How the Fed Affects GDP

Post on: 1 Май, 2015 No Comment

The Fed Tapers While GDP Surges

It has been a big week of news so far, with this morning’s second-quarter gross domestic product (GDP) print showing the economy grew some 4% from April through June. That number was a welcome relief from the revised contraction of 2.1% in the winter-ravished first quarter.

The economy now seems on pace to deliver GDP growth of about 2%, which is not fantastic, but not bad either. I think what today’s GDP print tells us is that the Federal Reserve will almost certainly continue the taper of its bond-buying program. The Fed also will likely stay the course, depending on the data, and raise interest rates sometime in mid-2015.

That’s essentially the path the Fed took in its latest Federal Open Market Committee (FOMC) meeting. The central bank continued to taper its asset purchases by $10 billion per month, as expected, and it also left short-term interest rates alone at near-zero. The Fed’s statement contained language that acknowledged prices were climbing to their 2% inflation target. It also acknowledged improved economic conditions and an improving labor market.

We’ll soon know just how well the labor market did in July, as the official employment data comes out on Friday morning. I suspect that the number will reflect what we’ve seen of late, and that is a moderate-but-steady improvement on the jobs front.

The bottom line here is that the market has some positive data to support current equity levels. Now, however, we have to see if this is as high as things are going to get for a while or whether we are in for a “sell-the-good-news” pullback that shakes things up.

ETF Talk: Eyeing Brazilian Small Caps

Brazil’s hosting of the recent World Cup seemingly put all eyes on the Portuguese-speaking South American nation in May and June. My colleague Nicholas Vardy wrote a column on investing in Brazil, perpetually regarded as “the country of the future,” and I myself penned an ETF Talk on iShares MSCI Brazil Capped (EWZ) . an exchange-traded fund (ETF) that tracks the Brazilian economy.

Once the soccer tournament ended, all that attention vanished rapidly. However, with EWZ rising in the month and a half since I covered it, I thought it would be fruitful to once again focus on Brazil. But this time, we will feature a smaller component of the country’s stock market: small caps.

Market Vectors Brazil Small-Cap ETF (BRF) is a fund that follows the performance of an index which tracks Brazilian small-capitalization companies. For the purposes of the index, a company is considered Brazilian if it is incorporated in that country or generates at least half of its revenues in Brazil. BRF has gained 1.69% this year, though it recently has recovered from a major decline. This fund offers a dividend yield of 1.78%.

BRF has holdings in a wide variety of sectors, chiefly in consumer cyclical, 28.37%, with smaller weightings in utilities, 14.92%; real estate, 14.35%; consumer defensive, 14.21%; and industrials, 10.25%, among others. This ETF’s top 10 holdings make up only 27.97% of its total assets. The top five of these companies are CIA Hering SA, 3.41%; SUL America –UNT N2, 3.16%; Odontoprev SA, 2.99%; CIA Saneamento De Minas Gerais-COPASA MG, 2.87%; and Fii Btg Pactual Corp Office, 2.85%.

iShares, the ETF provider that offers EWZ, also features a Brazilian small-cap fund: iShares MSCI Brazil Small-Cap (EWZS). EWZS seeks investment results that match those of a free float-adjusted market capitalization index designed to measure the performance of Brazilian equity securities in the bottom 14% of Brazil’s market, as measured by market capitalization. This ETF has lost 0.20% this year. However, just like BRF, EWZS has been recovering from a large drop. EWZS features a dividend yield of 1.87%.

EWZS has the same broad sector investment as BRF, with roughly similar weightings: consumer cyclical, 27.16%; real estate, 17.77%; consumer defensive, 14.46%; industrials, 14.41%; and utilities, 11.91%, among others. The fund’s top 10 holdings represent 29.48% of its total assets; the top five of these companies are Equatorial –ON NM, 5.09%; CIA Hering SA, 4.21%; MRV –ON NM, 3.12%; MILLS –ON NM, 2.74%; and Sao Martinho SA, 2.64%.

I hope these two funds from the small-cap segment of Brazil’s economy give you a new perspective of that country. As seen in the charts here, Brazilian small-cap funds are gaining ground after a relatively recent tumble. EWZ, representing the whole Brazilian market, is also on the rise, meaning that now may be a good time for you to consider investing in companies that are based in the host nation of the latest World Cup.

If you want my advice about buying and selling specific ETFs, including appropriate stop losses, please consider subscribing to my Successful ETF Investing newsletter. As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an e-mail. You just may see your question answered in a future ETF Talk.

China ETFs: Now You Have a Class A Choice

The world of ETFs just keeps getting bigger and better, with fantastic new choices spanning the entire globe. The latest sector demonstrating what I think is an extremely investable innovation is with ETFs pegged to the Chinese stock market.

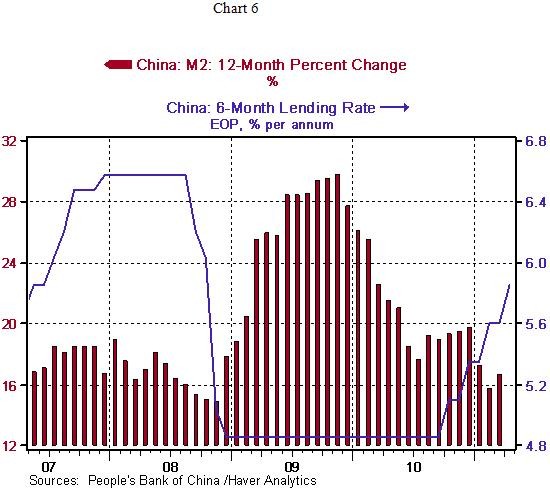

As subscribers to my Successful ETF Investing advisory newsletter know, I have been bullish on China and the growth story for some time. Recent metrics from that country, such as the outstanding manufacturing sector readings showing the best growth in that critical segment in 18 months, argue nearly conclusively that the Chinese economy now has virtually no chance of the so-called “hard landing” that China skeptics have been predicting.

The positive China data, as well as economic growth around the globe, hasn’t been lost on the smart money. Take a look at the table here of Chinese ETFs. As you can see, the gains over the past one month, three months and year to date have been outstanding.