How to avoid these novice investor mistakes CBS News

Post on: 18 Июль, 2015 No Comment

By Mitch Tuchman, guest contributor

It’s not easy being a novice investor. You know you need to put money into stocks, but where?

You might try watching financial cable TV to get some tips. A guest appears on camera, the host asks what will happen next in the stock market, then a second guest agrees (or disagrees).

Ten minutes later, it starts all over again. Only the new guest has a different viewpoint and offers completely different advice.

It’s enough to make you want to sit in a money market account, waiting for some kind of clear direction about what to do. But that’s how you ensure the worst possible outcome for your retirement.

Why? Because your brain is wired 180 degrees backward when it comes to money and investing. The most likely outcome, unfortunately, is that you’ll wait for stocks to go up before buying.

In fact, people often wait until the market hits an undisputed peak, which is exactly what’s happening now as the Dow Jones industrials set a record-high close on Friday. At that point, they become true believers and buy-in big — at what turns out to be the very top. Remember the dot-com bubble? Exactly.

What happens next isn’t so pretty. Having bought at the top, our novice investor sits back and waits. Stocks retrench, flatline for a while, then fall some more. It feels terrible. This wasn’t what our investor expected. So, he considers selling.

But his brain tells him, Wait, wait, it might turn around.

Then the bottom falls out. Panic sets in, and the investor holds on, nervously watching his account balance drop until, you guessed it, he finds the market bottom — and sells it all.

This happens over and over again to beginner investors, but the pattern can be avoided. In fact, it must be avoided. Every time you lock in a loss, it takes even more of a percentage gain to return to the previous cash position.

People have a hard time grasping this concept, but it’s true. If you put in $100 and the market falls 10%, you now have $90. Simple enough. If you panicked and sold, then reinvested a week later, you need a return of a little more than 11% to get back to $100. Try this out on a calculator.

Yet, the effect works in your favor going in the other direction. Compounding allows your investments to grow faster and faster over time. If your $100 earns 10%, it becomes $110. The next year it earns 10% again, but thanks to your new, higher account balance, instead of $10, you get $11.

The net-net on compounding is that money doubles every 10 years when invested at a market return of 7.2%. Then 10 years on, it doubles once more. And then again. Your $100 becomes $200, then $400, then $800.

For stock market novices, then, the trick is to invest as safely as possible while getting your targeted return and reinvesting the gains like clockwork. How can you achieve this with a minimum of stress? Here are three simple steps that will get you into the market with diversification and earning a solid, steady return.

1. Avoid stock picking and market timing

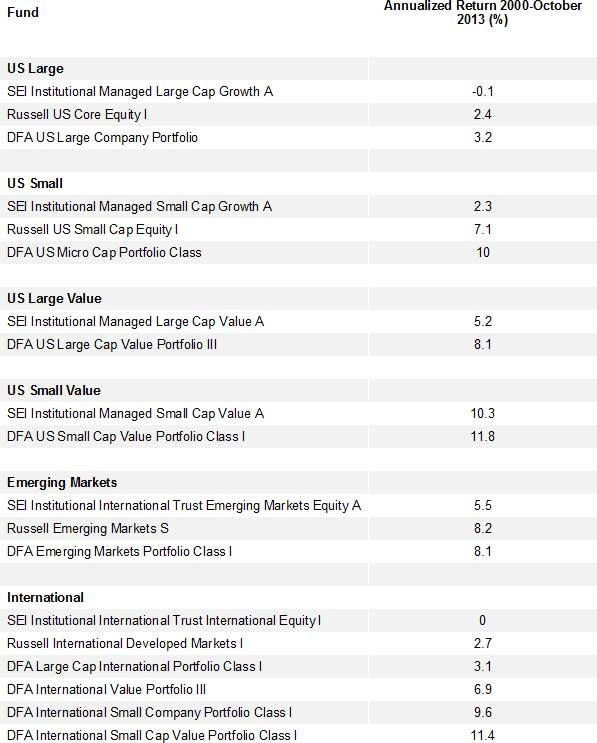

It’s impossibly hard to outguess Wall Street (and remember, the analysts are also just guessing!). Even the most highly paid money managers fail to beat the indexes. Some do for a while, but in time their strategies expire and they end up giving back those gains. Rather, decades of research has proven that owning the whole market through an index fund or exchange-traded funds (ETFs) is the most effective way to invest for the long term.

2. Keep costs as low as possible

One of the major reasons active mutual funds and managers lag the indexes is the cost of keeping them in business. Running storefront offices and call centers isn’t cheap, nor is paying bonuses to star managers who attract new clients. Morningstar, the fund research firm, long ago came to the disarmingly simple conclusion that the best indicator of a fund’s performance is its cost. Low fees equal higher returns.

3. Disciplined rebalancing is key

You might be thinking, If I just buy the market and wait, won’t I be taking a big risk? Perhaps, but there are excellent ways to reduce your risk and even outperform the index handily. A basket of investment types — U.S. stocks, bonds, real estate, foreign securities and commodities — will show variances in return over time. Rebalancing is the discipline of periodically selling gainers in some asset classes in order to buy those that are temporarily out of favor. Over time, then, your portfolio should shift slowly toward a more conservative, less volatile mix. reducing the risk of getting crushed in a last-minute market crash.

Retiring with more isn’t that hard to do. Unfortunately, few on Wall Street have an interest in pursuing the kind of simple, effective approach that most Americans truly need.

At Rebalance IRA. which keeps fees down (and returns higher) with low-cost ETFs and keeps risks low with scientific asset allocation and disciplined rebalancing, Mitch Tuchman helps everyday individuals (not the top 5%) attain financial independence. Follow Mitch on Twitter @MitchellTuchman and on LinkedIn .

2014 CBS Interactive Inc. All Rights Reserved.