How mega trends will change real estate investment by 2020 Asset Management Insights PwC

Post on: 25 Апрель, 2015 No Comment

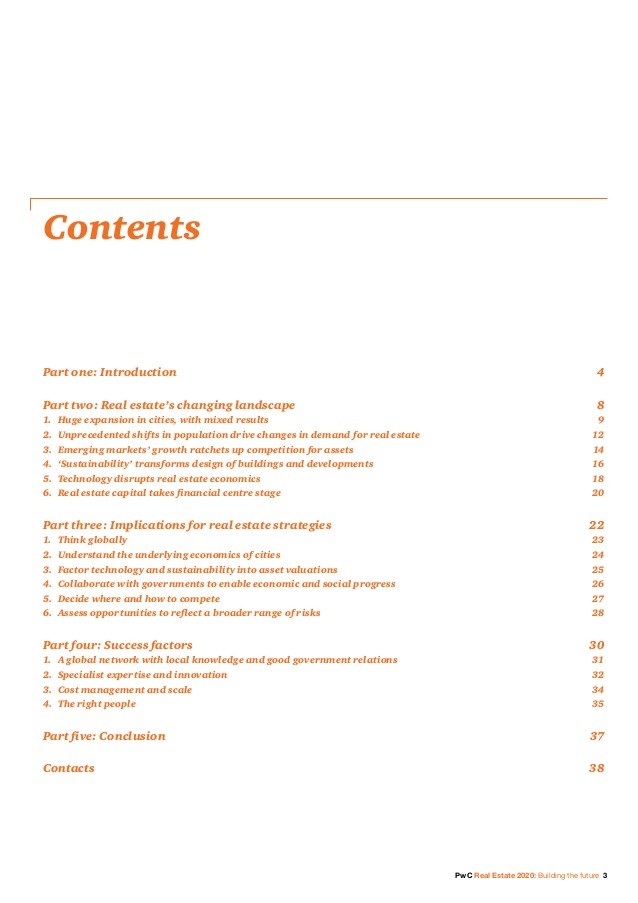

Rapid urbanisation and demographic changes, especially within emerging markets, will lead to substantial growth in the real estate investment industry over the next six years, as explained in our newly released report: Real Estate 2020: Building the future . At the same time as the industry’s opportunities grow, so too will assets invested into the sector.

The report anticipates that the global stock of investable real estate will rise by more than 55 percent to around $45.3 trillion by 2020, from a 2012 total of $29.0 trillion, and will expand again by a similar proportion by 2030. The expansion will be greatest in emerging economies, where economic development should lead to better tenant quality and, in some countries, clearer property rights. It will play out across housing, commercial real estate and infrastructure.

Private capital is expected to play a critical role in funding the growing and changing need for real estate and its supporting infrastructure. At the same time, intense competition for prime real estate is likely to cause real estate managers and investors to seek out new opportunities for yield. As they venture into new territories, the growing and changing real estate world will present them with a far wider range of risks, which they should be equipped to manage.

Mega trends and their implications

The following mega trends are likely to have significant implications for real estate asset managers and investors.

- A huge expansion in cities, with mixed results. By 2020, the 21st century’s great migration to the cities will be well underway. Cities are expected to swell across the fast-growing countries of Asia, Africa, the Middle East and Latin America. Even the developed Western countries will be urbanising, albeit at a slower pace. By 2020, cities will be competing fiercely with each other.

- Growth in emerging markets is anticipated to ratchet up competition for real estate assets and competition between real estate organisations.

- Sustainability will transform design of buildings and developments, presenting opportunities and risks for real estate asset managers.

- Technology will disrupt real estate economics: growth in online shopping will continue to reduce the need for retail space, but shorter delivery times increase the need for warehouse space close to customers. As workers increasingly work from home or satellite offices, the need for office space will decrease. For developers, technology advances will make eco-efficient building more practical. Real estate capital will take financial center stage. Private capital will play a critical role in funding the growing and changing need for real estate and its supporting infrastructure. Real estate managers will need to leverage the full range of financing possibilities to take on new types of risk, often with long-term investment horizons.

Six ways to prepare for 2020’s world

In order to prepare for the opportunities and challenges that will be evident by 2020, real estate managers and investors will need to adapt early in the following ways:

- Think globally. Real estate managers should think more globally but leverage local knowledge as global investable real estate will expand substantially, especially in emerging economies.

- Understand the underlying economics of cities. Fast-growing cities will present a wider range of risk and reward, ranging from low risk/low yield in advanced economy core real estate, to high risk/high reward in emerging economies.

- Factor technology and sustainability into asset valuations. Some buildings without competitive sustainability ratings will suffer a ‘brown discount.’ Technology will disrupt real estate economics, increasing the danger of obsolescence.

- Collaborate with governments to enable economic and social progress. Real estate managers, investors and developers will need to partner with government to mitigate risks of schemes that might otherwise be uneconomic.

- Decide where and how to compete. Competition for prime assets will likely intensify further. New wealth from the emerging economies is expected to intensify competition for prime assets. Real estate managers will need to think laterally, while concentrating more than ever on the basics of local knowledge and tenant demand.

- Assess opportunities to reflect a broader range of risks. As the nature of real estate investment changes, becoming more global and specialist, more risks will emerge. Risks will include those associated with partnering with local developers or governments in emerging economies, as well as risks associated with regulation and tax in an ever more globalised industry. Real estate managers will need to assess these opportunities to reflect the broader range of risks.

Success factors for the future

In order to prosper in real estate’s new world, leading industry players, such as managers, developers and the investment community need to make sure they have the right capabilities and qualities, especially in the four areas of: a global network with local knowledge, specialist expertise and innovation, cost management and scale, and the right people. By understanding the economic and demographic shifts that will change the real estate investment landscape, they can be fully prepared for the challenges and opportunities of 2020 and beyond.