How Much Real Estate Leverage Should You Use Planting Our Pennies

Post on: 18 Июнь, 2015 No Comment

Not too long ago I heard an acquaintance say:

When I bought my house I took the smallest down payment I could to increase my Real Estate Leverage for better returns. Think of it, a 20% downpayment uses 1/5th the money of a cash purchase, so your ROI is multiplied by a factor of 5! And a 3.5% downpayment is even better!

On the surface this sounds like it could be a reasonable statement. Less capital invested in the deal, plus if you have the right incentives lined up tax-wise could leave you with higher ROI. Maybe.

Here I started thinking about the many reasons that are often cited for taking out a mortgage:

- tax deductibility of interest payments

- paying down the loan with future dollars which (thanks to inflation) are worth less. (Worth less, not worthless. At least hopefully)

Was it true that if these benefits maxed out youd get a higher ROI through leverage?

If that really was the case, it would seem that money is too cheap and that the cost of leveraging should be higher to align more with the inherent riskiness leverage brings. My gut told me that this acquaintances statement was false.

I just had to prove it. So to Excel I went. (You know this meanspretty graphs below the fold!)

Comparing Cumulative Cost Basis

Your cost basis is just a fancy way of saying the money youve put into the investment. And the cumulative part just means adding it all up since you started investing. This is where the bulk of the differences between a cash purchase and a financed purchase happen to change your ROI. Were calculating ROI as:

(Sale Price Realtors Fees Amt Still Owed on Mortgage) / Cumulative Cost Basis

For A Cash Purchase. your cost basis is simply the price you purchased the property for.

For A Financed Purchase. there are upfront costs that include the down payment , loan origination costs. and points on your mortgage (pre-paid interest). But then each year you continue to add to your cost basis since you are paying interest and principal payments. private mortgage insurance (aka PMI) if applicable, subtract the tax benefits that you are getting each year from deducting any mortgage interest, and as we add these costs to the cumulative cost basis, we use those discounted cash flow skillz to discount these future payments back to year 1 according to inflation. The yearly additions to your cost basis look like this:

(interest pmt + principal pmt + PMI payment tax benefits)/ (1+ inflation rate)^(years -1)

The equations are fun and all, but heres the question were really trying to answer:

Will all of these tax deductions and lower cost future dollars overcome the amount that you are paying in interest and other fees?

I built a pretty awesome spreadsheet to test it all out. If you want a copy, shoot over an email and Ill send it over.

All Of The Spreadsheet Variables

As anyone who has ever bought a home can attest, there are what seems like a million different variables in the process and Ive tried to account for as many as I could in this spreadsheet. Things you can adjust are:

Purchase Price Median US home price was $173,200 in Jan 2013, so Ive used that for all these examples

Percent Down Payment The examples here are for the minimum conventional loan (20% down) and the FHA minimum of 3.5% down.

Mortgage Terms - Interest Rate, Points Required, # Years. Well fiddle with these assumptions a bit in the examples below.

PMI Rates - Rules for PMI recently changed. FHA increased the PMI yearly premium to 1.30% of the loan value and required that PMI be paid for the entire duration of the loan. Thats right. PMI payments no longer disappear once you hit the magic 20% equity unless you refinance into another loan.

Loan Origination Costs - The US nationwide average for mortgage origination costs on a $200K loan are $1,600

Marginal Tax Rate - What tax bracket are your mortgage interest deductions saving you money in? I use 25% for all the following examples (mostly cause thats our marginal tax bracket). In all of these examples, I am VERY generous and assume you get the full benefit of your tax deduction from mortgage interest despite the fact that many people cannot itemize tax deductions. (The PoPs included.) If you get the spreadsheet you can toggle this on/off.

Inflation - I took the average CPI from the past 20 years. It was 2.50%. That was used as the inflation rate in all of these calculations.

RE Growth Rate - Long term, on a nationwide basis, RE growth tracks inflation. But I left it as a variable we can toggle to test what happens if youre in an area like SF or NYC that has had long term growth rates above inflation.

Realtors Fees Upon Sale - I assumed 6% since thats a pretty fair industry standard for the seller to pay. Whew, thats a lot! So lets look at an average example.

An Average Case 20% Down

Here well use all the average values for our mortgage and real estate atmosphere.

- Mortgage Terms: 20% Down Payment, 6.45% APR with 0.97% points (these are the 20-year average of 30 year conventional mortgage rates and the points required to get those rates), 30 year loan

- Inflation = RE Growth Rate = 2.5% assumes that the housing market tracks inflation.

Heres what our results look like. The blue line is the ROI on a cash purchase, the red is the ROI on your mortgage financed at those average terms. The graph says it all, right? At no point in the 30 year loan period can you expect that leverage to pay off with an investment boost. A cash investment would have had a 97.2% ROI, which is almost double the 49.9% ROI on your mortgage financed purchase.

What About Increasing the Leverage Even More? Does That Help?

An Average Case With More Leverage 3.5% Down

Same terms as above, but with 3.5% down instead of 20%. In this case, you have PMI which is 1.30% per year, but since were only dealing with an average interest rate, we generously assume that you can get a no cost refinance into another loan with an average interest rate the year that you hit 20% equity. So what happens? Its even worse, especially in the early years. Notice it takes until year 21 for your financed purchase to have a positive ROI after calculating your adjusted cost basis. Kindof scary, right? After 30 years, youll have a financed ROI of 37% instead of 97% for a cash purchase.

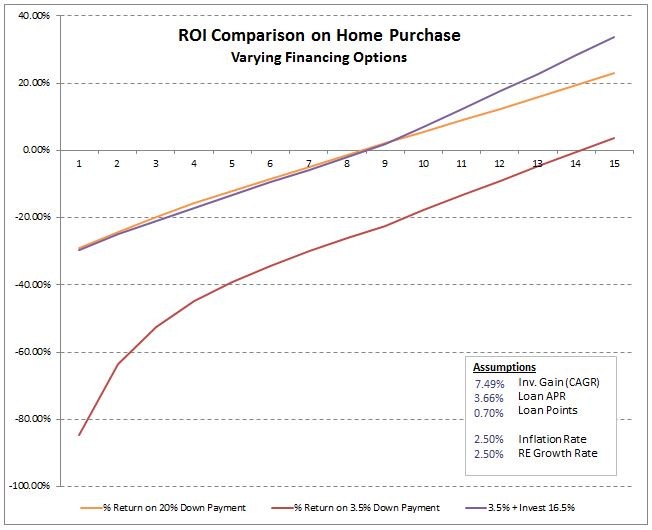

But Interest Rates Crazy Low Right Now. Nobodys Paying 6.45% on a Mortgage Right Now!

True, so lets try some more current mortgage rates.

2012 Interest Rates 20% Down

Same variables as used above, but the mortgage terms reflect the conventional loan averages from 2012. which are historic lows. (Though they are headed back up as of late)

Mortgage Terms. 20% Down, 30 year loan @ 3.66% APR with 0.70% points

With 2012 interest rates, the gap starts to shrink, and by year 30 were within 10% of the 97% gain from cash.

But youre still in negative ROI territory for the first 8 years. Put another way, it takes 8 years not to lose money on your housing investment. A smaller downpayment (3.5% graph not pictured) is even worse, shaving another

10% off your 30 year return to put it at 76%.

This Isnt Fair. My Housing Market Is Special, And It Will Grow Faster Than Inflation.

Most housing markets arent special and dont grow faster than inflation. But there are some areas where continued population growth and investment in a fixed geographic area has led to housing prices rising faster than inflation on a consistent basis. So what if our highly leveraged acquaintance bought in one of these areas?

San Francisco With 2012 Mortgage Rates 3.5% Down

San Francisco is perhaps the most extreme example, with one of the longest periods of sustained RE market growth in the US. It has had a compound average growth rate of 4.4% from 1986 2012 (well over the 2.9% compound CPI for the same period).

So what happens when we look at that 3.5% down payment mortgage in a booming market like San Franciscos?

Even with that generous growth beyond inflation, that 3.5% down payment still doesnt come out ahead. Its a close match in the middle years (say 13-16), but a cash purchase still comes out ahead in every single year. (By contrast, a 20% down payment in a SF style market would actually show financing working in your favor during the middle years, 10-20, of your 30 year investment horizon eking out small gains over a cash purchase.)

Take Home Message

Interest is a cost. A quite significant cost most of the time.

Does this mean everyone needs to save up and buy a home in cash? No. Wed be hypocrites to say that. There are many other reasons besides ROI to choose a specific downpayment. But be wary about anyone whos encouraging you to have a smaller (percentage) downpayment. Chances are theyre either mis-informed or dont have your best financial interests at heart.

What size downpayment did (or will) you use when buying a home? What are some of the reasons that you had for choosing that down payment at the time?