How to Hedge for Inflation

Post on: 22 Июль, 2015 No Comment

Submitted by Jared Kizer on Monday, July 28, 2014 — 9:00am

No investment can perfectly hedge inflation, but placing some protection against inflation in your portfolio is still possible. Your best bets are short-term Treasury Inflation Protected Securities and commodities.

When evaluating whether an asset class effectively protects against inflation, we examine the correlation between the returns and inflation. The stronger the correlation is, the better inflation protection the asset provides.

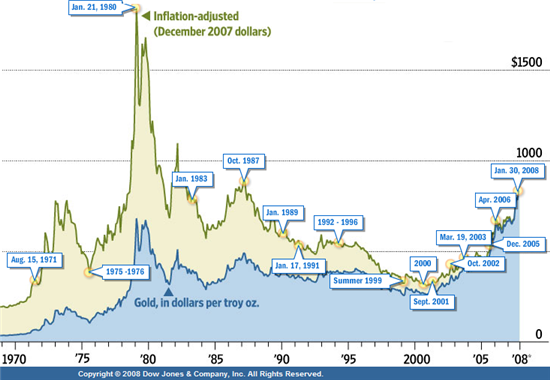

Traditionally, people see gold as a hedge against inflation, but history busted that myth. Indeed, gold tends to go up during inflationary periods, yet its correlation is loose. From 1981 to 2000, gold dropped 70%,while inflation rose 95%. People who relied on gold to counter inflation not only did not keep up with inflation, they lost significant buying power.

Some see stocks as an inflation buffer because their long-term returns are higher. This is a common error. Correlation is what matters. The reality is that equities have a very low correlation with inflation over almost all time horizons. Stocks do not always outpace inflation, especially in recession years. The total return of Standard & Poor’s 500 index, for example, was down about 12% during 2001 through 2010; meanwhile, the cumulative inflation rate was 23%, making the real loss greater.

Although there are no perfect hedges against inflation risk, this does not mean it is a waste of time to explore which investments provide better protection against inflation. There are meaningful differences in inflation protection across different asset classes.

We analyzed the quarterly returns of 10 different asset classes relative to the Consumer Price Index over two periods: a long term (from January 1981 to December 2013) and a shorter one (from September 2002 to December 2013) one. These 10 assets are:

U.S. stocks (S&P 500 ), international developed stocks (MSCI EAFE index ), short-term bonds (two-year Treasury notes ), long-term bonds (30-year Treasury notes ), short-term TIPS (one- to five-year TIPS index ), TIPS (full TIPS index), commodities (S&P GSCI index ), real estate (Dow Jones U.S. Select REIT index ), gold (spot gold prices from the Federal Reserve) and foreign currency (U.S. Dollar Index ).

The only asset that did a decent job of hedging monthly inflation over the longer period: commodities. The two that performed the worst were two-year and 30-year Treasury notes, with the latter doing significantly worse. The results over the shorter period show that commodities and short-term TIPS both performed well in hedging quarterly inflation risk, while equities, real estate, gold and foreign currency did not because they lack consistent correlation with inflation.

The relationship between inflation and the returns of some assets could strengthen over the long term, but overall, only two have consistent protection against inflation over relatively short horizons: short-term TIPS and commodities.

Short-term TIPS. These bonds, by definition, provide an element of inflation protection. The face value, or principal, of a TIPS increases with inflation. The interest rate is fixed, but applied to the new principal; so interest payments, or coupons, rise with inflation as well. For example, assume inflation is up 10%, a $1,000 TIPS with a 3% interest becomes $1,100, and the coupon is $33.

Commodities. The theory is fairly simple. When the price of goods and services rises, so does the price of the commodities used to make those goods and services.

Commodities prices can be volatile. Some take this high volatility as inability to hedge inflation. This is simply false. Here again, correlation is what matters. If commodities correlate with inflation perfectly, and the returns are 10 times more volatile than inflation, a 10% allocation to commodities, with the balance of the portfolio in short-term fixed income, is very close to a perfect hedge.

You cannot count on one specific investment to protect your money from inflation. That’s why diversifying your portfolio is a good idea.

Follow AdviceIQ on Twitter at @adviceiq .

Jared Kizer is the director of investment strategy for the BAM ALLIANCE , a community of more than 140 independent wealth management firms located throughout the United States. See its disclosures page for more information. Follow him on Twitter at twitter.com/JaredKizer . A St. Louis resident, Jared co-authored the book The Only Guide to Alternative Investments You’ll Ever Need in 2008 with financial author Larry Swedroe. To learn more about the BAM Alliance or to find an independent member firm, please visit www.TheBAMAlliance.com .

AdviceIQ delivers quality personal finance articles by both financial advisors and AdviceIQ editors. It ranks advisors in your area by specialty, including small businesses, doctors and clients of modest means, for example. Those with the biggest number of clients in a given specialty rank the highest. AdviceIQ also vets ranked advisors so only those with pristine regulatory histories can participate. AdviceIQ was launched Jan. 9, 2012, by veteran Wall Street executives, editors and technologists. Right now, investors may see many advisor rankings, although in some areas only a few are ranked. Check back often as thousands of advisors are undergoing AdviceIQ screening. New advisors appear in rankings daily.