How Do I Invest in Mutual Funds

Post on: 13 Июль, 2015 No Comment

Mutual fund investing is simple but that doesn’t mean it is easy. There are stock mutual funds, bond mutual funds, real estate mutual funds, cash mutual funds, and hybrid mutual funds. John Coulter, Illustration Works, Getty Images

I was once asked how to invest in mutual funds and I could not refrain from replying with “send a check to a mutual fund company .” All jokes aside, there are some important considerations an investor should take into account before investing in a mutual fund.

1. What is a mutual fund?

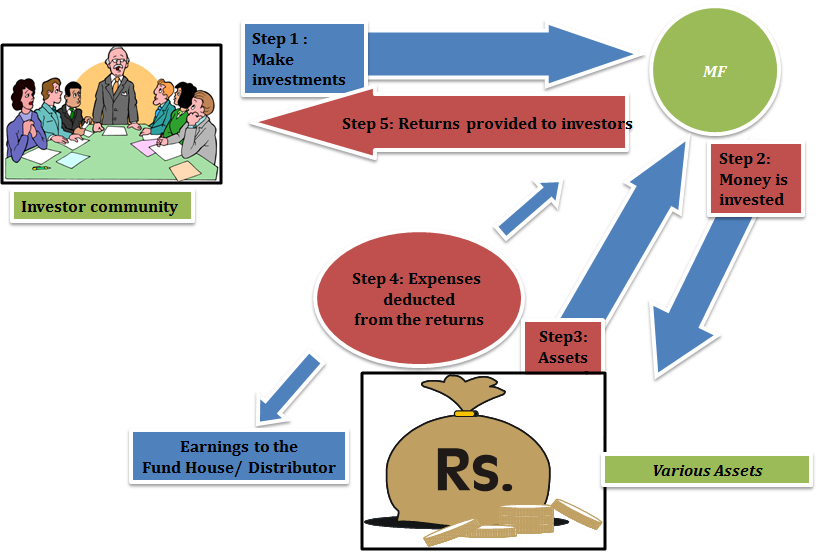

As with any investment, the first order of business is to understand what you are putting your hard earned money into. A mutual fund is a pool of money from a group of investors used to create a portfolio of different stocks, bonds and other securities as per the fund’s prospectus. Each investor then gets their respective piece of the pie.

2. How do I select a mutual fund?

This is where you will want to focus your attention. The number of mutual funds available to investors now rivals the number of stocks on the North American exchanges. All of these mutual funds can be categorized based on what the mutual fund invests in. At the broadest level, a fund will fall into one of three categories, equity (stocks), fixed income (bonds), and money markets (similar to cash). Equity and fixed income funds have subcategories, which will allow an investor to get specific with their investment dollars. For example, an equity fund investor may invest in a technology fund, which only invests in technology companies. Likewise a bond fund investor who is seeking current income may invest in a government securities fund which only invests in government securities.

Risk is an important consideration when evaluating mutual funds. As an investor, you should make every effort to understand how much risk you are willing to take and then seek a fund that falls within your risk tolerance. Naturally, you are investing with some objective in mind, so narrow down your list of candidates by concentrating on funds that meet your investment needs while staying within your risk parameters.

Furthermore, check to see what the minimum amount is to invest in a fund. Some funds will have different minimum thresholds depending on whether it is a retirement account or non-retirement account.

3. Buying a mutual fund.

Mutual funds are primarily bought in dollar amounts unlike stocks, which are bought in shares. Mutual funds can be bought directly from a mutual fund company, a bank or a brokerage firm. Before you can invest you will need to have an account with one of these institutions prior to placing an order. A mutual fund will be either a “load” or “no load” fund, which is financial jargon for either paying a commission or not paying a commission. If you are using an investment professional to assist you, you are likely to pay a load. Understand that a “no load” fund is not free. All mutual funds have internal expenses, which is to say that part of your investment dollars go to pay the fund company, the fund manager and other fees associated with running a mutual fund. These fees are often transparent to the investor and are taken out of the assets of the mutual fund. You should consider all fees and charges when investing in mutual funds

The process of buying a mutual fund can be done over the phone, online or in person if you are dealing with a financial representative. To place an order, you would indicate how much money you want to invest and what mutual fund you want to purchase. All mutual fund investors get the funds closing price on the day they place their order.