HEDGING CROSSCURRENCY BASIS SWAPS

Post on: 14 Май, 2015 No Comment

In a perfect world with perfect banks with perfect credit quality, no one would need to worry about hedging cross-currency basis swaps.

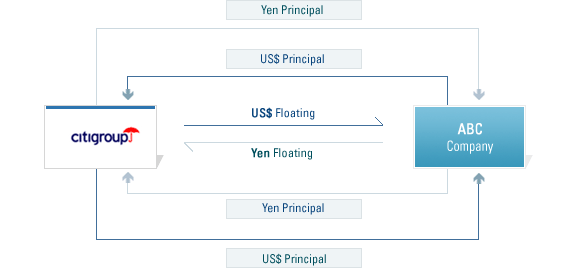

In a perfect world with perfect banks with perfect credit quality, no one would need to worry about hedging cross-currency basis swaps. Cross-currency basis swaps include initial and final exchanges of principal, making them, in terms of cash flow, identical to a simple exchange of floating-rate notes. Floating-rate notes are ‘always at par’ so why would anyone need to worry about hedging? The basis could move, so it is prudent to run a book of cross-currency basis swaps with no outright exposure to the basis. But when the basis becomes wide, as it has recently in USD/JPY, there are other risk factors that need to be managed as well. Before examining these, let’s take a look at the underlying causes of a cross-currency basis.

WHY IS THERE A BASIS?

In the past, the primary cause of cross-currency basis has been simple demand. Countries such as Japan which have net foreign asset holdings on aggregate have a propensity to convert those assets into their home currency. Whether they are U.S. Treasuries. Thai baht loans, or London real estate, foreign asset holders have some desire to offset foreign assets with foreign liabilities. One of the easiest ways to get a foreign liability on the books is to receive domestic currency in a cross-currency basis swap. Over the past 10 years, before the emergence of the Japan premium, it’s fair to say that demand has accounted for a USD/JPY basis at around 10 basis points.

In the past year, however, the USD/JPY basis has become considerably wider, not due to demand, but the fact that LIBOR itself represents different levels of credit quality from country to country. The U.S. dollar LIBOR survey is an average of eight Western banks. The yen LIBOR survey includes four Japanese and four Western banks. The Japanese premium (the difference between what Western banks and Japanese banks pay for deposits), was running as high as 60bps. That means that, Western banks effectively funded at dollar LIBOR flat and Japanese banks funded at dollar LIBOR plus 60bps. In yen, Western banks effectively funded at LIBOR minus 30bps while Japanese banks funded at LIBOR plus 30bps. The same bank could fund at a substantially different level relative to LIBOR in different currencies. The survey effect on the cross-currency basis spread for USD/JPY could be estimated as:

JPY/USD basis = Japanese Premium x (Japan Banks in USD Average Japan Banks JPY Average) / (banks in survey) = 60 bp x (0-7) /14 = -30.

This is in line with where the swaps are trading.

A COUNTERPARTY’S FUNDING COST MAY INFLUENCE HOW IT SHOULD HEDGE.

Market convention in cross-currency basis swaps has been to trade them with the spread on the non-dollar side of the deal. This convention has led many market participants to view the risk of the deal as on the non-dollar side, and to neglect the dollar side of the deal altogether. For banks that fund very close to LIBOR in dollars, this may well be a reasonable way to proceed. However, risk managers at banks that fund well below or well above dollar LIBOR, should not neglect the dollar side of the deal.

Suppose bank A funds at dollar LIBOR flat, and yen LIBOR minus 30bps. Bank A enters into a cross-currency basis swap to pay dollars and receive yen LIBOR minus 30bps. Since the swap is at the same level as A’s funding, A has no risk except to the basis itself. Suppose A’s counterparty is bank B. B funds at dollar LIBOR plus 30bps and yen LIBOR flat. When bank B looks at the deal and applies his cost of funds to both sides of the deal, it should effectively be short a stream of dollar payments and long a stream of yen payments representing the difference between the swap coupon and its funding cost. These are not necessarily small. If the swap is for 10 years and USD100 million notional, then B should note that it is effectively short dollar payments and long yen payments. The dollar payments have a present value of roughly (swap duration x (swap coupon — funding) x notional) = (7.8 x 0.003 x 100million) = USD2.3million. This stream of payments has interest rate and currency risk. After A and B do their deal, A is basically hedged, but B should do a small an interest rate hedge, and more importantly, it should buy USD2.3 million in the spot foreign exchange market. A has no outright market forex. If A had actual sub-LIBOR funding on the dollar side then it should perceive a short dollar position as well. If a counterparty’s home currency is not dollar, trades also need to be hedged back to the base currency.

CREDIT RISK

It should be noted that a change in forex will significantly affect A’s credit risk. Specifically, a decrease in USD/JPY credit risk is only a factor if total exposure to a couterparty across many deals is positive and will lead to additional credit exposure to B. To some extent, A should take the other side of B’s forex hedge to avoid a reduction in the credit quality of his portfolio. It is not always practical to hedge credit risk with market risk. Here we are only concerned with managing cash flows, and will neglect credit effects.

OFFSETS

Once a deal is done, it will undoubtedly be offset at some time in the future. The offset likely will occur with a different principal exchange and basis level. Suppose A and B offset their deal with the same yen notional, but with a larger dollar notional. The net result of the two deals is that A has loaned the difference in the dollar notional to B at LIBOR flat. A can fund the asset, at LIBOR, so it might not care too much. B has borrowed dollars from A at LIBOR; it can invest this at LIBOR plus 30bps so it is happy, that is if it didn’t have a forex hedge.

CURRENCY RISK OF SWAPS WITH A RESETABLE NOTIONAL

Resetable notional deals do not require the same forex hedging. Counterparties see value on each side of the deal according to their funding. If the deal is at market levels, the two sides values are denominated in different currencies, but offset at current forex rates. That value is periodically reset to spot rates, so forex hedging is not required. Once the basis swap moves, or funding levels change, each side of the deal will have a different value, and reseting the notional affect profit and loss and the currency should be hedged.

This week’s Learning Curve was written by Clark Landis , senior vice president at DKB Financial Products .

This is a popular article! Why not try something more recent on cross-currency basis swaps?