How Can You Diversify Your Retirement Portfolio

Post on: 16 Март, 2015 No Comment

You’ve taken the first big step towards a prosperous retirement: youve figured out your retirement goals, translated those into your requirements for investment returns, and identified the level of risk you feel comfortable holding.

Now its time to set up the asset allocation that will be aligned with these return goals and risk tolerance.

Asset allocation is the single most important decision you can make when constructing your portfolio. Studies show that over 80% of a portfolio’s variance over time is due to its asset allocation. Other decisions like asset selection or market timing have a much smaller impact on long-term performance.

This post will introduce some of the building blocks for smart asset allocation in retirement planning.

Step 1: The Risk Decision

Asset allocation is easier if you break down the process into several steps.

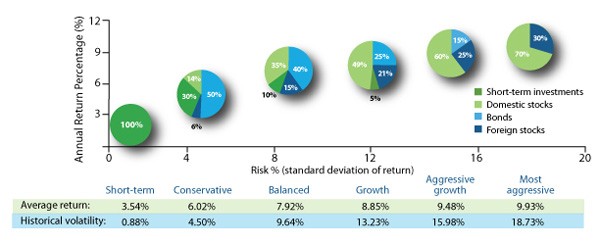

The first is to figure out how much you want to hold in equities and how much you want in fixed income. That will be based on how much growth youre seeking and how much you want to hedge the risk associated with equities.

The farther away retirement is, the more weight you can allocate to equities. Your equity weighting should be higher when you are in your twenties and gradually decrease over time.

How much is the right weight? That will depend on your specific goals and risk tolerance. An equity weight of 70-80% is a good benchmark for a young person with a moderate level of risk tolerance.

Step 2: Pick Asset Classes

In asset class selection, as in so many other walks of life, simplicity is best. You want diversification without unnecessary overlaps or redundancies.

In equities there are three primary asset classes you should consider:

- Valuation style (value versus growth)

- Capitalization (large, mid-cap and small)

- Geographical location (U.S. versus non-U.S. developed and emerging markets)

In fixed income investments, youll focus on two qualities. One is maturity or duration. This helps you diversify along the lines of interest rate risk. The other is credit quality. This helps you hedge credit risk.

In addition, youll want to consider asset classes that are neither equities nor fixed income. These are broadly known as alternatives and they include commodities, real estate assets and various hedge strategies .

Step 3: Slice the Pie

Once you have decided what asset classes you want to include in your portfolio, the next step is to establish the weights. Thats another way of saying that you need to decide how to slice the pie, dividing your portfolio into different percentages of various types of investments.

This decision should be aligned with your return objectives and risk tolerance. Say, for example, that you have a 75/25 weighting between equities and fixed income as a starting point. You may then divide the 75% equity weighting into a domestic / international split of 45/30.

The 45% in U.S. equities can be further divided into 30% large/mid cap and 15% small cap. The 30% large/mid cap can consist of 15% value and 15% growth.

Meanwhile, the 30% non-U.S. equities could consist of 20% developed markets and 10% emerging markets.

Your 75% equity weighting is now allocated as follows:

U.S. Large Value: 15%

U.S. Large Growth: 15%

U.S. Small Cap: 15%

International Developed: 20%

International Emerging: 10%

The other 25 percent of your portfolio is in fixed income. You could divide that into 10% high-quality short term bonds, 10% high-quality intermediate/long term bonds and 5% “junk” bonds. You now have a diversified portfolio.

If you wanted to take it a step further you could consider reallocating 10% away from your equities weights—for example, by taking 2% from each of the five equities asset classes shown above. You could then invest 5% in commodities and 5% in real estate investment trusts (REITs).

This example is doesnt imply that the weights shown in the example are “correct”. Your goals and risk tolerance will determine whats best for you. In future posts well talk about some tools you will find on Jemstep to help with your diversification.

Have you ever attempted a disciplined asset allocation? Tell us what you think.

For a free, easy way and objective way to find the best investments for you, visit Jemstep.com.