How Interest Rates and Yields Affect Property Prices Yahoo News Singapore

Post on: 19 Май, 2015 No Comment

By Mr. Propwise

Interest rates have a significant effect on the real estate market as they affect both the cost of taking a mortgage from the bank to fund the property purchase, and the relative attractiveness of the property purchase versus other investment alternatives.

Since the Global Financial Crisis in 2008, we have been in a very low interest rate environment with SIBOR below 1%, as governments around the world have flooded the markets with liquidity to prevent a second Great Depression. This has also had the effect of boosting property prices as the cost of borrowing has decreased and affordability has increased.

Given that we’ve been in a low interest rate environment for over three years now, it might feel like interest rates will always remain at such low levels and that low interest rates are the norm. But we should remember that not too long ago interest rates were well above where they are now. We should thus be prepared for higher rates than the current unnaturally low levels.

Looking at SIBOR

SIBOR (Singapore Interbank Offered Rate) is a daily reference rate based on the interest rates at which banks offer to lend unsecured funds to other banks in the Singapore wholesale money market (or interbank market). Many mortgages in Singapore are now priced off SIBOR.

120903 Figure 1

From Figure 1.1.3a, we can see that over the last 25 years, low interest rates were certainly not the norm. The 3-Month and 12-Month SIBORs have been at or above 7% in 1990 and briefly in 1997. More recently the 3-Month and 12-Month SIBORs were above the 3% level for a period from 2005 to 2007.

As of June 2012, the 3-Month SIBOR and 12-Month SIBOR are at or close to their all-time lows at 0.38% and 0.56% respectively, much lower than their historical average of 2.71% and 3.01% since July 1987 (a 25 year period). What this means is that if interest rates were to return to their historical averages, mortgage rates would be closer to the 4+% level versus the 1+% level at the time of this writing.

The impact of higher interest rates on mortgages

To put the implication of this in more concrete terms, a buyer who takes a 30-year mortgage loan of $1,000,000 at a 1% rate will pay $3,216 for his monthly mortgage payment. If mortgage rates were to rise to 4% he would have to pay $4,774 instead, or a 48% increase. For buyers who have overleveraged, that increase could be fatal. Thus conservative investors should factor in a 4% mortgage rate level when planning their property purchases, to ensure that they will be able to meet their monthly repayment obligations.

For investors who are looking to buy properties for rental income, one useful way to look at the attractiveness of the investment would be to compare the rental yield of the property and the prevailing mortgage rate, and see if they can make a “spread” between the two.

120903 Figure 2

As of 2012Q2, average estimated yields were at 3.28% versus an estimated effective mortgage rate of 1.58%, resulting in a positive 1.70% yield spread (Figure 1.1.3b).

Will higher interest rates lead to lower property prices?

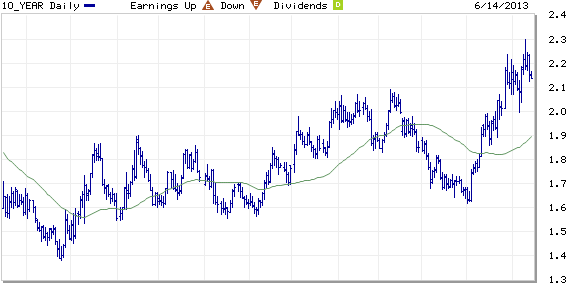

120903 Figure 3

In short, the answer to the question of whether higher interest rates will lead to lower property prices is “not necessarily”. Figure 1.1.3c plots the URA Property Price Index versus 3-Month SIBOR, and in general if we look over the entire 25 year period it looks like the two are negatively correlated (i.e. periods of falling interest rates seem to correspond to periods of rising property prices and vice versa), but the relationship is not tight. There are several periods of rising interest rates that have also corresponded with rising property prices. Interest rates, while a significant factor to the property market, are only one of several factors that affect it.

By Mr. Propwise for PropertyMarketInsights.com , a Singapore property market research site that helps buyers and sellers make profitable investment decisions – subscribers get updates on where we are in the Property Market Cycle Model to help you time your investments.

Related Articles