How Real Is China’s Growth Real Time Economics

Post on: 21 Апрель, 2015 No Comment

growth

Perhaps the most common question about China’s phenomenal record of growth is: Is it real?

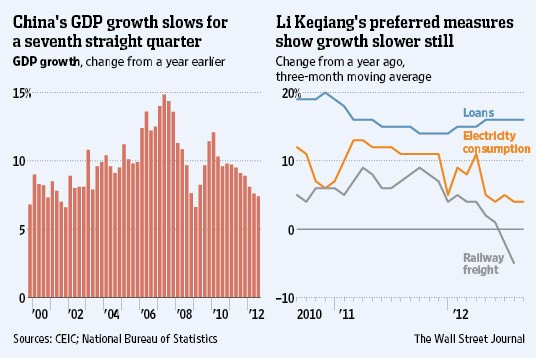

Even China’s premier, Li Keqiang. has expressed doubts about China’s GDP results. In a 2007 discussion with the U.S. ambassador to China, which both thought was private, Mr. Li called GDP a “man-made and therefore unreliable” statistic.

Mr. Li, at the time the Communist Party chief of Liaoning province, said he looked at stats on electricity, rail cargo and loans to get a better gauge of economic activity, according to a copy of the ambassador’s memo, which was made public by WikiLeaks.

Economists have tried to put together alternative indices. One of the most thorough is produced by Capital Economics, which releases what it calls the China Activity Proxy. The data series started in 2009, so it has a track record. It’s published monthly unlike GDP data, which is released quarterly.

The London-based research group uses one of Mr. Li’s favorite indicators, electricity output, as a proxy for industrial activity. It adds four others – freight shipment (a broad measure of economic activity), floor space under construction (real estate); passenger travel (service sector); and cargo volume (international trade).

“They are relatively low profile (statistics), so should be subject to fewer questions about data manipulation,” Capital Economics explained.

For the most part, Capital Economics finds that its CAP index generally jibes with China’s GDP numbers, especially in 2009 and 2010. But in the last two years, its CAP index suggests growth may have been 1 to 2 percentage points below the official GDP numbers.

What’s up? Mark Williams, a China economist at the firm, says official GDP numbers reflect output data and are “skewed toward what is going on in industry.”

CAP data, he says, also capture “harder to measure” parts of the economy.

Over the past two years, he says, big firms have benefited disproportionately from a surge in lending. CAP data suggests that service-sector firms may be hurting more than the official GDP numbers would suggest.

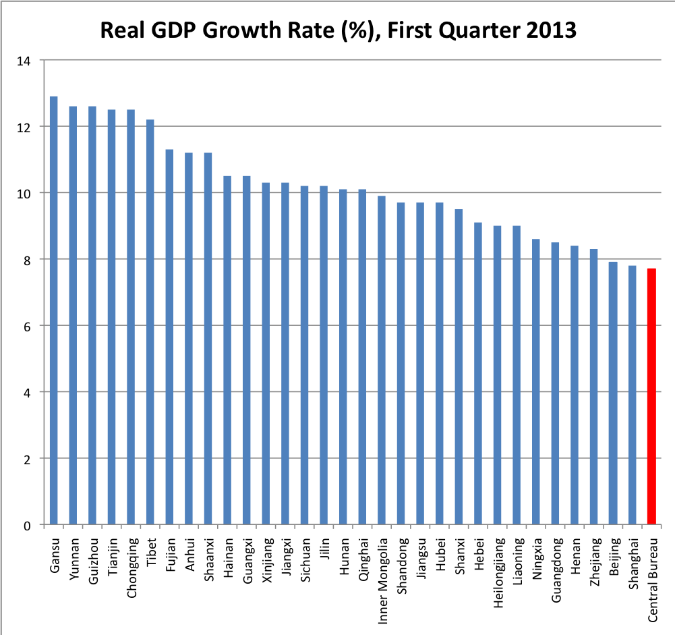

As for 2014, Mr. Williams is at the low end of estimates for GDP growth: He forecasts 7% growth, down from an expected 7.6% this year. Some others are forecasting growth of 8% or so, figuring that the rebound in global growth will help Chinese exports and that the Chinese government will do what’s needed to keep the economy from slowing too quickly whatever officials say about their commitment to reform.

Follow @WSJecon for economic news and analysis

Follow @WSJCentralBanks for central banking news and analysis