How To Build An Income Portfolio For Retirement

Post on: 16 Май, 2015 No Comment

As the Baby Boomer generation plans for their retirement, it is no secret that there will be an increasing demand for income producing securities . While I prefer individual dividend growth stocks, the ETF universe is offering some attractive alternatives that may make retirement planning a little less time-intensive.

With number of income producing investment products increasing, one should notice the growing selection of Dividend paying ETF products that sample indicies from around the globe. With low expenses and exposure to hundreds of companies worldwide, ETFs may become the choice investment for the future.

How To Choose Exchange Traded Funds

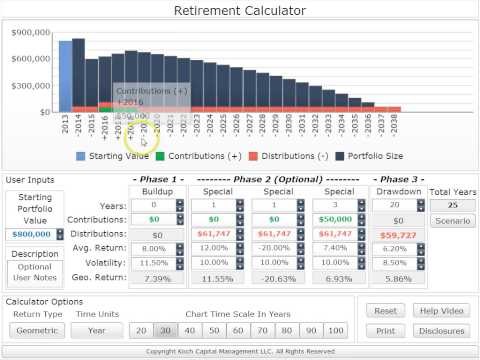

When selecting income producing ETFs and allocating assets to these various funds, planning for income in retirement and managing portfolio risk becomes a bit easier! Take this sample portfolio for instance:

iShares MSCI Pacific Ex. Japan (EPP) 20%

The fund uses a representative sampling strategy to try to track the MSCI Pacific ex-Japan index. The index consists of stocks from the following four countries: Australia, Hong Kong, New Zealand and Singapore. This investment is non-diversified.

This ETF is down over 12.0% so far this year and now sports a juicy Dividend Yield of 5.25%, while holding the expense ratio at 0.50%. This may present an excellent buying opportunity for a long-term investor.

BLDRS Developed Markets 100 (ADRD) 30%

For exposure to Japan, The United Kingdom, France and Germany, ADRD does the trick just fine as it seeks to provide investment results that correspond, before fees and expenses, to the price and yield performance of the Bank of New York Developed Markets 100 ADR Index.

ADRD provides a Dividend Yield of 2.88% and has an extremely low P/E ratio of just 9.36. The expense ratio for ADRD is reasonable at 0.3% with a standard deviation of 9.69.

iShares Dow Jones Select Dividend (DVY) 35%

The fund uses a representative sampling strategy to track the Dow Jones Select Dividend index. The index is comprised of one hundred of the highest dividend-yielding securities (excluding REITs) in the Dow Jones U.S. Total Market index, a broad-based index representative of the total market for U.S. equity securities.

This Dividend ETF Yields a respectable 4.5%, making it well worth the tiny expense ratio of 0.40%. DVY also sports a relatively low standard deviation of 6.64, allowing you to sleep at night during your retirement!

Vanguard REIT Index (VNQ) 15%

The Vanguard REIT ETF seeks income and moderate long-term capital growth. The fund normally invests at least 98% of assets in stocks of real estate investment trusts (REITs) that are included in the Morgan Stanley REIT index.

Real Estate Investment Trusts have long been used in retirement portfolios for their income producing nature and this ETF is no exception. VNQ delivers a 5.1% Yield and has a return of 2.29% YTD. As usual, Vanguard keep their expenses to the bare minimum at 0.12%.

The Story Behind The Story

This portfolio is not necessarily built for tax efficiency, but the use of Exchange Traded Funds and the emphasis on dividend income is taylor made for retirement planning. This portfolio covers a host of asset classes as well as having a great geographic asset mix. I am a huge believer in investing outside of North America in order to capitalize on both capital growth and higher dividend yields offered in other markets.

Why Not Bonds?

I am not, however, a huge believer in fixed income going forward as the supply of money should be greater than the demand. Baby boomers will not be requiring loans, but will be investing their hard-earned savings.

That said, a portion of a portfolio dedicated to fixed income in retirement will certainly reduce risk. However, with longer life spans, it is absolutely necessary to have capital growth in a retirement portfoliowe could live a lot longer than we think!

I certainly dont want to run out of money, or places to spend it when I reach 114 years old. But, I guess Ill cross that bridge when I come to it hopefully walking on my own two feet.