Heiken ashi forex forex heiken ashi Heiken Ashi

Post on: 16 Март, 2015 No Comment

the currency or stock market traders are always trying to predict in which direction the price will go up or down. Many people, using different methods, did it better than others, but none in due measure was not right. Since this is impossible. Using fundamental analysis or technical analysis does not give you 100% — the first result.

Initially, the technical analysis has been invented and implemented by Japanese traders. They used the so-called candlesticks. Who are familiar Japanese candles can say that this is one of the best methods of understanding of market conditions, as well as the psychological state of buyers and sellers.

We can not say that with Heiken Ashi charts can predict the price movement is better, but it is simpler than the classical analysis of candlesticks. In this article I will explain the analysis of the Heiken Ashi candles, as well as signals from this indicator, and tell about your personal opinion about it and how you can use it in trade.

Description Indicator Heiken Ashi

The indicator represents the usual bars of the trading session. The difference between the classical Japanese candles, and this indicator is that the indicator Heiken Ashi takes to build the prices of bars and averages them, making the session more smoother. This is a very important point, since the foreign exchange market is more volatile than other markets.

Open = (Open + Close the previous candle’s previous bar) / 2

Close = (Open + Max + Min + Close) / 4

Min = [Min value of (Min, Open, Close)]

Max = [Max value of (Max, Open, Close)]

Thus, Heiken Ashi is slower than the candlestick, and the signals are delayed.

What are the advantages and disadvantages of such delay, FPIC you?

This delay made the Heiken Ashi indicator more suitable for the use of such volatile pairs like GBP / JPY, EUR / JPY, CAD / JPY. It protects us against hasty conclusions in early trading and playing against the market.

The high and low price of each candle depends on the previous candlestick. Thus, Heikin-Ashi scheme is slower than a candlestick chart, and its signals are delayed (for example, using moving averages to trade in our scheme and in accordance with them).

strategy works on Heiken Ashi

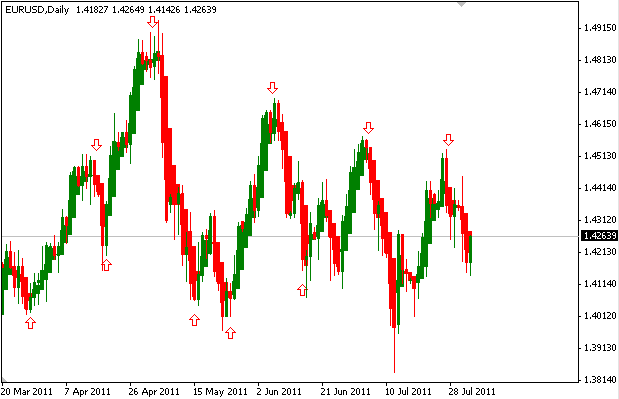

small example of the strategy work on Heiken Ashi

Heiken Ashi add to the price chart has the stochastic oscillator, since it will be used to confirm the signal and the formation of so-called golden cross».

Confirming the intersection of the Heiken Ashi, the intersection of the stochastic oscillator, we can say about the power of the coming trend. Also taken into account and the formation of the classical models of candlesticks.

signals Heiken Ashi

Now, when we found out the main points with Heiken Ashi, let’s see what kind of signals can produce this indicator and how to interpret them.

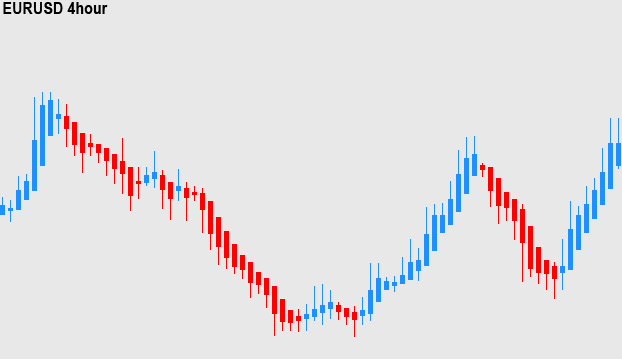

- Blue candle with no shadows. A strong bullish trend, which is likely, may continue.

- Candles with long shadows and with a small body. In fact, like a doji formation, which represents the fatigue and the subsequent trend reversal. But we must wait for confirmation from other indicators signals.

- Blue candle with a few shadows. Continues bullish uptrend. Yet there is potential for upward movement.

- Red candle with shadows. The downward trend is beginning to wane. Possible closure of existing short positions.

- Red candle with no shadows. Strong downward trend, the likelihood of continuing strong high. You can add to an existing position.

As I have explained the delay, the LED Heiken Ashi gives fewer false signals and will not allow you to trade against the market. On the other hand, Heiken Ashi candles are easier to read, because in contrast to the Japanese candlesticks, they are not confusing different formations and structures.

Heiken Ashi understanding will come with time, of course, the regular use of it in his trade.