How to find the best RRSP savings rates Roseman

Post on: 16 Март, 2015 No Comment

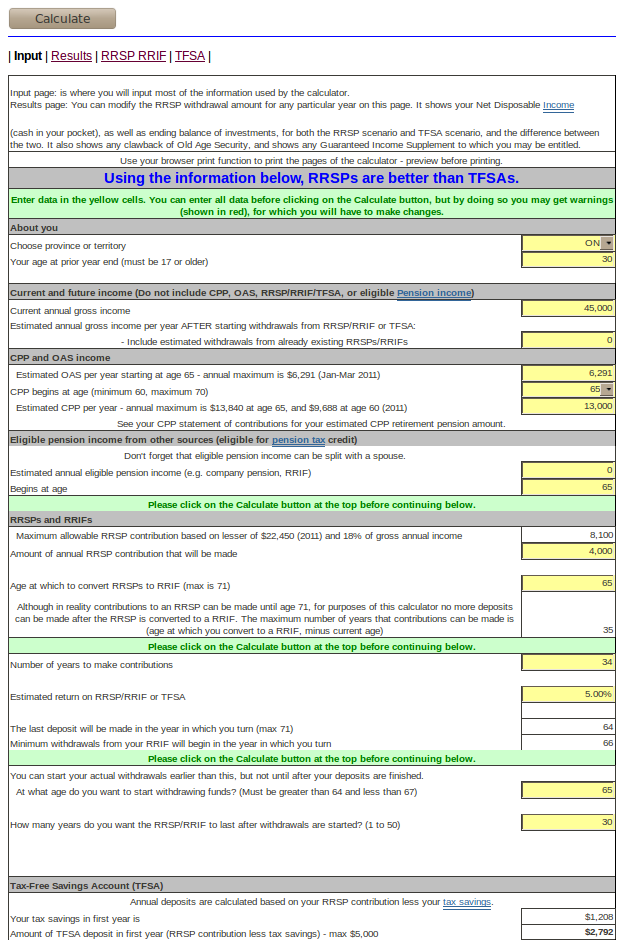

You have to look beyond what the big banks offer if you want a higher rate on a savings account or GIC for your RRSP.

Stock markets are booming. But as the March 1 the RRSP deadline looms, many people dont feel comfortable putting their retirement savings at risk. They would rather earn a low interest rate than face a potential capital loss if theres an economic slowdown.

So where can you find the best interest rates on RRSP savings accounts and guaranteed investment certificates? Heres a guide for last-minute shoppers still looking to contribute to a registered retirement savings plan for 2012.

Q: Where can you find interest rates online?

A: Cannex is a company that compiles interest rates for products offered by financial institutions in Canada. While it sells this information to businesses, it offers some free comparative charts at its website .

When it comes to deposit accounts, you can earn 1.95 to 2 per cent on your savings at several Manitoba-based financial institutions such as Accelerate, Achieva, Hubert, MAXA and Outlook Financial. They do business with Ontario customers by telephone or Internet banking.

When it comes to registered GICs, you can earn 3.15 per cent at ICICI Bank by locking in for five years. Its one of the few to break above two per cent.

A dozen financial institutions offer 1.95 to 2.25 per cent on two-year GICs higher than the 1.1 to 1.3 per cent two-year GIC rates at larger banks.

A: You probably know about Canada Deposit Insurance Corp. (CDIC), the federal crown corporation that insures eligible deposits for up to $100,000 each.

CDIC has just over 80 member institutions, which are listed at its website. Some online banks that offer high rates are CDIC members. Some are not.

If youre looking for a CDIC member paying higher rates on two-year GICs, you can choose among AGF Trust, B2B Bank, Canadian Direct Financial, Community Trust, Effort Trust and ICICI Bank.

However, the Manitoba companies mentioned earlier arent CDIC members. Theyre owned by credit unions and their deposits are insured by the Deposit Guarantee Corporation of Manitoba (DGCM).

DGCM is a non-profit organization that covers deposits held in Manitoba credit unions and cuisses populaires. It audits members financial controls and keeps money in reserve to cover a possible insolvency.

However, DGCM is not a provincial government agency. This is different from CDIC, which has the financial backing of the federal government.

Another difference is that DGCM covers the full amount on a deposit if a member company goes out of business. This guarantee is more generous than CDICs $100,000 limit.

Among Ontario credit unions, you can get higher savings account rates at First Ontario (1.7 per cent), Parama (1.35 per cent) and Alterna Savings (1.2 per cent).

Theyre covered by the Deposit Insurance Corporation of Ontario (DICO), a provincial agency that offers unlimited protection for registered deposits. Deposits in nonregistered accounts are covered for up to $100,000.

Q: How do I transfer registered deposits among financial institutions?

A: You can move money to get higher rates elsewhere by filling out the right Canada Revenue Agency forms, which allow a direct transfer among financial institutions. Taking RRSP funds into your own hands, even temporarily, is considered to be a taxable withdrawal.

With tax-free savings accounts, you have to avoid withdrawing funds yourself and putting them into another TFSA. This could put you over your limit, resulting in a one per cent monthly tax on the excess amount.

Fight Back. Ill be speaking about my new book and signing copies for sale on Sat. March 2, at 11 a.m. at the Revue Cinema in Toronto.