How Goldman s Counterparty Valuation Adjustment (CVA) Desk Saved The Firm From An AIG Blow Up

Post on: 16 Март, 2015 No Comment

The role of CVA desks

A commercial banks CVA desk centralises the institutions control of counterparty risks by managing counterparty exposures incurred by other parts of the bank. For example, a CVA desk typically manages the counterparty risk resulting from a derivative transaction with another financial institution (such as entering an interest rate swap agreement). The main role of the CVA desk is to consolidate credit risk management within the company. This can improve risk control procedures, including taking account of any offsetting positions with the same counterparty (which can reduce the need to hedge). CVA desks will charge a fee for managing these risks to the trading desk, which then typically tries to pass this on to the counterparty through the terms and conditions of the trading contract. But CVA desks are not typically mandated to maximise profits, focusing instead on risk management.

CVA desks hedging of derivatives exposures In a derivative transaction, a bank may incur a loss if its counterparty defaults. Specifically, if the banks derivative position has a positive marked-to-market (MTM) value (calculated for the remaining life of the trade) when the counterparty defaults this is the banks expected positive exposure. These potential losses are asymmetric. If the value of a banks derivative position increases (ie the bank is likely to be owed money by its counterparty), the potential loss in the event of default of the counterparty will rise. In contrast, if the value of the banks derivative position falls such that it is more likely to owe its counterparty when the contract matures then the potential loss on the transaction is zero.

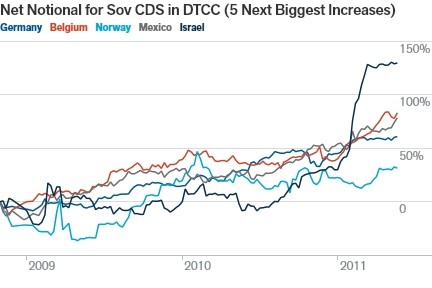

Having aggregated the risks, CVA desks often buy CDS contracts to gain protection against counterparty default. If liquid CDS contracts are not available for a particular counterparty, the desk may enter into an approximate hedge by purchasing credit protection via a CDS index and increase the fee charged to the trading desk to reflect the imperfect nature of the hedge. On occasion, when CDS contracts do not exist, CVA desks may try to short sell securities issued by the counterparty (ie borrow and then sell the securities) but this is rare.

Another way to mitigate counterparty risk is for parties to a derivative trade to exchange collateral when there are changes in the MTM value of the derivative contract. The terms of the collateral agreements between the counterparties (detailed in the credit support annex in the derivative documentation) include details such as frequency of remargining. Since MTM exposure for the bank is greatest if counterparties do not post collateral, CVA desks have reportedly been influential in promoting better risk management via tighter collateral agreements in order to reduce the CVA charge.

The plot thickens: the table below demonstrates the external (net of CVA netting), and internal (gross up) exposure to AIG by Goldman Sachs. As is glaringly obvious, the two actual trading groups within Goldman, the IG Flow and Structure Credit, experience a miraculous transformation when moving from internal to external exposure, as noted above. In fact, this transformation is so big that had it not been for the extremely beneficial impact from the CVA internal-to-external adjustment, the firm would have in fact been short not only residual CDO exposure, but would have found itself net short AIG CDS as well, further increasing the motivation to tear up contracts, in the least, as is what ended up happening post Maiden Lane III, and to push outright for the prevention of an AIG bankruptcy (which also happened). It also puts into doubt the veracity of all those statements by Messrs Viniar and Blankfein that Goldman was hedged to an AIG collapse, and in fact did not need the government bail out.

Another observation: Goldman’s flow operations once again demonstrate that they in no way take a hedged position against order flow, yet merely execute alongside (or just ahead of) the whales. It is, however the prop desk, or in the CVA case, the prop’s prop trading desk, that ends up bailing out the firm (time after time). Indeed, in this particular case, the prop side of Goldman’s operations is responsible for not only all the revenue associated with any selling of AIG CDS, but with initiating the positions in the first place, and furthermore, eliminating any and all massive losses that would have been borne out of the firm’s flow traders, had nature runs it course. In other words Goldman’s claim that prop accounts for just 10% of revenues is patently false, or true only in the case where the balance of the firm consistently generate negative revenues, with the delta a plug coming out of David Copperfield’s hat.

So just what is the basis of the CVA intervention: did the trading desk merely buy massive amounts of AIG CDS with the same counterparties (with CVA listed on the trade ticket instead of IGF or Structured Credit as the executor) and netting all at the end of the day, or, in yet another fractal bifurcation, merely buy protection of the secondary counterparties (to AIG as primary), thereby offsetting secondary risk. Or, as the BOE suggests, did the CVA merely double count hedged risk exposure: Another way to mitigate counterparty risk is for parties to a derivative trade to exchange collateral when there are changes in the MTM value of the derivative contract. In other words, while Goldman was collecting excess collateral via aggressive EOD variation margin collection, did the CVA also book this as an actual trading offset? If so, the firm has been lying about its net exposure to AIG via CDS all along.

To get to the bottom of this, Senator Grassley needs to immediately get not only the cost basis and trade dates of every single trade ticket that comprises the alleged $1.7 billion in net exposure, but also explicit details on the activity of Goldman’s CVA desk as pertain to AIG risk mitigation, and how precisely that shadowy group within Goldman decides which counterparty requires such massive risk margin contrary to exposure produced by the firm’s flow traders. After all, flow was and always is actively aware of unbalance risk well pre-CVA (which is really just a glorified middle office) intervention. Why is it that the flow desk was so comfortable with a huge bullish exposure on AIG, while the CVA had a mandate to be so very bearish? Since Goldman has indicated it is willing to cooperate with regulators and politicians, we are confident this minor additional data hunting expedition will be in no way unfeasible to 200 West risk mavens. And while at it, the Senator should also request the actual P&L per trade, and the actual unwind or novation date per ticket. In the case of novations, as we have speculated previously, if Goldman was merely offloading its short-risk exposure to an unwitting market maker or hedge fund, while AIG’s CDS were trading tens of points upfront, even as the firm knew full well the FRBNY would not let it fail, this would constitute trading on material insider information, as we have demonstrated previously. If indeed Goldman was selling its AIG CDS at the very top of the market, that would open up an entirely whole new regulatory can of worms, one that we are confident all the pent up class action lawsuits and David Cuomo would be more than interested to tap into.