How to avoid new 3 8% tax on investment income

Post on: 29 Май, 2015 No Comment

BillBischoff

Duncan Andison / Shutterstock.com

The new 3.8% Medicare tax on net investment income took effect on January 1. It only affects higher-income individuals, but that can include anyone who has a big one-time shot of investment income or gain this year (or any other year). For example, if you sold some company stock for a big profit, you could be a victim. What to do? Read this for the first installment of our two-part series on strategies you can employ between now and the end of the year to avoid paying—or minimize your exposure to—the new tax.

Basics on the New Investment Income Tax

The following types of income and gain (net of related deductions) are generally included in the definition of net investment income and therefore potentially exposed to the new 3.8% tax.

- Gains from selling investment assets—such as gains from stocks and securities held in taxable brokerage firm accounts, and real estate gains (including the taxable portion of a big gain from selling your principal residence).

- Capital gain distributions from mutual funds.

- Gross income from dividends.

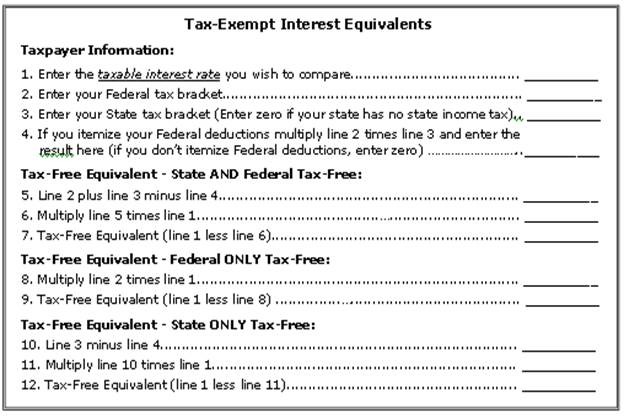

- Gross income from interest (not including tax-free interest such as municipal bond interest).

- Gross income from royalties.

- Gross income from annuities.

- Gross income and gains from passive business activities (business activities in which you don’t spend a significant amount of time) and gross income from rents.

- Gains from selling passive partnership interests and S corporation stock (you don’t spend much time in the partnership or S corporation business activity).

- Gross income and gains from trading in financial instruments or commodities.

Are You Exposed?

You are only exposed to the new 3.8% Medicare tax if your modified adjusted gross income (MAGI) exceeds the applicable threshold of: $200,000 if you are unmarried, $250,000 if you are a married joint-filer or qualifying widow or widower, or $125,000 if you use married filing separate status.

The amount hit with the 3.8% tax is the lesser of: (1) your net investment income or (2) the amount by which your MAGI exceeds the applicable threshold from above.

For this purpose, MAGI is defined as your “regular” adjusted gross income (AGI) from the last line on page 1 of your Form 1040 plus certain excluded foreign-source income net of certain deductions and exclusions (most folks are not affected by this add-back).

Strategies to Minimize the Tax Must Aim at the Proper Target

As explained earlier, the new 3.8% Medicare tax hits the lesser of: (1) your net investment income or (2) the amount by which your MAGI exceeds the applicable threshold. Therefore, planning strategies must be aimed at the proper target to have the desired effect of avoiding or minimizing your exposure to the tax.

- If your net investment income amount is lower than your excess MAGI amount, your exposure to the tax mainly depends on your net investment income. So you should focus first on strategies that will reduce net investment income. In my next article, I’ll provide some specific strategies for doing just that. Of course, some strategies that reduce net investment income will also reduce MAGI. If so, that cannot possibly hurt.

- If your excess MAGI amount is lower than your net investment income amount, your exposure to the tax mainly depends on your MAGI. So you should focus first on strategies that will reduce MAGI. In my next article, I’ll supply some. Of course, some strategies that reduce MAGI will also reduce net investment income. If so, that cannot possibly hurt.

Example 1: Targeting Net Investment Income.

In 2013, you and your spouse will file jointly. Unless something changes between now and year-end, you expect to have $450,000 of MAGI which will include $150,000 of net investment income. You will owe the 3.8% Medicare tax on all $150,000 of your net investment income because that amount is the lesser of: (1) your excess MAGI of $200,000 ($450,000 — $250,000 threshold for joint filers) or (2) your net investment income of $150,000. Your bill for the 3.8% tax will be $5,700 (3.8% x $150,000).

Your exposure to the 3.8% tax mainly depends on your net investment income level because that number is lower than your excess MAGI. Therefore, you should focus first on strategies that will reduce net investment income. For instance, you could sell some loser securities from your taxable brokerage firm accounts to offset earlier gains from those accounts.

In contrast, strategies that would lower your MAGI would not reduce your exposure to the 3.8% tax unless those strategies reduce your MAGI by quite a bit. For instance, making an additional $15,000 deductible contribution to your tax-favored retirement account would not by itself reduce your exposure to the 3.8% tax.

Example 2: Targeting MAGI.

In 2013, you will file as an unmarried individual. Unless something changes between now and year-end, you expect to have $300,000 of MAGI which will include $125,000 of net investment income. You will owe the 3.8% Medicare tax on $100,000 because that is the lesser of: (1) your excess MAGI of $100,000 ($300,000 — $200,000 threshold for single filers) or (2) your net investment income of $125,000. Your bill for the 3.8% tax will be $3,800 (3.8% x $100,000).

Your exposure to the tax mainly depends on your MAGI level because your excess MAGI number is lower than your net investment income. Therefore, you should focus first on strategies that would reduce MAGI. For instance, making $15,000 of additional deductible contributions to your tax-favored retirement accounts would reduce your MAGI by $15,000 and therefore reduce the hit from the 3.8% tax. Selling loser securities from your taxable brokerage firm accounts to offset earlier gains from those accounts would also reduce your MAGI.

Stay Tuned for Specific Strategies

In my next article, I’ll cover some specific short-term and long-term strategies that you can use to reduce or maybe even completely eliminate your exposure to the new 3.8% tax. Stay tuned!