How does the deduction for state and local taxes work

Post on: 18 Июль, 2015 No Comment

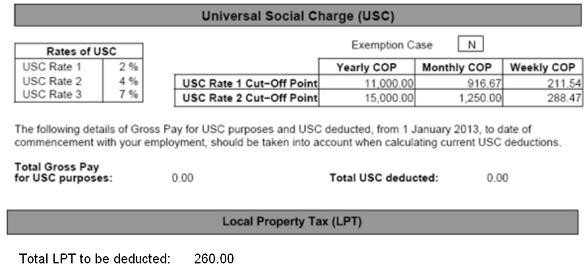

Taxpayers who itemize deductions may subtract general state and local taxes in calculating their federal taxable income. They may deduct either income or sales taxes they have paid (that choice expires, however, after 2007) as well as property and certain other taxes. Virtually all of the 48 million households who itemized in 2005 claimed a deduction for state and local taxes paid; these deductions totaled $420 billion. The state and local tax deduction cost an estimated $50.7 billion in tax expenditures in fiscal 2007, compared with $73.7 billion for the home mortgage interest deduction and $41.9 billion for the individual charitable contributions deduction.

- State and local taxes have been deductible since the inception of the federal income tax in 1913, when all taxes (including federal, state, and local taxes not directly tied to a benefit) were deductible against federal income. By 1964 deductible taxes had been limited to state and local taxes on real and personal property, income, general sales, and motor fuel sales. The deduction for taxes on motor fuel was eliminated in 1978. The Tax Reform Act of 1986 eliminated the deduction for general sales tax; this deduction was partially and temporarily reinstated in 2004.

- From 2004 to 2007, itemizers could elect to deduct state and local sales taxes in lieu of deducting state and local income taxes. About 73 percent of itemizers deducted income taxes in 2005, while 23 percent-mostly in states without a general state income tax-chose to deduct sales taxes. About 86 percent of itemizers deducted real estate taxes.

- Although taxpayers in all states claim the deduction, the benefits are concentrated in relatively few states: those with a disproportionate share of high-income households and relatively high state and local taxes. In 2005, taxpayers in California and New York together made up 20 percent of those claiming the deduction and accounted for 30 percent of its value. Itemizers in New York, New Jersey, Connecticut, and California (listed in descending order of the average deduction) claimed on average over $12,000 per household (see figure), well above the national average deduction of $8,764 per household.

See Also

Data Sources

Internal Revenue Service, Statistics of Income Division, Individual Master File System, January 2007, Historical Table 2 .