.”

This saying by William Howard Taft definitely best describes the significance and the importance of appropriating for one’s self real property and it applies to everyone which is living in the world today. Investing in real property which can provide cash flow to its owners through regular income and dividends is simply the best deal that you can get with acquiring real properties. Real Estate Investment Trust or REIT is now one of the various ways to indirectly invest your money on real estate.

What is REIT?

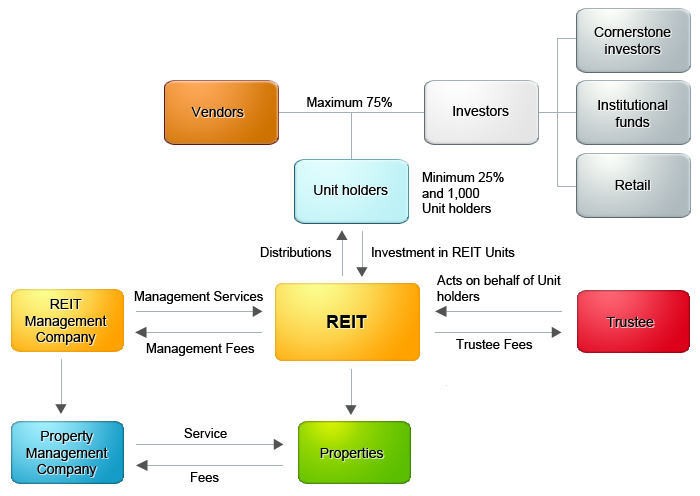

Real estate investment trust or REIT is a form of company which invests its shares in acquiring and running profit-making real estate or properties and dividing the dividend among its shareholders. It is a system where investment comes through the buying of shares and investing it to buy real-estate which is rented out in order to gain monetary profits. Some of these properties include hotels, office and warehouse spaces, hospitals and shopping centers.

Investing in Malaysian REITs.

Real estate investment trusts first started in the United States in 1880 in order to let investors avoid double-taxation on their business investments. It also allowed smaller investments to be made on such large-scale business undertakings which broke the tradition of control by only the wealthy businessmen and corporations.

Malaysian REIT

Malaysia has caught up with the trend and has used the model of both the US and Australia in their own form of REIT. The good thing about REIT investing in Malaysia is that it has brought a good amount of profits for its investors for the past few years. It brought an average of 6%-8% gains profit on dividend by the year 2005 which was greater than what other developing countries in Asia had done on that year.

Some of the more well-off REITs in Malaysia are the AXIS-REIT which focuses on renting-out warehouse and office buildings, the KPJ Healthcare REIT which caters to hospitals, and the YTL-REIT which owns properties for shopping malls and complexes.

Property developers are the common shareholders and owners of REITS as they specialize in the development of real estates. They have the advantage of knowing how to create and give the best improvements that can be made in real properties which lets them have a better business strategy for renting them out for business purposes. They also have that edge of knowing how to maintain and operate such establishments to get the best profits that can be had on that type of business.

Why Invest in Malaysia

Malaysia has come to be one of the leading nations when it comes to profits made in REIT in this particular region of Asia. In terms of economic development, it was able to have great strides which have now placed them as one of the best of the developing countries in the world. They are more competent as shown by the results of the initial gains profit made on the dividends of REITs.

Aside from this, REIT is still on its development stage in Malaysia and creativity and ingenuity in business strategy is still a welcome activity on its market. Managers of REITs can still make their own signature steps in how they want to improve the performance of their properties in the market.

What to Look For on an REIT?

You should always put your money where you can be rest-assured that it will be handled correctly – you would not want to invest on something which will not yield results. Careful thinking and a serious study of an REIT’s background is an important element before putting an investment in it. So what should you look for to get the best deal in an REIT?

- First, it should have an ever increasing dividend payout to its shareholders. Look at their past records and see if there is any improvement on the money that they return to their investors. If you do not see much improvement there, then you may want to reconsider.

- Second, it should not be a stagnant entity – it should be acquiring assets and making improvements on their assets for the past few years. Remember, you are not going to put your money on their shares for it to acquire the same amount of dividends each year or even to lessen. The management of that entity should be finding out ways in which to improve their financial and economic status.

- The assets and properties should be well-taken care of and should be located in a strategic location which will aid in the improvement of its sales in rent. Check if the property is located in an area where there are better chances of improvement or is accessible to the market. If you are thinking of investing in a shopping mall, ask yourself if it is located centrally to an area which will attract a lot of mall-goers? If it is a warehouse, is it properly maintained to ensure the safety and protection of the materials that will be entrusted to it?

- Fourth, it should cater to tenants which show a promising chance of longer-term tenancies. Is the property occupied by a business which has a greater chance of staying for about two years? Or are they letting in businesses which are small-scale or those which have chances for being easily dissolved or abandoned upon certain circumstance? The permanency of those who rent the space is an important factor that will determine the success of the REIT.

- Does it have sufficient numbers and variety of tenants that it will be able to continue functioning even if one large client should leave? It should be able to sustain its business without depending on a single particular client to keep it going.

- Sixth, the management is composed of competent and well-skilled professionals who will be able to handle the business’ ups-and-downs. All types of business experience problems either financially or organizationally but it is the way with which its administrative team is able to cope with it that they are able to come through. An entities staff is a reflection of the business and what it is eventually coming to be. If the REIT is staffed with excellent and knowledgeable personnel, you will be sure that it will be able to go through good and tough times.

Why Invest in REIT

Investing in REIT is now considered as a safer way of making an investment due to its nature and structure as an entity. Consider the following advantages that it has in contrast to other forms of investment such as in properties and banks.

The REIT form provides you with lesser risks as the burden is shared by a lot more shareholders and investors. Remember that it is a collective ownership made when you buy shares in it.

It provides people with the chance to become a part-owner of a large-scale business or businesses which would be quite impossible if you are going on the traditional type of investing. Control is also given to all who have shares and not just to the large shareholders.

Management is made by an administrative team which relieves you of some of the problems of owning a business. Giving the keys to the management will let you own a business where you would be able to gain profits and never have to worry about how to make it.

The shares that you own can be sold in the stock market as they are treated as regular stocks. Hence, you can make them liquid in a very short span of time as early as three days. The shares also gain profits as their price also increases and decreases depending on the economic market.

Buying REIT Investments in Malaysia

You can buy shares of REIT of any entity in Malaysia by going to Bursa Malaysia much like the same way that you buy stocks in other markets. You can also consult stockbrokers regarding what shares are currently being sold in the Malaysian market. You can use the online listings of Malaysia’s REITs at their IPO official website.

Real estate investment trusts are now one of the safer ways to make an investment. Malaysia is one of the countries in Asia which have made great strides in REITs and the present state of the country’s economy is certainly an ideal one which will definitely allow investors a chance for creativity and ingenuity in business strategy and a greater share of the market. Expansion is also one of the possibilities in an REIT in Malaysia.

So, what else do you want to know more about REIT? Post a comment or question below.

What to know more about REIT Investment? Visit REIT Method REIT Investment Made Easy