How Much Do You Earn in a Money Market Account

Post on: 26 Апрель, 2015 No Comment

Shop Around

The best way to get a good interest rate on your money market account is to shop around. Banks compete with one another for deposits, and one of the ways they do that is by offering higher rates on money market accounts. You can start with your own bank, and then compare the interest rate they offer with that offered by other local banks. Watch your local newspaper for money market specials, and be on the lookout for radio and TV ads offering higher rates on money market savings. When the Federal Funds rate set by the government falls, so do money market rates, but shopping around can get you a better deal. In 2010 most money market accounts paid less than 1 percent, but some accounts paid much more than that.

Minimum Balance

Unlike savings accounts, which often do not have a minimum balance requirement, money market accounts tend to have minimum balance requirements in the hundreds, or even thousands, of dollars. If you fall below that minimum balance requirement your account might stop earning interest, and you could also be subject to maintenance fees and other charges. Before you open a money market account you should check the fine print carefully to make sure you can meet the minimum balance requirement.

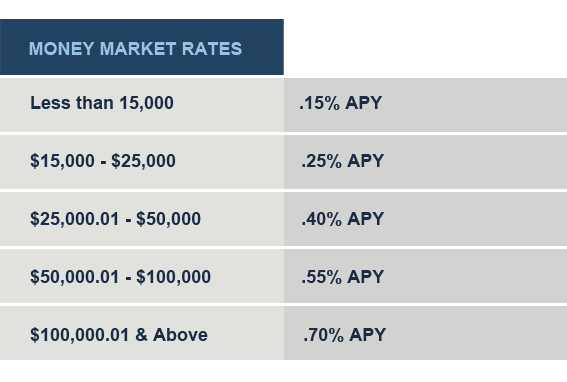

Tiered Earnings

References

Resources

More Like This

Risks of Money Market Accounts

The Average Money Market Returns

How to Transfer Contacts & Calendars to a New Cell Phone

You May Also Like

eHow; Real Estate & Investment; Understand & Invest in Stock Market; Losing Money in Stock Market; How Much Money Can You Earn.

Checking accounts do not commonly earn interest, but savings accounts do. A money market account is somewhat similar to investing in.

It's easy to get confused over financial terminology. Many people have heard of IRAs and money markets, but until you understand their.

Money market accounts don't pay a fixed interest rate. That's because the interest rate is based on the yield of the government.

A money market account is a combination checking and savings account. Your bank invests your deposited money for you, and seeks to.

Making Money; Do Market Research; How Much to. House cleaning can be a great way to start your own business. Not.

These investments include money market accounts, government bond funds and certificates of deposit. Do you want to make money, get rich.

Banks offer money market accounts as a way to earn higher interest rates on savings, while. How to Invest In The Forex.

How Much Do You Earn in a Money Market Account? If you want to keep your money safe while earning a competitive.

Cashing a check is normally a simple process involving the check, you, and your bank. But when you are missing the third.

As of January 2011, the average money market account interest rate ranged from 1 to 2 percent, depending on the financial institution.

Money can be moved between banks through a process called wire or online transfers. For a fee, banks electronically move money from.

Money market deposit accounts are a type of savings account offered by banks and credit unions. The Internal Revenue Service requires account.

A money market account is similar to a regular checking account except with limitations on the number of checks, deposits and transfers.

Difference Between CD & Money Market Account; How do I Calculate the Interest Made on a CD? Money Market Account Vs. CD;.