High Frequency Trading Strategies_1

Post on: 16 Март, 2015 No Comment

High frequency trading is the process of selling and buying shares with the help of quantitative computer algorithms. Since the year of its inception (1999), the trading of high frequency shares market has been an unexplored lot. The profits maybe astounding but there are also inherent problems with high frequency trading strategies.

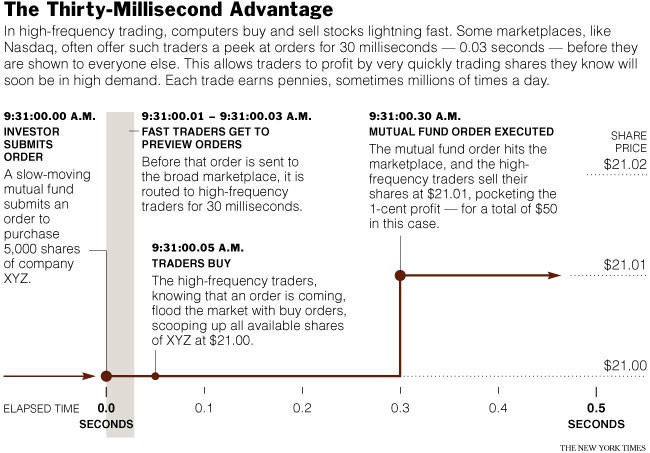

Trading regulators are finding that several unscrupulous traders are taking advantage of the individual investors though the high frequency trading strategies are beneficial for the investors in the long term because of the liquidity margin that the trading provides in getting better prices.

Nevertheless, in order to regulate the transactions of high frequency trading. the SEC is keeping a tab on the amount of transactions on a daily basis and the firms are liable to produce the daily report of the last day transactions when demanded by the regulators. This strategy will help in weeding out the unscrupulous traders or the unregistered market traders without going into the process of lengthy audits. The investigators will seek to find illegal trading activity and manipulative data, and the firms under scrutiny will be the ones whose shares in the exchange-listed securities remain within $2 million and $20 million in any given month.

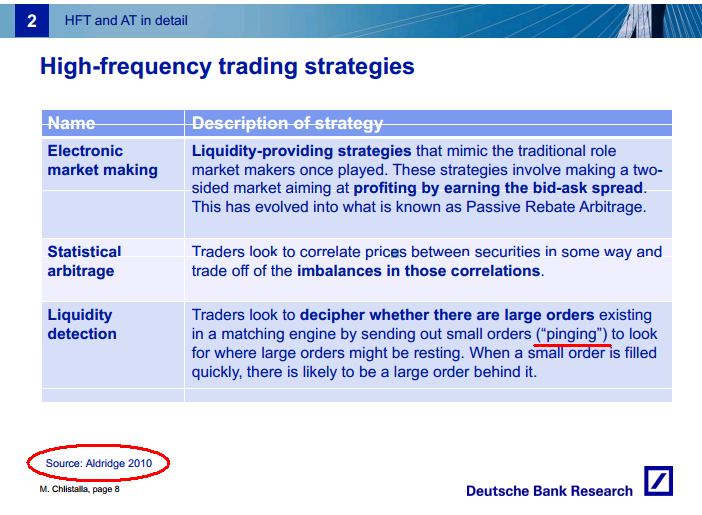

There are four HFT strategies followed by firms:

1. The Market Making

2. The Ticker Tape Trading

3. The Event Arbitrage

4. The High Frequency Statistical Arbitrage

In the last few years, the HTF has changed the market perception. The new way of dealing with buying and selling have placed the traditional investors under risk. Unless and until the traditional traders modify their old trading strategies it will be difficult for them to cope with the intensely competitive market of high frequency transactions.

Nevertheless, the HTF strategies offer high profitability ratio and always questions of the availability of performance data on the returns that are sized at variety frequencies. Correct and hard data of the frequency transactions are hard to locate because most of the in vesting firms are secretive about their investments. However, one can compare the data publicly available and estimate the maximum potential profitability. In the HFT strategies, the Sharpe ratio is the often-used measuring strategy to analyze the profitability of the trading strategies. The Nobel Prize Winner, William Sharpe, proposed the Sharpe ratio tool.

There are problems in exercising the HFT strategies due to the presence of unscrupulous traders but that is not a reason for investors to stop investing in high frequency trading.