How Does RenttoOwn Work

Post on: 6 Июль, 2015 No Comment

The term “rent-to-own” used to only be synonymous consumer goods; however, with the economic downturn and the housing market bubble bursting, rent-to-own is becoming a more available option. In this article we’ll cover the basics of what you—as a potential homebuyer—need to know about a rent-to-own agreement.

What is “rent-to-own”?

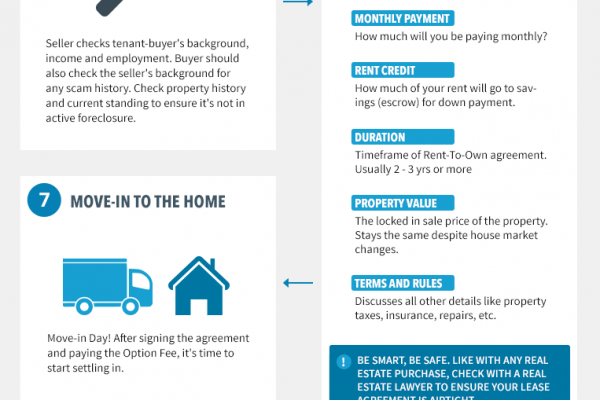

Rent-to-own, otherwise known as a “Lease Purchase”, is a contractual agreement between a buyer (you) and a seller to purchase a house with a closing date that is in the future, usually one to three years after the agreement is made. This is different than a “Lease Option”, where you are given the choice—before it goes on the market—to buy the home you were leasing, but are under no contractual obligation to do so. In a rent-to-own agreement, you will pay a deposit fee (usually around $5,000) in addition to your rent and rent premiums. Your rent payments will go towards the seller’s mortgage fees, and the premium payments will go towards your down payment of the house from the seller.

Why is a rent-to-own agreement something I should consider?

There are a few reasons why you may want to consider renting-to-own. The first, and most likely, being that you don’t currently have the finances to pay a down payment on a home. This can be a good option if you want to buy a house in a specific neighborhood, but can’t make the purchase right away. Also, if you feel you’ll be able to make a down payment within one to three years, but are afraid that the property value in the area will rise, locking in an agreement now is a good way to freeze the property at the current value while you secure the necessary funds to buy. Furthermore, instead of relying on yourself to save up enough for a down payment, your monthly payments in a rent-to-own will keep you on the right track. For example, if your premium fee is $500 a month, after a year that would be $6,000. Add that to your $5,000 deposit and you already have $11,000 towards the down payment after your first year in the agreement.

What are the disadvantages of a rent-to-own agreement?

A rent-to-own agreement is a contract, and as with any contract, you have to be able to deliver. If the allotted amount of time to purchase the home expires and you can’t fulfill your end of the deal, you will end up losing your initial deposit. Also, because you were paying rent as well as a rent premium, you have ended up paying considerably more to rent a house than you would have otherwise. Just like as it’s in your favor to lock in the price of a house before it goes up, property values can also plummet. Since many homes aren’t rent-to-own unless it has been hard for the seller to sell or had to move quickly, these agreements aren’t usually going to be a huge windfall for the buyer and you may even end up at a loss.

Deciding if it’s right for you.

Before considering a rent-to-own agreement, check your credit score and deal with any errors or problems that may keep you from getting a loan. Next, visit a mortgage lender and get pre-qualified for a loan. When meeting with a mortgage lender, they will go over debt ratios with you. This will display the amount of debt you can have each month while still being approved for a mortgage. They will also educate you on loan types, which will make you even more ready to enter into the agreement.

A rent-to-own situation can be a slippery slope, and since there is no standard contract for such an agreement and every state has its own regulations, it’s important to talk to an attorney or real estate agent to make sure you completely understand the financial contract you are about to enter. By doing so, you will also verify that the house isn’t in foreclosure and that there aren’t any problems with the home’s title.

Lastly, be aware if the house will need major improvements. If it does, try to negotiate a lower price with the seller that will take improvement investments into effect (like a lower rent). Be careful because if you decide to make improvements and then are unable to purchase once the agreement period has expired you will most likely not be reimbursed for those improvements, and you just gave the seller a better-looking home that he can try to sell again, now at a higher value.