House flipping becomes more profitable

Post on: 7 Май, 2015 No Comment

CateyHill

Bloomberg News/Landov

If you’ve been dreaming of fixing up a home and unloading it for a tidy profit, now may be the time to do it.

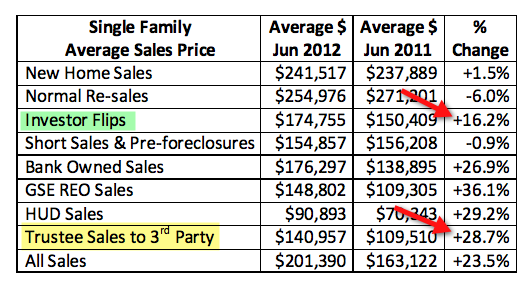

In the first three months of this year, home flippers raked in a 30% gross return on their investment — one of the highest levels in years, according to data released Thursday by RealtyTrac ; that’s compared to just 4% in the last quarter of last year. Flippers bought the homes for an average of $183,276 and sold them for $238,850, the data showed.

Of course, most flippers have to shell out some loot to spruce the home up before they unload the house for a higher price, but even taking that into consideration, the profits were likely considerable as, on average, the median amount spent on improvements for home flips is only about $4,800, according to BuildZoom.

These impressive returns are thanks, in part, to a more stable housing market, slower new-home building, and fewer total home flips (flips were down to just 3.7% of all single-family home sales in the first quarter), says Daren Blomquist, vice president of RealtyTrac. And he adds that this is a trend that will likely hold steady in the coming months. “Flippers are behaving rationally this time around as opposed to the last boom when they helped create a price bubble,” he says.

That said, flippers in some markets fare better than others. In Pittsburgh, flippers bought homes for an average of just under $55,000 and sold them for almost double that, and in the Philadelphia area they bought homes for about $166,000 and sold them for $258,000. Meanwhile, flippers in Charlotte, Houston, Tampa and Indianapolis tended to lose money on their deals.

Market-by-market data should be taken with a grain of salt because in some markets, there were only a small number of flips with which to base the data. And, the ROI numbers don’t take into account the cost to renovate the homes. Plus, flipping is risky and can lead to substantial monetary losses.

Still, the news that flippers are churning out profits will no doubt delight those willing to gamble on the real estate market once again. So MarketWatch asked some real estate experts what potential home flippers need to know beyond picking out a property with potential.

Type of flip. Some properties require just cosmetic work and others require multiple building permits — and it’s the latter that usually yields the biggest profits. Flips that were associated with building permits had a median ROI of 50%, compared to just 13% across all properties, RealtyTrac data revealed. What’s more, BuildZoom data shows that the more an investor spends on the home flip, the higher his return on investment. Still, Zillow’s real estate expert Brendon DeSimone, author of “Next Generation Real Estate,” says that the heftier flips are usually best left to developers and those who are experienced flippers.

Cost. The median cost for improvements on flipped homes was nearly $5,000. But depending on how much work you want to do, those costs could skyrocket. Consider: A major kitchen remodel costs roughly $55,000, bathroom $16,000, and a new roof $19,000, according to Remodeling Magazine. To get a budget for your project, DeSimone says that potential flippers need to tally up all the costs for every project they want to do and then add 10% to that.

What’s more, flippers shouldn’t assume they will make a profit, experts say. “You need to be financially comfortable even if you just break even,” says Julie Davis, a real estate agent at Alain Pinel Realtors. To help ensure that you will make money, DeSimone says that the location of the property is essential (you may want to think about school districts, for example): “Look for a fixer upper in a great location,” he says. And he adds, try to buy a property that is very undervalued. “You make the most on the buy side,” he says. And Davis says that good flippers are “obsessed with numbers” on everything from historical area home prices to interest rates.

Timing. The average flip took 101 days to complete, up from 79 during the same period last year, RealtyTrac data revealed. And during that period, homeowners will need to devote a lot of time to rehabbing the house. “This is not a part-time job,” says DeSimone, who notes that those with 9-to-5 jobs may find it difficult to find the time to oversee and do the work it takes to flip successfully.

More from MarketWatch: