How much to pay for stocks

Post on: 5 Июль, 2015 No Comment

The right way to use P/E and other valuation tools when looking at stock investments

Sivy 70: America’s Best Stocks

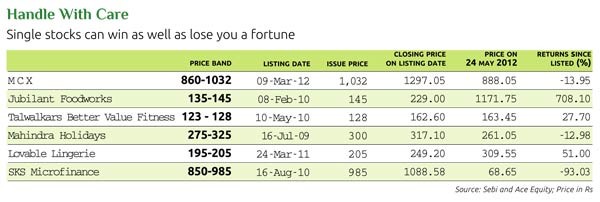

When times are good, investors think the happy days will last forever, and they are willing to pay exorbitant amounts for earnings.

When times are bad, they assume the world is ending and refuse to pay much of anything. In assessing how much a stock is worth, investors talk about valuation, the stock price relative to any number of criteria.

Price/earnings (P/E) ratio

Everybody uses it, but not everybody understands it. The actual P/E calculation is easy: Just divide the current price per share by earnings per share.

But what number should you use for earnings per share? The sum of the past four quarters? Estimates for next year?

There is no right answer. The P/E based on the past four quarters provides the most accurate reflection of the current valuation, because those earnings have already been booked.

But investors are always looking ahead, so most also pay attention to estimates, which also are widely available at financial websites.

Wall Street analysts generally compute earnings-per-share estimates for the current fiscal year and the next fiscal year and use those estimates to assign a P/E, though there is no guarantee that the company will meet those estimates.

The P/E can’t tell you whether to buy or sell. It is merely a gauge to tell you whether a stock is overvalued or undervalued. Assuming they have the same total shares outstanding, is a $100 stock more expensive than a $50 stock?

Not exactly. Where valuation is concerned, price is dictated by expectations of future performance. If the earnings of the higher-priced company are growing considerably faster than the other, the higher price may be justified.

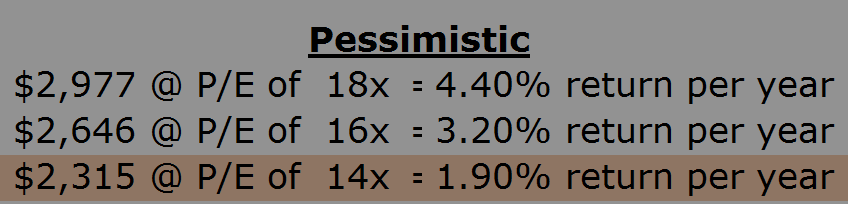

What’s an appropriate P/E? Different types of stocks win different valuations. Generally, the market pays up for growth or enormous profitability. Consider a slow-growing industrial conglomerate and a tech company with fat profit margins and enormous growth potential.

The market will typically reward the second company with a higher P/E.

To quickly compare P/Es and growth rates, use the PEG ratio — the P/E (based on estimates for the current year) divided by the long-term growth rate. A company with a P/E of 36 and a growth rate of 20% has a PEG of 1.8.

In general, you want a stock with a PEG that’s close to 1.0 (or lower), which means it is trading in line with its growth rate. But for a quality company, you can pay more.

Also, don’t get excited by rock-bottom P/Es — some companies are doomed to low valuations. One group the market tends to penalize is cyclicals, companies whose performance rises and falls with the economy.

Price/Sales ratio

Just as investors like to know how much they’re paying for earnings, it’s also useful to know how much they’re paying for revenue (the terms sales and revenue are used interchangeably).

To calculate the Price/Sales ratio, divide the stock price by the total sales per share for the past 12 months. You could also use revenue estimates for the next fiscal year, which are being published more frequently on financial websites.

Like P/Es, Price/Sales ratios are all over the map, with fast-growers tending to get the highest valuations.

Price/Book Value ratio

Defined simply, book value equals a company’s total assets minus its total liabilities and intangible assets. In other words, if you liquidated a firm, this is what the leftover assets would be worth after paying off all your creditors.

On the balance sheet, book value is represented as shareholders’ equity. (Dividing this aggregate total by the number of shares outstanding will give you a per-share book value.)

This is a more conservative measure, which embraces a bird-in-hand philosophy of valuation. Investors use it to spot cases in which the market is over- or undervaluing a company’s true strength.

For example, a retailer that owns the buildings its stores are housed in might be sitting on unrealized real estate gains.