How REITs Work Real Estate Investing

Post on: 29 Март, 2015 No Comment

Individuals buy shares in real-estate investment trusts, and so do other investors, such as pension funds, insurance companies, banks, and mutual funds. Shares in most REITs can be purchased on the major stock exchanges, and financial planners help investors select a company just as they would other investments that are held for current income and long-term appreciation.

REITs offer an annual report and prospectus to help current and potential investors evaluate their income and growth potential. Some of the things you should consider when evaluating a trust are its management, its source of current funding, its potential for future funding, and its earnings.

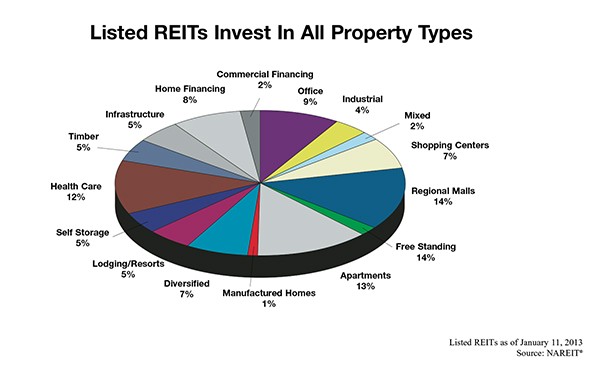

Different types of REITs perform differently in various economic conditions. Since a REIT’s property investments are sometimes focused in specific geographical locations, a potential investor should research the supply and demand for the type of property held within the trust’s portfolio. For instance, a REIT that specializes in apartment buildings in college towns with growing student populations might be in a position to keep the majority of its units rented.

A REIT’s shareholders elect trustees or a board of directors, who in turn appoint management personnel. Some of the current management teams were past owners of private corporations that have become today’s publicly traded REITs, shifting their ownership into the company’s stock at the switch, while staying on to continue managing the new public corporation as they had when it was a private enterprise.

REITs distribute the majority of their income to investors each year, so in order to grow they must be in a position to obtain additional capital to continue making investments.

How Do I Evaluate a REIT?

REIT performance is judged using net income as defined by generally accepted accounting principles (GAAP). Another important factor is funds from operations (FFO). It looks at GAAP net income but excludes gains or losses from the sales of most properties and the depreciation of the trust’s real-estate holdings. Depreciation is excluded from the calculations because real estate maintains more value than other items that type of calculation is used to assess, such as personal property or machinery.

Investors can compare a REIT’s stock price to its net asset value (NAV), a per-share calculation that analyzes the market value of the company’s assets. The NAV is only one aspect of the trust that you should consider. You can research specific REITs by using the tools at one of the online sources listed in Appendix C.

REITs are required to send IRS Form 1099-DIV to each of their shareholders. That form shows investors the total of their prior year’s dividends and indicates how dividends should be allocated on the investor’s current tax return.

Most experts recommend that you consider the management team’s experience and the length of time they have worked together. Do they have a good track record for choosing worthwhile investments and managing them effectively? Has the team remained stable for a long period of time, or have members been replaced frequently in an effort to improve the trust’s operations and income? An investment professional can help you find answers to those questions.

Look at a REIT’s past acquisitions. Have they steadily increased over the years, or are they stagnant? Where is new funding coming from? What about paid dividends and investment growth has the REIT produced good results in both areas? Your investment planner can walk you through all of the specifics you must consider when evaluating a trust’s past, present, and future potential.

It’s important to research a REIT just as carefully as you would any other stock. Get started by finding an investment planner whose opinion you trust, and ask that person as many questions as it takes to feel comfortable that you understand the basics of REIT evaluation. For reading materials, visit your local library and browse the online REIT resources in Appendix C.