How Increasing Inflation Could Affect Housing Prices

Post on: 19 Май, 2015 No Comment

I was talking with a friend who was telling me that it was the absolute perfect time to buy a house because housing prices have tumbled and interest rates are low.

I asked him, What happens to housing prices if there is inflation and rates go up?

He said, Housing prices should go up with inflation as they do for all goods. Housing is a natural hedge for inflation

Did my friend have a point? Yes and no.

Yes, he was right that in a high inflationary environment, housing prices should rise with all other assets. Rents will go up, as will the price of all the inputs into housing such as lumber and labor costs.

Obviously, housing prices will go up to reflect this reality.

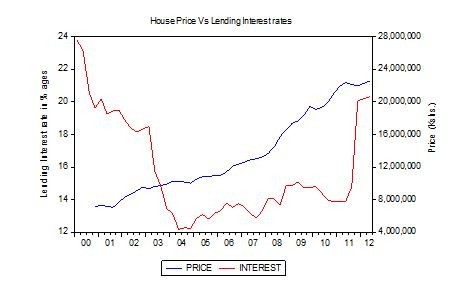

But no, when inflation and thus nominal interest rates increase, housing prices tumble. When rates fall, housing prices tend to increase.

Relationship between mortgage rates and housing prices

You can see an obvious correlation by looking at the following graph of interest rates and the log of real housing. The two black circles are areas where the correlation is obvious. The third red circle is an area where the correlation seems less relevant.

click to enlarge images

30 year fixed mortgage rate and change in real home appreciation from 1970 to 2006

The simplest explanation for this correlation comes down to payment. Most people have to finance their homes. As such, they make housing decision based upon monthly payment, i.e. what they can afford. If a borrower with 2,000.00 available per month for a mortgage, they could afford to finance about $372,500 over 30 years with a 5% rate. If that rate were to increase to 10%, the amount they could afford to finance would drop by almost 40% to $273,000.

From 1982 to 2003, there was a long term trend of dropping mortgage rates. During this same term, we had a general improvement in the change in housing prices. The exception was 1990 to 1991 where there is a period of negative changes to housing prices that aren’t explained by the mortgage rates. Also, from 2003 to 2006, mortgage rates stabilized, but housing increased dramatically. New products such became popular such as subprime mortgages and payment option arms that allowed lower payments so people could afford more housing and thus drive up the price even while mortgage rates were stable.

But just how quickly do prices react to changes in interest rates?

We did a regression analysis of interest rates and real housing prices over the last thirty years. When we do a year over year analysis while looking at the change of real housing prices over the same timeframe, we get no correlation (see table). When we took a look at the data with a lag, we get more interesting results.

For the mortgage rate information I am using Freddie Mac 30 year fixed mortgage rates. I am taking the average rate over the course of one calendar year. I use the change (or log) of the mortgage rate in the regression. Because it is averaged, the functional rate is close to the middle of the year. For housing data, I am use beginning-of-year real housing pricing data from Shiller. Then I take the change (or log) of this figure. Keep in mind that we are looking at real housing prices less inflation. If you looked at nominal rates in a high inflationary environment, prices might be nominally stagnant, but the real prices might actually have dropped.

As we are using middle of the year mortgage rate data and beginning of year housing data, a 1 year lag in the data is actually closer to a 6 month lag. And a comparison of year to year data would be middle of year mortgage data with beginning of year housing data. Thus, a comparison of year to year data should be statistically insignificant and that is exactly what the results show.

There are other reasons to believe that the changes to the interest rates would not immediately transfer to home prices. Indeed, we found that the lag could be up to three years (2 years). This could be partially explained by the following:

- Real estate market is illiquid as selling a home can take several weeks if not months.

- Appraisal values are based upon sales price comparisons which can be several months old.

- Financing a purchase of a home could be difficult if sale value is significantly above appraisal value

- Individuals may be inclined to wait rather than sell if the neighbouring homes sold for more.

With a one, two and three year time lag, all give us significant results at the 90% level. Only year two gives us significant results at the 95% level. Year 1 and Year 3 are very close to the threshold of being significant at the 95% level.