How Do Changes in Interest Rates Affect the Housing Market

Post on: 19 Май, 2015 No Comment

How Do Changes in Interest Rates Affect the Housing Market?

blog very useful and great story of your friend,give more detail in Most people have to take out a mortgage loan in order to become home owners. Whether the mortgage loan has a fixed or adjustable rate, a long or short term, you will have t

blog very useful and great story of your friend,give more detail in

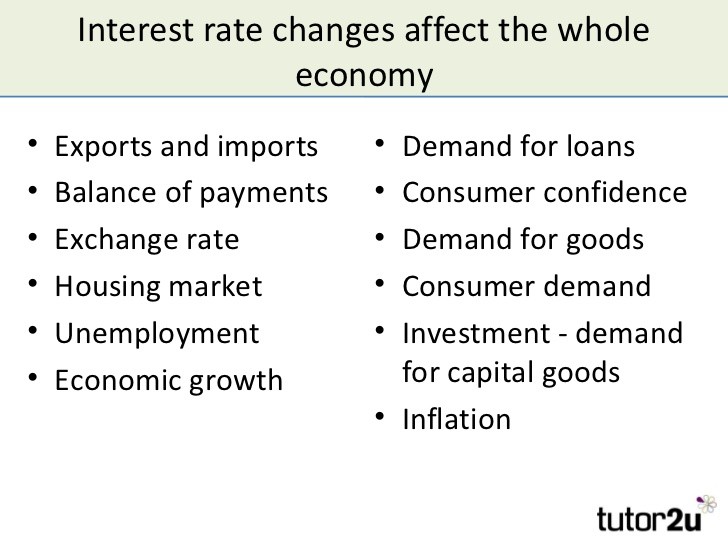

Most people have to take out a mortgage loan in order to become home owners. Whether the mortgage loan has a fixed or adjustable rate, a long or short term, you will have to pay interest. How much interest you will be paying on your mortgage loan depends on many ctors, such as the loan type, the repayment duration, or how big your down payment is. These are the ctors that will influence the interest rate that is advertised by the lender. Interest rates are also affected by ctors which cant be controlled by the borrower or the lender, such as the actions of the Federal Reserve or the state of the economy. Because most people and milies buy homes through a mortgage loan, the housing market is deeply affected by changes in current interest rates.

Normally, low mortgage interest rates attract more home buyers. Paying less interest means that the overall mortgage loan value will be lower, so people will be saving money. When rates are low, home sales rise because more people can afford to take out low-cost loans. Home owners can refinance their mortgage, and try to take out a lower interest rate mortgage to pay for their home. Low interest rates result in a large demand for homes, so the home construction industry is also stimulated.

future.Thanks

Interest rates have fluctuated significantly throughout history, influenced by changes in local and global economy, wars, recessions and many other ctors. The housing market will always have to gain or suffer from these fluctuations. Also, understanding how these fluctuations in interest rate affect the housing market can help investors make better decisions. Choosing between a fixed-rate or an adjustable-rate mortgage, and knowing when to refinance can make a huge difference in how much it will cost you to become a home owner, or how much profit you will make if you invest in real estate.

An interest rate is the rate at which someone can borrow money from a lender for a predetermined period of time. The interest rate will normally be a percent of the total amount borrowed, and will be paid each month, depending on the type of loan. For example, some loans require a larger payment towards the interest in the beginning, while the payment towards the principal is very low.

Interest rates on a mortgage loan can be of two kinds: fixed and adjustable. After being determined before the closing of the loan, fixed interest rates remain the same for the duration of the repayment period. Adjustable interest rates are normally fixed for a short period of time, after which they can increase or decrease, depending on many ctors, such as the health of the economy.

When interest rates are high, the demand for homes decreases because mortgage loans become more expensive, and most people cant afford them anymore, dont qualify, or simply choose to rent until interest rates go down again. High interest rates also affect home builders, as the demand for new homes also decreases.